Selecting a dependable stock trading platform determines how effectively traders can access markets, manage risk, and execute decisions in real time. Every second and every pip matter, so a weak system or delayed execution can lead to measurable losses. Choosing the right solution involves analyzing performance, usability, data accuracy, and security.

The focus is not only on finding a platform with modern tools but also one that functions with consistency across different market conditions.

Understanding What Makes a Trading Platform Reliable

Reliability in trading software refers to stability, transparent order handling, and data integrity. A trustworthy platform must process orders without freezing or slippage and deliver accurate market data. Traders rely on these systems to make quick judgments, often during volatile sessions.

Several elements define reliability:

- System uptime – uninterrupted operation during trading hours with minimal downtime.

- Latency – the delay between placing and executing an order. Lower latency means better trade precision.

- Data accuracy – real-time quotes without artificial delays or manipulation.

- Regulation and reputation – platforms backed by licensed brokers and audited infrastructure.

- Transparency – clear documentation about spreads, execution methods, and server locations.

Reliability is built through long-term technical refinement, consistent uptime, and audited compliance rather than flashy visuals or marketing.

Key Features Every Trader Should Look For

Not all trading systems deliver the same value. Professional traders assess them by how well they handle execution pressure, order types, analytical capabilities, and personalization. The following subsections describe the most critical features that define a high-quality trading environment.

Order Execution Speed and Stability

Execution determines how close the final trade price is to the quoted one. In fast-moving markets, delays of milliseconds can impact outcomes.

A strong platform processes requests through optimized servers and multiple liquidity providers. The system should maintain low latency under peak loads and protect against re-quotes.

When comparing execution quality:

| Factor | Ideal Value | Notes |

| Average execution time | <100 ms | Suitable for scalpers and high-frequency strategies |

| Slippage rate | Minimal | Should stay consistent during volatile news releases |

| Order rejection rate | <0.1% | Reflects system reliability and market depth |

Stability during news releases or major price swings is a good indicator of underlying server architecture.

Charting Tools and Technical Indicators

Effective analysis depends on flexible charting tools. Traders interpret price behavior through candlestick formations, volume patterns, and oscillator signals. A robust system integrates:

- Multiple chart types (candlestick, line, Heikin-Ashi, etc.)

- Adjustable timeframes down to one second or tick-by-tick

- Customizable indicators and scripts

- Drawing tools for support/resistance, Fibonacci, and trend channels

Professional systems also allow exporting data for algorithmic testing or third-party integrations.

| Tool Category | Example Indicators | Purpose |

| Trend analysis | Moving Averages, Parabolic SAR | Identify direction and momentum |

| Volatility measurement | ATR, Bollinger Bands | Gauge potential range and risk |

| Oscillators | RSI, MACD, Stochastic | Spot entry and exit points |

Account Types and Customization Options

Flexibility in account configuration lets traders choose between different pricing structures and leverage levels. A good platform supports micro, standard, and professional accounts, each suited for distinct strategies.

Essential parameters include:

- Leverage range suitable for short-term and long-term positions.

- Commission vs. spread model transparency.

- Swap-free or Islamic account options for compliance with religious restrictions.

- Customizable layout for watchlists, depth-of-market views, and workspace arrangements.

Such customization helps align technical setup with individual trading habits.

Comparing User Experience and Accessibility

Reliability extends beyond order speed. Comfort, visibility, and access across multiple devices directly influence consistency. A platform that feels intuitive reduces the mental load during high-pressure trading.

Interface Clarity and Ease of Use

A clean interface allows faster reaction and decision-making. Navigation menus, chart windows, and trade panels must be logically arranged.

New traders prefer simplified layouts, while advanced users expect deep parameter control. Platforms that let users modify color schemes, hotkeys, and window docking generally deliver better ergonomics.

Three key UI factors worth assessing:

- Logical grouping of trading tools and charts.

- Readable typography and minimal visual clutter.

- Responsive resizing across different monitors.

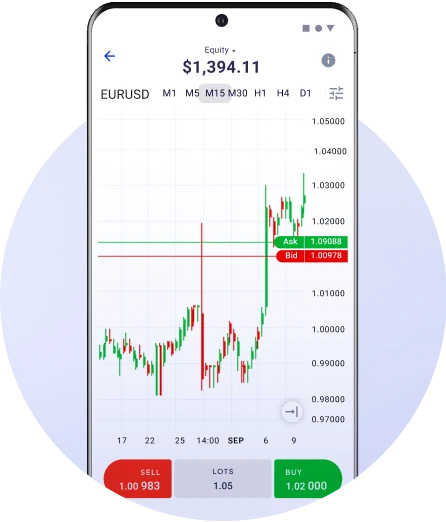

Availability on Desktop and Mobile Devices

A modern trading system synchronizes seamlessly across desktop terminals, web browsers, and mobile applications. Real-time synchronization ensures open positions and alerts remain consistent regardless of device.

| Device Type | Primary Use Case | Features |

| Desktop | Intensive chart analysis | Multi-monitor support, algorithmic trading |

| Web terminal | Quick access | Runs without installation, ideal for work PCs |

| Mobile app | Monitoring and small trades | Push notifications, simplified execution panel |

Mobile trading should maintain execution precision, not serve merely as an accessory.

Language Support and Regional Access

A global user base demands multilingual interfaces and localized servers. Translation quality affects comprehension, while nearby data centers influence execution time.

Reliable systems also adjust to regional regulations, displaying correct leverage caps and margin requirements for each jurisdiction.

Evaluating Customer Support and Service Quality

A trading system’s reliability is not only determined by its tools but also by how effectively issues are resolved when something goes wrong. Delayed assistance can lead to financial losses, especially when technical interruptions occur during volatile sessions.

Reliable brokers maintain multilingual support channels operating 24/7, with skilled representatives capable of addressing both technical and account-related queries.

Traders should assess support through several factors:

- Availability – response time during both peak and off-peak hours.

- Communication channels – live chat, email, ticketing, and phone lines.

- Specialized knowledge – whether representatives understand margin calls, swaps, or order execution details.

- Self-service options – access to a detailed knowledge base, video tutorials, and market status dashboards.

Quality service becomes evident when complex questions are solved promptly without transferring between multiple departments. An efficient help desk reduces downtime and builds long-term user trust.

Costs, Spreads, and Hidden Fees

Trading costs influence overall profitability more than most traders initially realize. A small spread difference can accumulate into a significant amount over hundreds of trades. Evaluating fees helps determine if the platform aligns with the trader’s strategy.

Key pricing components include:

- Spread – the difference between bid and ask prices. Fixed spreads remain constant, while variable ones expand during volatility.

- Commission – charged per traded volume, common on professional accounts.

- Swap/Overnight fee – cost of holding leveraged positions overnight.

- Deposit and withdrawal charges – depending on the payment method used.

Testing Before Committing

Evaluating a trading solution without risking capital is a practical step often overlooked. Realistic testing reveals latency, interface stability, and pricing consistency before any real funds are involved.

Demo Accounts and Trial Periods

A demo account replicates live market conditions without financial exposure. It helps traders assess speed, chart accuracy, and strategy execution reliability. Most systems offer real-time pricing with virtual balances that can be reset anytime.

Key elements to test:

- Execution time and potential delays.

- Stability during news announcements.

- Accuracy of chart data compared with market sources.

- Compatibility with different devices and browsers.

Testing in this environment also highlights how spreads behave across sessions and whether the interface allows intuitive risk management.

Testing Order Execution and Platform Performance

Once comfortable with a demo setup, traders can proceed with a small live account to observe actual fills and slippage. Order execution consistency under market stress reveals the platform’s true performance.

Performance benchmarks to evaluate:

- Order confirmation delay – how long it takes to reflect in the terminal.

- Server location – closer proximity means lower latency.

- System behavior during volatility – does it freeze, requote, or maintain execution speed?

- Data refresh rate – frequency of price updates during active sessions.

Reliable systems maintain near-identical results between demo and live environments. Large discrepancies signal potential pricing manipulation or insufficient liquidity.

Safety and Data Protection

Financial security ranks as one of the top priorities for any trader. A trustworthy platform must safeguard deposits, personal data, and transaction history.

Data encryption, segregated accounts, and regulated oversight form the foundation of safety.

Crucial protection layers include:

- Regulatory compliance – operating under financial authorities such as the FCA, CySEC, or FSCA.

- Data encryption protocols – SSL/TLS encryption across all connections.

- Two-factor authentication (2FA) – prevents unauthorized logins.

- Segregated client funds – client deposits stored separately from company capital.

- Regular audits – independent verification of operational integrity.

Frequently Asked Questions

How can I verify if a trading platform is regulated?

Check the broker’s registration number on the official website of the relevant authority, such as the FCA or CySEC. Cross-reference the data to confirm authenticity.