What Makes a Good cTrader Broker

A solid cTrader broker must meet a set of technical, regulatory, and operational standards that guarantee reliability and a comfortable trading experience. Not all brokers offering cTrader perform equally, so traders need to evaluate several aspects before opening an account.

Below are the main criteria to consider:

- Regulation and Safety — A broker licensed by reputable authorities such as FCA, CySEC, ASIC, or FSCA ensures fund protection, transparent operations, and regular audits.

- Execution Speed and Stability — Since cTrader is designed for fast order routing, the broker’s server infrastructure must minimize slippage and downtime.

- Account Types and Spreads — Top brokers provide both raw-spread and commission-based accounts, allowing traders to choose pricing models suited to their strategies.

- Deposits and Withdrawals — The availability of local and global payment options, including cards, e-wallets, and crypto, reflects the broker’s accessibility and efficiency.

- Trading Instruments — A wide selection of forex pairs, indices, commodities, stocks, and cryptocurrencies gives traders more flexibility in diversifying portfolios.

- Customer Service Quality — Quick multilingual assistance through chat or email is vital for solving technical issues and maintaining confidence.

- Additional Tools — Features like copy trading, VPS hosting, and educational resources add value for users who want more than just execution speed.

Top cTrader Brokers in 2026

The cTrader ecosystem has expanded globally, and several companies have earned recognition for maintaining superior execution standards, competitive conditions, and trusted regulation. Below is a list of the top-performing cTrader brokers in 2026 that stand out for consistency and innovation:

- Pepperstone

- IC Markets

- FxPro

- Admiral Markets

- FP Markets

Each broker on this list has been evaluated based on regulation, trading costs, execution speed, and overall usability. The next sections provide a short overview of their strengths and features.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No commission, spreads from 0.0 pips | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| Low commission on Raw Spread accounts | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.1 pips | Forex Commodities Indices Crypto | $100 | Up to 1:500 | MT4 MT5 cTrader FXPro App | ||

| No commission, spreads from 0.1 pips | Forex Stocks Indices Crypto CFDs | $100 | Up to 1:500 | MT4 MT5 MetaTrader Supreme Edition | ||

| From 0.0 pips (ECN) | Forex Crypto Indices | $100 | 1:500 | MT4 MT5 cTrader |

Pepperstone

Pepperstone

Pepperstone remains one of the most preferred choices for traders using cTrader. It is known for its ultra-low spreads, lightning-fast execution, and transparent trading model. Regulated by ASIC and FCA, Pepperstone offers both Standard and Razor accounts, catering to beginners and professionals alike.

Key highlights:

- Spreads from 0.0 pips on major currency pairs

- Execution speed below 30 ms

- Free VPS hosting for active traders

- Broad access to forex, indices, commodities, and crypto CFDs

- Integration with cTrader Automate for algorithmic strategies

Pepperstone’s infrastructure ensures precision trading under real market conditions, making it ideal for scalpers and high-frequency traders who rely on speed and accuracy.

IC Markets

IC Markets

IC Markets is widely recognized for its institutional-grade liquidity and consistent performance. The broker’s cTrader servers are located in the Equinix NY4 data center, which ensures rapid order execution and minimal slippage.

Features overview:

| Feature | Details |

| Regulation | ASIC, CySEC, FSA |

| Spread Type | Raw ECN, from 0.0 pips |

| Execution | No dealing desk, deep liquidity |

| Instruments | 60+ forex pairs, indices, metals, crypto |

| Platforms | cTrader, MT4, MT5 |

The broker supports multiple payment systems, including bank transfers, cards, and regional e-wallets. Its consistent pricing transparency makes it one of the best options for professional traders who prioritize reliability and speed.

FxPro

FxPro

FxPro has earned a long-standing reputation for stability and innovation in trading technology. As one of the early adopters of cTrader, it continues to deliver an efficient and transparent trading experience with deep liquidity and low spreads. FxPro operates under multiple regulatory frameworks, including FCA and CySEC, providing strong security and global accessibility.

Main specifications:

| Category | Details |

| Regulation | FCA, CySEC, FSCA, SCB |

| Account Types | cTrader Account with raw spreads |

| Spreads | From 0.1 pips on EUR/USD |

| Commissions | $3.5 per side ($7 per round lot) |

| Instruments | 70+ forex pairs, indices, shares, metals, energies |

| Platforms | cTrader, MT4, MT5, FxPro App |

FxPro’s cTrader environment is optimized for advanced execution models with no dealing desk intervention. The platform offers depth of market visibility, advanced charting tools, and instant order processing. Traders appreciate the clear cost structure and reliable execution under volatile conditions.

Admiral Markets

Admiral Markets

Admiral Markets (now rebranded as Admirals) offers cTrader alongside MetaTrader platforms and focuses on providing professional-grade conditions within a regulated environment. The company operates under FCA, CySEC, and ASIC supervision, offering robust protection and transparency.

Highlights of Admiral Markets’ cTrader offering:

- Institutional liquidity and no requotes

- Spreads starting from 0.0 pips on major pairs

- Fast execution supported by advanced server infrastructure

- Educational materials, webinars, and market analysis

- Multi-asset access including forex, CFDs on stocks, indices, ETFs, and cryptocurrencies

FP Markets

FP Markets

FP Markets is a highly competitive broker offering cTrader with institutional liquidity and ultra-fast order execution. Established in 2005 and regulated by ASIC and CySEC, the company combines transparent pricing and strong technical support for all levels of traders.

Main advantages:

- True ECN connectivity for faster execution

- Raw spreads from 0.0 pips

- Commission from $3 per side

- Over 10,000 trading instruments

- VPS service for automated strategies

Comparing the Best cTrader Brokers

To make the selection process clearer, the table below compares the key characteristics of the leading cTrader brokers mentioned above. This summary helps identify which provider aligns best with individual trading styles.

| Broker | Regulation | Spreads (from) | Leverage (max) | Platforms | Minimum Deposit |

| Pepperstone | ASIC, FCA | 0.0 pips | 1:500 | cTrader, MT4, MT5 | $200 |

| IC Markets | ASIC, CySEC, FSA | 0.0 pips | 1:500 | cTrader, MT4, MT5 | $200 |

| FxPro | FCA, CySEC, FSCA | 0.1 pips | 1:500 | cTrader, MT4, MT5 | $100 |

| Admiral Markets | FCA, ASIC, CySEC | 0.0 pips | 1:500 | cTrader, MT4, MT5 | $100 |

| FP Markets | ASIC, CySEC | 0.0 pips | 1:500 | cTrader, MT4, MT5 | $100 |

Each broker demonstrates strong reliability, but preferences depend on trading strategy.

Pros and Cons of Trading on cTrader

Like any trading platform, cTrader has both advantages and limitations. Understanding these helps traders decide whether it fits their trading style.

Pros:

- Transparent order execution with no dealing desk interference

- Fast trade placement ideal for scalping and day trading

- Modern, user-friendly interface with advanced charting tools

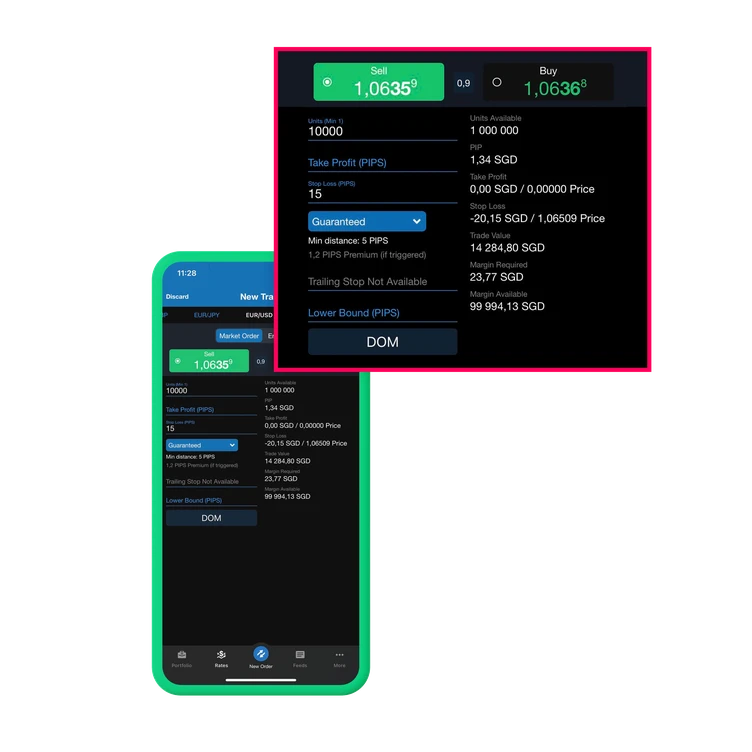

- Depth of Market (DoM) visibility for greater market insight

- Supports cAlgo (cTrader Automate) for algorithmic trading

- Full mobile and web compatibility

Cons:

- Limited integration with some custom indicators from MT4/MT5

- Smaller community compared to MetaTrader

- Fewer third-party plugins and automated script options

cTrader’s technical precision and institutional-level transparency make it one of the most advanced tools for traders who value control, real-time data, and execution efficiency.

How to Choose the Right cTrader Broker

Selecting the right cTrader broker requires a balance between regulatory credibility, trading conditions, and technical reliability. While most brokers promote similar features, subtle differences in execution, spreads, and platform stability can significantly impact performance—especially for active or high-volume traders.

To make an informed decision, it’s essential to evaluate the following practical factors:

1. Verify Regulation and Reputation

Always confirm that the broker holds a valid license from a recognized authority such as the FCA (UK), CySEC (Cyprus), ASIC (Australia), or FSA (Seychelles). Regulated brokers must follow strict operational rules that protect client funds and ensure fair dealing practices. Reading verified reviews and checking registration numbers on official regulator websites helps confirm legitimacy.

2. Analyze Spreads and Commission Models

Compare spreads and commission structures across brokers.

- ECN accounts usually have raw spreads starting from 0.0 pips with a fixed commission per lot.

- Standard accounts may have slightly higher spreads but no commission.

A trader who opens many short-term positions should prioritize low spreads and high execution speed, while long-term investors might focus on stability and swap rates.

3. Assess Execution Quality and Server Speed

Since cTrader supports fast execution and direct market access (DMA), the quality of a broker’s infrastructure is crucial. Data centers located in London (LD5), New York (NY4), or Amsterdam (AMS1) can significantly reduce latency. Brokers that publish execution statistics or latency data show higher transparency and reliability.

4. Check Deposit and Withdrawal Flexibility

Efficient funding is key to maintaining liquidity in trading accounts. Reputable brokers offer:

- Bank cards and local transfers

- E-wallets such as Skrill, Neteller, or Perfect Money

- Cryptocurrency payments for faster global processing

Withdrawal requests should typically be processed within 24 hours. Consistent payout speed reflects a broker’s operational efficiency.

5. Compare Available Instruments

The wider the choice of assets, the more opportunities for diversification. Some brokers focus mainly on forex, while others include indices, commodities, shares, and digital currencies. For traders using automated strategies, access to multiple markets can improve risk distribution.

Frequently Asked Questions

What is cTrader and how is it different from MetaTrader?

cTrader is a forex and CFD trading platform developed by Spotware Systems. Unlike MetaTrader, which uses a proprietary scripting language (MQL), cTrader employs C# for automated trading through cAlgo (now known as cTrader Automate). It also features Level II pricing, showing the full market depth for greater transparency.