Exness offers a range of trading instruments, including currency pairs, commodities, and traditional stock market indices. However, one frequently asked question is whether Exness provides access to the Volatility 75 Index (VIX 75). This index has garnered attention among traders due to its high volatility and unique structure.

What is the Volatility 75 Index (VIX 75)?

The Volatility 75 Index, commonly known as VIX 75, is a synthetic index created by the platform Deriv (formerly Binary.com). It simulates market volatility and does not represent any underlying financial asset such as stocks or commodities. Instead, it reflects price movements driven by market volatility, making it especially attractive to traders looking for high-risk, high-reward opportunities.

What sets the VIX 75 apart from other indices is its extreme volatility. This means that traders can witness significant price swings within very short periods, which can lead to substantial gains or losses. The index moves in such a way that it often creates a sense of excitement for traders who are comfortable with taking large risks. Moreover, VIX 75 is available 24/7, giving traders the flexibility to enter and exit positions at any time, unlike traditional financial markets that are closed during weekends.

Trading Volatility 75 on Exness

Currently, Exness does not provide access to the Volatility 75 Index for trading. This index, known for its highly volatile nature, is primarily offered by platforms like Deriv and a select few brokers that specialize in synthetic indices. Synthetic indices, such as VIX 75, are a unique asset class, and not all brokers choose to offer them due to the complexity and regulatory hurdles that come with trading such instruments.

Why Doesn’t Exness Offer the Volatility 75 Index?

Several factors likely contribute to Exness not offering the Volatility 75 Index. One significant reason could be regulatory constraints. Synthetic indices like VIX 75 are not universally accepted across all financial jurisdictions, and some regulators may impose restrictions on such products. Exness, being a regulated broker with licenses in multiple regions, may have chosen to focus on products that align more closely with traditional financial instruments, which are widely accepted and regulated across global markets.

Additionally, Exness tends to focus on offering more established and liquid instruments. Their primary focus is on forex trading, with instruments such as major currency pairs (e.g., EUR/USD, GBP/USD), metals like gold and silver, and global indices such as the US30 and the S&P 500. These products are more mainstream, widely recognized, and often involve less volatility compared to synthetic indices like VIX 75.

Exness might also prioritize ensuring a stable and secure trading environment for their clients, and synthetic indices, while appealing to some, come with risks that not all traders are prepared for. Therefore, Exness might have opted to avoid offering such products to maintain a more risk-averse trading environment.

Alternatives to VIX 75 on Exness

Even though Exness does not offer the Volatility 75 Index, there are several alternative indices and instruments available on the platform that might appeal to traders interested in volatile markets. These instruments, while not as volatile as VIX 75, can still provide substantial trading opportunities. Below are some of the main alternatives.

US30 (Dow Jones Industrial Average)

The US30, also known as the Dow Jones Industrial Average, is one of the most widely traded indices globally. It tracks the performance of 30 major U.S. companies, including household names like Apple, Microsoft, and Coca-Cola. While not as volatile as VIX 75, the US30 still experiences significant price swings, particularly during times of economic uncertainty or political events. Traders often turn to the US30 for its liquidity and reliability in terms of historical data and market movement.

Key characteristics:

- Reflects the U.S. economy’s performance.

- Liquidity and consistent market activity.

- Prone to large price movements, particularly during economic events.

S&P 500 (SPX)

The S&P 500 index is another popular alternative. It tracks the performance of the 500 largest publicly traded companies in the U.S. and is often considered one of the most reliable indices for trading. While it’s less volatile compared to VIX 75, the S&P 500 can experience rapid price movements, especially during market corrections or economic announcements.

Key characteristics:

- Represents 500 large U.S. companies.

- Low volatility compared to VIX 75.

- Regular price swings based on news and events.

Nasdaq 100

The Nasdaq 100 index is another widely traded instrument that includes companies in technology, healthcare, and consumer services. Due to its strong tech-sector composition, it tends to be more volatile than the S&P 500, though less so than VIX 75. Traders who are interested in volatility but want something more traditional may find the Nasdaq 100 a suitable choice.

Key characteristics:

- Composed of technology and innovation-driven companies.

- Volatile, especially during tech sector earnings reports.

- Liquid and widely traded.

Commodities like Gold and Oil

For traders seeking volatility, commodities like gold and oil can also present substantial price swings, especially during global geopolitical events or shifts in economic policy. While not synthetic indices, commodities are affected by global factors, which can result in volatile price movements. Gold, in particular, is known for its safe-haven appeal during times of financial uncertainty, while oil often experiences volatility due to supply-demand imbalances or geopolitical tensions.

Key characteristics:

- Gold often reacts to economic instability.

- Oil is highly sensitive to geopolitical issues.

- Can experience sharp moves based on global events.

Why Do Traders Seek Volatility 75?

The primary reason traders seek out the Volatility 75 Index is its extreme price movements. The index is designed to simulate volatility, meaning traders can expect fast-paced and erratic price changes within a single trading day. This creates opportunities for both large profits and considerable losses. Traders who are skilled in managing risk and understanding volatility may find VIX 75 a suitable instrument for their strategies.

However, trading such an instrument requires careful risk management. The volatility that makes VIX 75 appealing can also lead to rapid losses if the market moves against a position. This is why it’s crucial for traders to ensure they have the right experience and tools before engaging in synthetic index trading.

Conclusion

While Exness does not offer the Volatility 75 Index, there are several alternatives available for traders looking for high volatility instruments. Popular indices like US30, S&P 500, and Nasdaq 100 provide ample opportunities for trading with varying levels of volatility. Additionally, commodities like gold and oil offer their own sets of challenges and rewards for traders willing to navigate the complexities of global markets.

For those specifically seeking synthetic indices, platforms like Deriv may be the best place to explore the VIX 75. However, Exness remains a strong choice for traders looking to trade a broad range of traditional financial products with solid execution and regulatory protections.

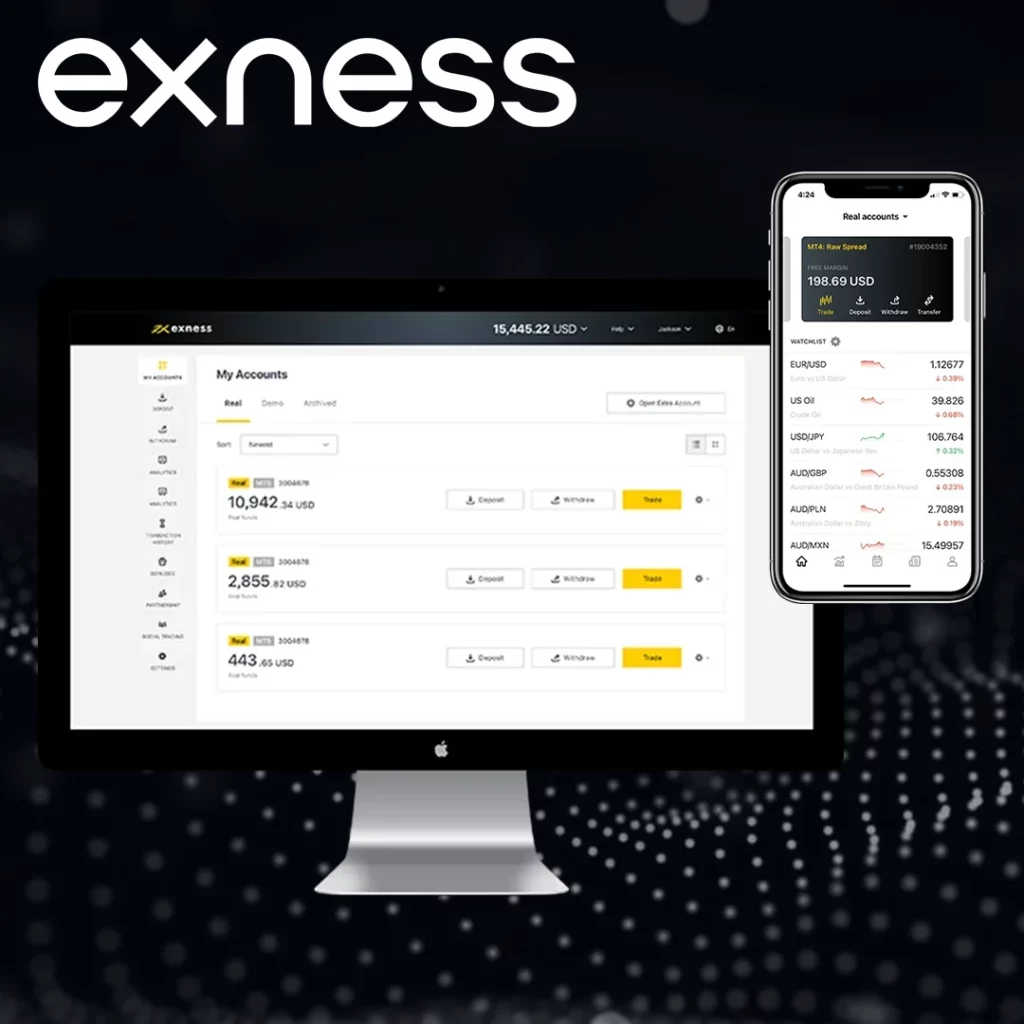

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs

Does Exness offer the Volatility 75 Index for trading?

Exness does not offer the Volatility 75 Index (VIX 75) for trading. This index is available on other platforms like Deriv, which specialize in synthetic indices.