In the fast-paced world of online trading, having control over the amount of risk you’re willing to take on each trade is crucial. One of the ways to achieve this is by using Stop Loss (SL) and Take Profit (TP) orders. These two powerful tools, available on Exness’s trading platforms, can help protect your investments and lock in profits without requiring constant monitoring of your trades.

Understanding Stop Loss (SL)

Stop Loss (SL) is a fundamental order designed to limit your losses by automatically closing a trade when the price moves against you by a set amount. This order is particularly helpful for traders who cannot continuously watch the market, as it allows you to set a predefined risk level and stay on track with your trading plan.

How Stop Loss Works

Once you place a Stop Loss order, you’re instructing your trading platform to close your position if the price reaches your predetermined level. The idea is to cut losses before they can become too large.

- For a Buy Order: If you are long (buying) an asset, you would set your SL below the entry price.

- For a Sell Order: If you are short (selling) an asset, the SL is placed above the entry price.

Example of Stop Loss in Action

Imagine you’re trading the EUR/USD pair. You enter a buy position at 1.2000 and decide to set a Stop Loss at 1.1950. This means that if the price falls to 1.1950, your position will automatically close, limiting your loss to 50 pips.

- Risk Management: By defining the price point at which to exit the trade, you limit your potential losses.

- Fixed Exposure: The Stop Loss ensures that you do not lose more than a specified amount, regardless of how volatile the market becomes.

- Automatic Execution: It closes your position automatically when the price hits the Stop Loss level, which means you don’t need to be present to execute the action manually.

However, keep in mind that in periods of extreme market volatility, slippage may occur, meaning the price at which your Stop Loss is executed may be different from the set level. This is often seen during major news events or market gaps.

Understanding Take Profit (TP)

Take Profit (TP) is an order that automatically closes your position once the market reaches a price at which you are satisfied with the profit. By using TP, you can lock in gains before the market turns against you. It allows you to profit from favorable price movements without needing to monitor every price tick.

How Take Profit Works

When you set a Take Profit order, you’re defining the price level at which you want your trade to close for a profit. Unlike Stop Loss, which works to minimize loss, TP secures your gains by closing your position when the market hits your target.

- For a Buy Order: In a long position, you would place your TP above the entry price.

- For a Sell Order: For a short position, TP is set below the entry price.

Example of Take Profit in Action

Consider that you enter a buy trade for EUR/USD at 1.2000. You set your Take Profit at 1.2100. If the market price rises to 1.2100, the platform will automatically close your position, locking in the profit at that point.

- Profit Protection: TP ensures that you capture profits before a reversal happens, especially in fast-moving markets.

- Predefined Exit: It eliminates the need for manual intervention, ensuring that you don’t miss out on profits if the market suddenly changes direction.

- Automation: TP orders let you take a more hands-off approach to trading, letting you set the trade and walk away.

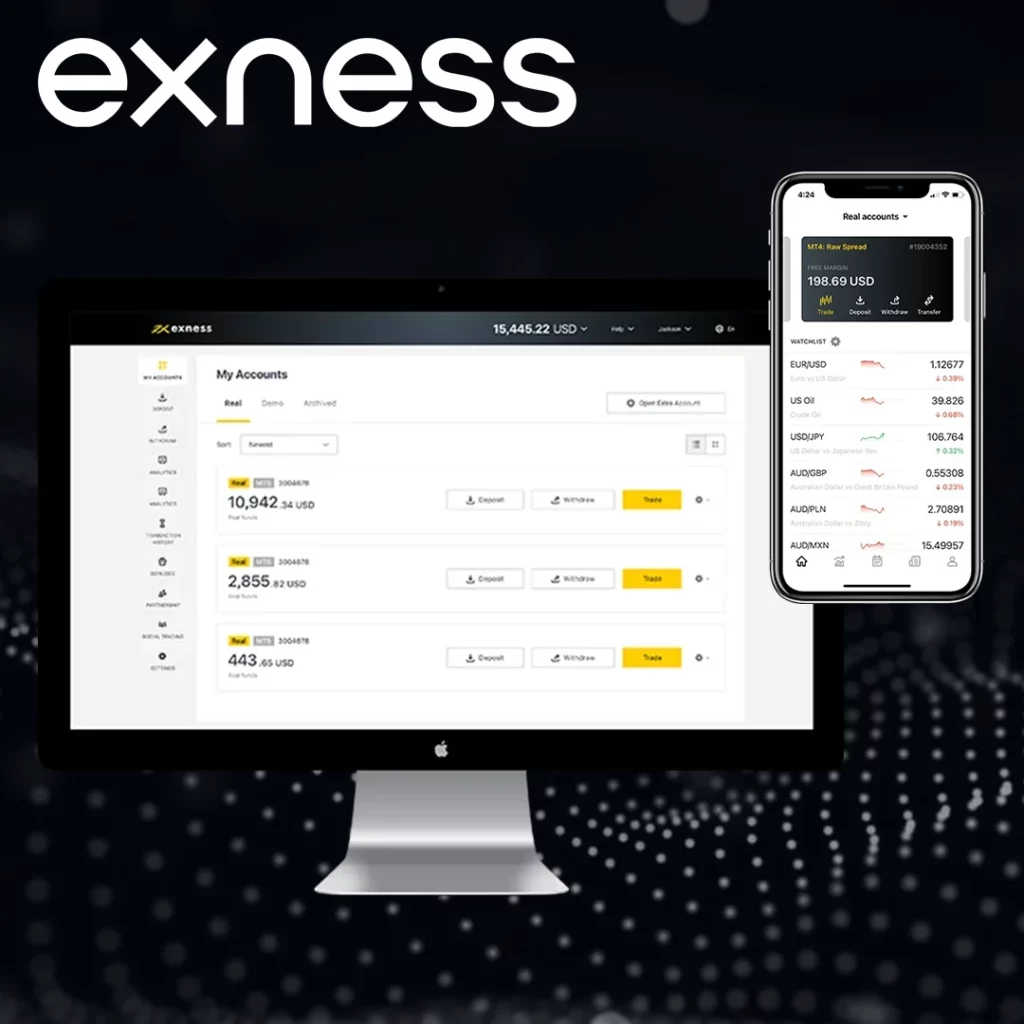

Setting Stop Loss and Take Profit on Exness Platforms

Exness offers several ways to set both Stop Loss and Take Profit orders across its trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the proprietary Exness Terminal.

On MetaTrader Platforms (MT4 & MT5):

- When you open a new position, you can directly input your desired Stop Loss and Take Profit levels in the relevant fields.

- If you are placing a pending order (such as a buy stop or sell stop), you can still define your SL and TP before the order is executed.

Exness Terminal

Exness’s own trading terminal also provides easy-to-use options for setting SL and TP during trade execution or even after the trade is placed.

Once set, these orders will automatically close your position at the predefined levels. However, you can always adjust them as market conditions evolve.

Advantages of Using Stop Loss and Take Profit

Using Stop Loss and Take Profit orders offers numerous advantages, especially when you’re trading in volatile and unpredictable markets. Here’s how these tools can benefit your trading approach:

Risk Control

- Stop Loss helps manage your risk by setting a maximum loss per trade.

- Knowing your limit in advance makes it easier to control the overall risk exposure in your portfolio.

Emotional Discipline

- SL and TP help take emotions out of the equation, preventing impulsive decisions like chasing after the market or closing trades too early.

- It allows traders to stick to their plan, reducing the chances of making hasty decisions due to fear or greed.

Time Efficiency

- By automating the process of closing a position, you don’t need to be constantly glued to your screen.

- SL and TP orders are especially useful for traders who cannot monitor the market all day due to time constraints or other commitments.

Flexibility

- You can modify your SL and TP levels as market conditions change. This flexibility allows you to adjust to new market insights or trends without taking manual action.

Advanced Strategies for Using SL and TP

While using Stop Loss and Take Profit is straightforward, there are advanced strategies to optimize their effectiveness:

Trailing Stop

A Trailing Stop is a dynamic form of Stop Loss. As the market moves in your favor, the trailing stop moves with it, helping lock in profits while protecting you from significant reversals.

- Example: If you have a buy position in EUR/USD with a 50-pip trailing stop, and the price moves up by 100 pips, your Stop Loss will move up to break even, and it will trail the market at 50 pips below the new price. This allows you to capture more profit if the market continues in your favor.

Locking in Profit

You can use multiple TP levels to lock in partial profits. For instance, you might set a Take Profit at 50 pips, and once the market hits that level, you secure part of the profit and leave the rest running for further gains.

- This strategy allows you to take some profits off the table while still leaving part of the trade open for additional upside potential.

Adjusting Stop Loss to Break Even

Once a position moves in your favor by a certain amount, you can move your Stop Loss to break even (the entry price). This strategy ensures that you are no longer risking your initial capital if the market reverses.

- Risk-Free Trade: After moving your SL to break even, you’re essentially trading with no risk, as any price movement against you will not result in a loss.

Understanding Slippage in SL and TP Orders

During periods of high volatility or significant market movements, slippage can occur. This happens when the price of an asset changes before your Stop Loss or Take Profit order can be executed, resulting in your order being filled at a different price than expected.

- Exness’s Protection Against Slippage: Exness offers negative slippage protection that can help minimize the risk of slippage during market conditions where prices fluctuate rapidly.

Conclusion

Stop Loss and Take Profit are vital tools in any trader’s toolkit. They allow for effective risk management, ensuring that losses are capped while profits are secured. Exness provides robust platforms like MT4, MT5, and the Exness Terminal, which make it simple to set and manage these orders. Whether you’re a beginner or an experienced trader, mastering the use of Stop Loss and Take Profit orders is key to consistent trading success.

The flexibility, automation, and control they offer empower traders to execute their strategies efficiently, without the stress of constant market monitoring. By incorporating these tools into your trading strategy, you can enhance your overall risk management approach and increase your chances of achieving long-term profitability.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs

What is Stop Loss (SL)?

A Stop Loss (SL) is an order placed to automatically close a trade when the price moves against you by a predetermined amount. It helps limit potential losses on a trade.