What Is ZuluTrade and How It Works

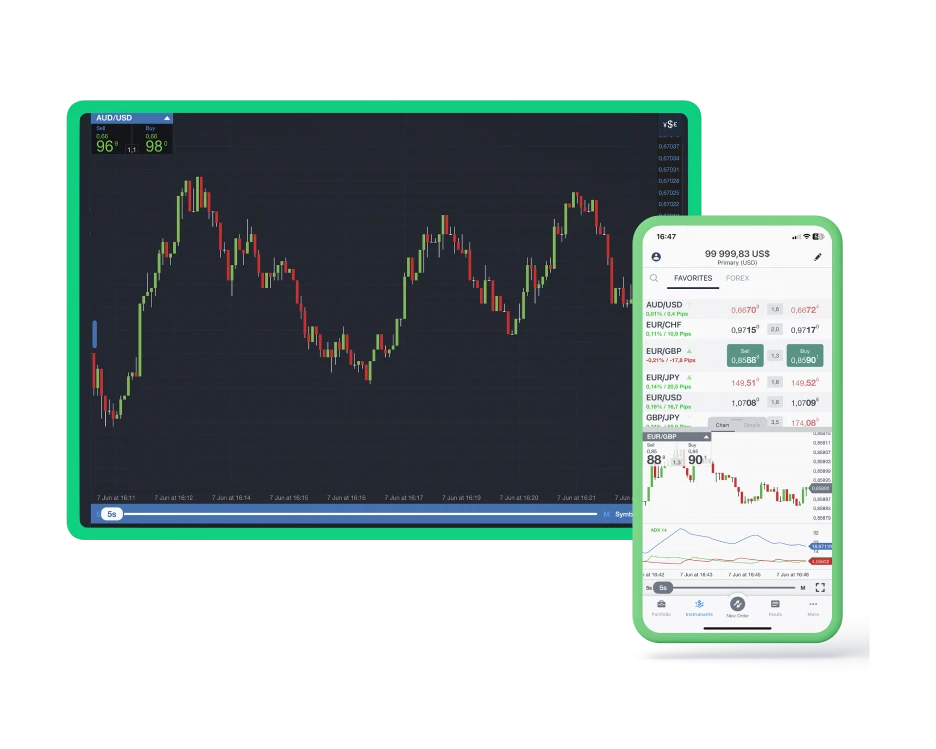

ZuluTrade is a social trading network that links investors’ trading accounts to professional traders—called signal providers. When a signal provider opens, modifies, or closes a position, the same action automatically reflects in the follower’s account, according to the chosen settings.

The platform functions as an intermediary rather than a broker. It does not execute orders directly but connects with brokers who are compatible with ZuluTrade. These brokers process trades on behalf of both signal providers and investors.

Key Features of ZuluTrade

Before choosing a broker, it is useful to understand the main components of how ZuluTrade operates:

- Signal Providers: Experienced traders who share their strategies publicly.

- Followers: Users who copy the strategies of chosen providers.

- ZuluRank: A performance rating system that helps users compare providers.

- ZuluGuard: An automated risk management tool that protects followers from poor-performing traders.

- Simulation Tools: Allowing investors to test strategies before committing funds.

These components make the platform attractive for users who prefer a more passive trading approach or wish to diversify without managing every trade manually.

Copy Trading Explained

Copy trading is the process of mirroring the positions of another trader in real time. The system tracks the trading activity of selected professionals, automatically opening and closing trades in the follower’s account.

This concept became popular due to its accessibility—anyone can participate in financial markets without mastering complex analysis or spending hours on chart monitoring. The investor only needs to select reliable signal providers and set appropriate risk parameters.

Main Advantages of Copy Trading

To better understand why ZuluTrade remains relevant, consider the main advantages of this approach:

| Feature | Description |

| Automation | Trades are executed automatically, minimizing emotional influence. |

| Accessibility | No deep technical knowledge is required to participate. |

| Transparency | Performance metrics of traders are visible to everyone. |

| Diversity | Investors can follow multiple providers for better portfolio balance. |

Despite its advantages, copy trading also carries risks. Losses from copied strategies can occur, and past performance never guarantees future results. Therefore, selecting the right provider and broker is critical.

Best ZuluTrade Brokers in 2026

When using ZuluTrade, the quality of the connected broker determines execution accuracy, spreads, commissions, and withdrawal convenience. Below are some of the top brokers compatible with ZuluTrade in 2026.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| Low commission on Raw Spread accounts | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.0 pips | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| From $5 per lot | Forex Commodities Indices Crypto | $100 | Up to 1:400 | AvaTradeGo MT4 MT5 | ||

| No commission, spreads from 0.1 pips | Forex Commodities Indices Crypto | $10 | Up to 1:2000 | MT4 MT5 | ||

| No commission, spreads from 0.6 pips | Forex Stocks Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 |

IC Markets

IC Markets

IC Markets is known for its tight spreads and high-speed execution, making it suitable for automated trading systems. The broker supports ZuluTrade through its MetaTrader 4 and MetaTrader 5 accounts. Investors can connect directly from the ZuluTrade dashboard and manage their copied strategies through the IC Markets infrastructure.

Key Highlights:

- Spreads from 0.0 pips on major currency pairs

- Compatible with MT4, MT5, and cTrader

- Regulation by ASIC and CySEC

- Offers both Raw Spread and Standard accounts

- Minimum deposit: $200

IC Markets is popular among algorithmic and copy traders who value speed, liquidity, and transparency.

Pepperstone

Pepperstone

Pepperstone is another top-tier ZuluTrade partner recognized for its institutional-grade execution and low-cost trading environment. It integrates smoothly with ZuluTrade and supports multiple trading platforms, including MT4, MT5, and cTrader.

Key Highlights:

- Regulated by FCA (UK) and ASIC (Australia)

- Average EUR/USD spread from 0.1 pips

- Supports automated and copy strategies

- Provides advanced risk management tools

- Minimum deposit: $200

Pepperstone’s stability and fast execution make it an appealing option for both beginners and experienced copy traders.

AvaTrade

AvaTrade

AvaTrade is one of the most established brokers connected to ZuluTrade. It offers global accessibility and strict regulation, making it a reliable choice for investors who prioritize security and consistency. The broker provides a wide variety of instruments, including forex, commodities, indices, and cryptocurrencies, all of which can be accessed through ZuluTrade.

Key Highlights:

- Regulated by multiple authorities, including the Central Bank of Ireland and FSCA

- Minimum deposit: $100

- Fixed and floating spreads available

- Supports MT4, MT5, and AvaTradeGO platforms

- Integration with ZuluTrade is fast and straightforward

AvaTrade stands out for its balanced mix of safety, accessibility, and technological stability. The connection between the ZuluTrade platform and AvaTrade accounts enables smooth automated order execution with minimal delays.

FXTM

FXTM

FXTM (ForexTime) is another strong option for those looking to use ZuluTrade. It combines flexibility with robust execution and low entry requirements. This broker caters to both retail and professional clients, offering several account types designed to match different trading styles and risk appetites.

Key Highlights:

- Minimum deposit: $10

- Regulated by FCA and FSC

- Floating spreads from 0.1 pips

- Supports MT4 and MT5

- Offers instant trade execution on major pairs

FXTM’s connection to ZuluTrade makes it suitable for beginners who want to start small and test various providers without committing large sums. The platform’s low-cost structure is particularly attractive for copy trading portfolios that depend on high trade frequency.

XM

XM

XM is a globally recognized forex and CFD broker known for its broad product range and tight spreads. It provides access to over 1,000 trading instruments, including forex, stocks, indices, and precious metals. Through ZuluTrade integration, XM allows users to automate strategies from selected signal providers while maintaining full control over their account risk settings.

Key Highlights:

- Regulated by ASIC, CySEC, and IFSC

- Minimum deposit: $5

- Execution speed below one second

- Compatible with MT4 and MT5

- Offers negative balance protection

XM’s competitive conditions and low entry barrier make it a strong choice for traders who want to explore copy trading without a high initial investment.

How to Choose the Right ZuluTrade Broker

Choosing the most suitable ZuluTrade broker requires attention to regulation, fees, and performance stability. Not all brokers offer the same execution quality or cost structure, and these factors can have a major impact on returns.

Key Factors to Evaluate:

- Regulation and Security – Always verify that the broker is licensed by recognized authorities such as ASIC, FCA, or CySEC. This ensures client fund protection and operational transparency.

- Execution Speed – Fast order processing reduces slippage when following high-frequency signal providers.

- Spreads and Commissions – Even small cost differences can affect profitability over time.

- Account Types and Minimum Deposit – Choose an account that suits your capital and strategy.

- Platform Compatibility – Ensure that the broker integrates fully with ZuluTrade’s infrastructure and your chosen trading terminal.

- Customer Support and Accessibility – Efficient problem resolution and regional support can make trading more reliable.

Pros and Cons of Using ZuluTrade

Like any trading approach, ZuluTrade has both strengths and limitations. Understanding them helps traders set realistic expectations.

Pros

- Automated execution of trades from proven strategies

- Wide selection of signal providers with performance metrics

- Flexibility to modify lot sizes, risk limits, and providers anytime

- Transparency through public rankings and trading histories

- Compatible with multiple regulated brokers worldwide

Cons

- Dependence on the chosen signal provider’s performance

- Potential delays between provider and follower executions

- Risk of losses during market volatility

- Commissions or profit-sharing fees may reduce returns

- Limited manual control during automated sessions

Frequently Asked Questions

Can ZuluTrade be used by beginners?

Yes, ZuluTrade is designed for both new and experienced traders. Beginners can start by following providers with long-term stable results and low drawdowns.