The trading industry has shifted toward flexible, cloud-based solutions, yet desktop tools remain popular among professional users. Both web and desktop setups built around MetaTrader 5 serve different needs. Each has strengths depending on how a person trades, manages risk, and uses automation.

Overview of Web and Desktop Trading Software

Trading software connects users to liquidity providers, market data, and analytical tools. Desktop applications like MetaTrader 5 run directly on local devices, using the computer’s hardware for processing. They offer deep integration with custom indicators, algorithmic scripts, and multiple chart configurations.

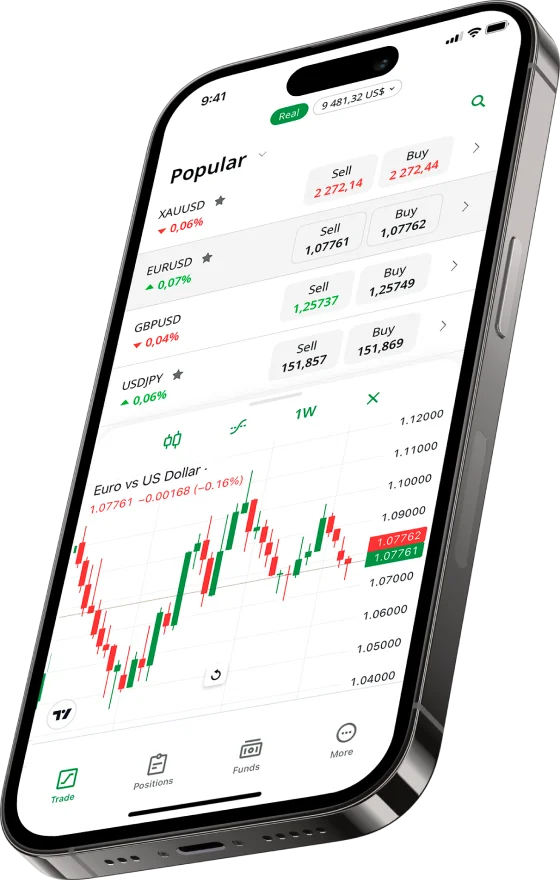

Web terminals, in contrast, operate within browsers. They require no installation, relying on secure cloud servers to execute trades. Most modern web versions now mirror the core features of desktop software—real-time quotes, one-click trading, and access to account management functions. The main distinction lies in storage, speed, and the ability to modify system settings.

| Feature | Web Platform | Desktop Application |

| Installation | Not required | Required |

| Speed | Depends on connection | Uses local CPU/RAM |

| Customization | Limited | Extensive (EAs, scripts) |

| Data Storage | Cloud | Local |

| Accessibility | Any device | Device-specific |

Advantages of Web Trading Platforms

Web versions of MetaTrader 5 focus on simplicity, fast access, and security. They work well for traders who move between offices or use several devices during the day.

Accessibility from multiple devices

A major strength of web trading is cross-device access. Users can log in from a work computer, laptop, or smartphone without extra setup. Charts and templates synchronize automatically with the broker’s servers. This flexibility helps those monitoring several accounts or switching between environments.

Web platforms are especially practical for short-term traders who prioritize mobility. A stable internet connection is all that’s needed to execute trades, check economic calendars, and track open positions in real time.

Automatic updates and cloud data storage

Web terminals stay updated automatically. Unlike desktop programs, which require manual downloads, the browser version always runs the newest release. This reduces downtime caused by version mismatches or compatibility issues.

Cloud storage adds another layer of convenience. Account settings, indicators, and templates are stored remotely, allowing users to resume their work instantly from any device. There’s no need for file transfers or backups.

| Function | Web Version Behavior |

| Software updates | Automatic via server |

| Templates | Saved in cloud |

| Custom indicators | Limited use |

| Accessibility | Global, via browser |

Security measures used in browser trading

Modern web trading platforms employ encryption protocols such as SSL/TLS to protect transmitted data. Login credentials and transaction details are stored securely, and many brokers enforce two-factor authentication. Session timeouts, automatic logouts, and server firewalls further reduce potential risks.

While browser-based trading depends on network security, most reputable systems—like MetaTrader 5 Web Terminal—meet international data protection standards. Traders still need to avoid public Wi-Fi and use private networks for maximum safety.

Advantages of Desktop Applications

Desktop trading software remains the standard for professional analysis and algorithmic execution. MetaTrader 5 is widely used in this category for its powerful processing, data precision, and extensive configuration potential. While web tools emphasize accessibility, desktop setups provide a deeper technical edge.

Stability and offline functionality

A desktop terminal runs independently of the browser and uses local resources for performance. That structure gives more stability during high volatility, especially when market data updates every millisecond. Network interruptions affect web terminals more, but a local client can reconnect automatically to the broker’s servers without losing chart states or open order details.

Offline analysis is another practical benefit. Traders can open stored chart history, run strategy tests, or adjust indicators even without an internet connection. Once back online, the terminal synchronizes new data and resumes live trading. This helps those who test Expert Advisors (EAs) or review price behavior outside market hours.

Faster execution and advanced customization options

Execution speed is a defining strength of desktop tools. MetaTrader 5 processes orders locally before sending them to the broker’s gateway. That reduces latency and improves order accuracy during fast price movements. Web versions rely on server-side processing, which introduces a slight delay depending on connection quality.

Customization is another area where desktop applications excel. Traders can install EAs, custom indicators, and scripts written in MQL5. Chart templates can include multiple timeframes, custom colors, and complex overlays. Many professionals build entire workstations around these functions.

| Feature | Desktop Version Advantage |

| Execution speed | Lower latency |

| Algorithmic tools | Full MQL5 library support |

| Custom indicators | Unlimited use |

| Offline mode | Available |

| Resource control | Uses full system performance |

Comparing User Interface and Functionality

The layout and usability of MetaTrader 5 differ slightly between its web and desktop versions. The web interface emphasizes quick access with a clean design and responsive menus. It’s suitable for executing trades fast or checking markets during travel. In contrast, the desktop version provides modular panels that can be rearranged, docked, or expanded across multiple monitors.

Functionality also varies by depth. Desktop users can open dozens of charts simultaneously, attach EAs, and run optimization tests. The web version keeps only the most-used features active to maintain browser performance. For traders using several monitors or advanced strategies, the desktop interface remains more practical.

| Aspect | Web Platform | Desktop Application |

| Layout customization | Minimal | Extensive |

| Number of charts | Limited | Dozens simultaneously |

| Indicator library | Basic | Full |

| Multimonitor support | Via browser tabs | Native multi-screen |

Performance and Security Considerations

Performance is determined by both network quality and local hardware. Web terminals rely heavily on internet speed, while desktop terminals depend on CPU and memory capacity. During volatile sessions, desktop programs usually handle rapid data feeds better since they process ticks locally.

Security follows different models. In a browser, all operations pass through encrypted HTTPS channels, reducing exposure to local malware. On desktops, users are responsible for maintaining antivirus protection, software updates, and secure storage of login credentials.Both versions of MetaTrader 5 employ SSL encryption and account verification measures. However, the safest setup depends on user discipline—keeping software updated, enabling two-factor authentication, and using trusted devices for logins.

Which Option Fits Different Trading Styles

Every trader develops unique habits. The choice between web and desktop setups depends largely on trading strategy, frequency, and the need for automation. MetaTrader 5 supports both approaches, allowing users to switch between them without losing data.

Web trading for flexibility and mobility

Web access suits active users who monitor markets throughout the day from different devices. Those managing multiple accounts or trading during travel gain the most benefit. The setup requires no installation and synchronizes data automatically.

Scalpers and day traders often appreciate this approach when quick position checks are necessary. A browser-based terminal is also convenient for beginners or part-time investors who prioritize simplicity over deep customization. Execution is reliable, provided a stable internet connection and secure network are used.

Typical users of web terminals include:

- Traders working from shared or corporate computers.

- Those using mobile hotspots or public internet access.

- Users who prefer automatic updates and minimal maintenance.

Desktop setups for professional or algorithmic trading

Professional traders rely on speed and system control. Desktop tools like MetaTrader 5 give access to algorithmic trading, tick data, and complex backtesting. These features require stable performance and direct hardware access, making desktop configurations the better option.

Algorithmic strategies depend on consistent execution. Running EAs on local machines—or dedicated VPS servers—reduces latency, ensuring signals are processed immediately. Advanced charting tools, multiple monitors, and historical data archives further strengthen the desktop advantage.

Desktop terminals fit users who:

- Run automated Expert Advisors.

- Conduct detailed technical analysis with custom indicators.

- Trade high volumes or scalp during news releases.

The Future of Trading Platforms

Technology continues to merge online accessibility with local power. The distinction between web and desktop software is narrowing as cloud synchronization improves and processors become faster.

Trends in hybrid models and cloud synchronization

Many brokers now offer hybrid models. Users can open trades on a web interface and manage them later from a desktop version of MetaTrader 5. Data syncs through secure servers, keeping watchlists, templates, and orders consistent across all devices.

Hybrid systems reduce dependence on one device type. They combine browser accessibility with desktop precision, allowing traders to start analyzing on one machine and continue elsewhere without manual exports.

Cross-device compatibility and user data continuity

Cross-device design has become a development priority. Real-time synchronization ensures identical chart layouts, watchlists, and indicator settings on every device. Cloud backups mean account data is never lost even after reinstallations or system failures.

This continuity also improves productivity. A trader can begin an analysis on a tablet, finalize entry levels on a laptop, and execute positions from a desktop terminal. MetaTrader 5 already supports such synchronization through server-based storage and unified login credentials.

Frequently Asked Questions

Can both web and desktop versions of MetaTrader 5 run simultaneously?

Yes. Trades made on one interface update instantly on the other because both connect to the same broker server.