Social trading has reshaped how many people approach the financial markets. Instead of relying solely on personal analysis, traders can now observe and replicate the positions of proven professionals. This model allows users to follow experienced investors and apply their strategies automatically, bridging the gap between beginners and experts in real time. The approach has grown rapidly due to its accessibility and transparency, especially for those entering forex, stock, or crypto markets for the first time.

What Is Social Trading and How It Works

Social trading refers to a system where investors share their trades publicly, allowing others to copy them automatically or manually. A social trading platform connects experienced traders—often called signal providers—with followers who want to mirror their actions. Each transaction the expert makes appears instantly in the follower’s account, scaled according to chosen investment size and settings.

These platforms operate on automation and data-sharing technology. When a professional opens or closes a trade, the same order is executed for followers proportionally. The goal is to reduce the learning curve by allowing less-experienced traders to observe real strategies while participating actively in the market.

| Term | Description |

| Signal Provider | A professional whose trades can be copied by others. |

| Follower | A trader who replicates the trades of a chosen signal provider. |

| Copy Ratio | The portion of the expert’s trade size mirrored in the follower’s account. |

This transparency encourages accountability. Successful traders gain followers and often receive a share of profits or commissions. At the same time, followers benefit from insights and exposure to proven market strategies.

Key Features of Social Trading Platforms

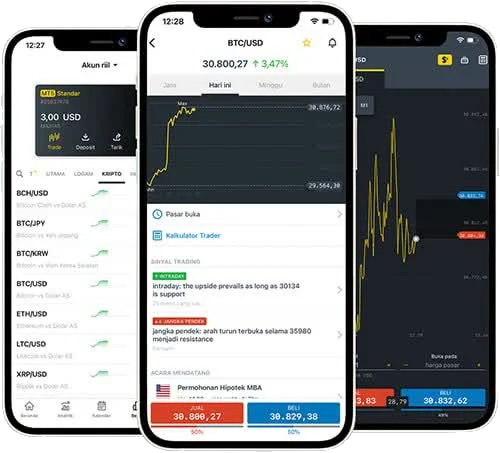

Modern social trading platforms come with analytical and automation tools designed to help users evaluate, copy, and monitor trades efficiently. They combine features from traditional trading terminals with social network elements, allowing users to analyze data and communicate with others simultaneously.

Copy and Mirror Trading Options

There are two main ways to replicate expert strategies:

- Copy Trading: The system duplicates every order from the selected trader automatically. It’s ideal for users who prefer a passive approach.

- Mirror Trading: Instead of following one trader, users replicate predefined algorithmic strategies used by professionals.

- Manual Copying: Some users prefer to analyze expert trades and execute similar ones manually, maintaining more control over entry and exit timing.

Each method offers flexibility. The key difference lies in automation level—copy trading is fully automated, while manual copying allows intervention.

| Type | Automation Level | Best For |

| Copy Trading | Full | Beginners seeking simplicity |

| Mirror Trading | Partial | Traders testing multiple strategies |

| Manual Copying | Low | Traders with some analytical experience |

Trader Performance Metrics and Leaderboards

Transparency is central to social trading. Platforms usually display detailed statistics for every signal provider, helping users assess consistency and risk. Key performance metrics include:

- Profit Percentage: Overall return over a selected period.

- Drawdown: Maximum capital decline during trading. Lower values suggest steadier risk control.

- Win Rate: The ratio of profitable trades to total trades executed.

- Average Trade Duration: Useful for understanding whether the trader focuses on short-term or long-term positions.

- Risk Score: A combined indicator based on volatility, leverage, and trade frequency.

Most systems use leaderboards to highlight top-performing traders ranked by profitability, stability, and follower count. Some include filtering tools to search by asset class, trading style, or region.

These leaderboards function as data-driven dashboards, giving every follower a clear view of who consistently performs well and under what conditions. Instead of relying on reputation, the evaluation relies entirely on historical results verified by the platform’s analytics engine.

How to Start Copying Expert Traders

Getting started with social trading is simpler than it appears. The main steps include choosing a trustworthy service, completing account setup, and evaluating traders based on measurable data. The process doesn’t require advanced technical skills, but attention to detail is crucial to minimize risk.

Choosing a Reliable Platform

The first step is selecting a trading platform with a proven reputation for transparency and stable execution. A reliable platform should operate under regulatory oversight, offer segregated client accounts, and publish verified performance data.

Before joining, it’s advisable to review:

- Regulation: Confirm registration with recognized authorities such as FCA, CySEC, or ASIC.

- Execution Speed: Low latency ensures copied trades are executed without slippage.

- Data Accuracy: Historical performance should be verified and free of manipulation.

- Fee Structure: Check if the system charges commissions, spreads, or profit-sharing fees.

- User Interface: A well-organized dashboard simplifies monitoring and comparison.

Below is an example of what to compare:

| Feature | Importance Level | Notes |

| Regulation | High | Legal protection for users |

| Execution Speed | High | Prevents slippage during copying |

| Fees | Medium | Look for transparent pricing |

| Support Channels | Medium | Useful for technical issues |

A strong infrastructure and responsive interface are as essential as low costs. Transparency and speed ensure accurate replication of trades, especially in volatile markets.

Setting Up an Account and Verifying Identity

Once the platform is selected, the next phase involves registration and compliance verification.

The process typically includes:

- Creating an Account: Enter basic contact information and confirm your email.

- Identity Verification (KYC): Upload identification and proof of address to comply with regulations.

- Funding the Account: Deposit a chosen amount based on your capital allocation plan.

- Selecting Base Currency: Match it with your trading goals to avoid conversion losses.

- Setting Risk Parameters: Adjust trade size and stop-loss levels before activating copying.

These steps are crucial for account security. Proper verification protects user data and prevents unauthorized withdrawals.

A verified account also ensures seamless execution when connecting with professional traders.

Selecting Traders Based on Strategy and Risk Profile

Choosing which traders to copy determines overall performance. The goal is not to follow the most profitable trader blindly, but to select those whose risk tolerance aligns with your objectives. Consider factors like consistency, average drawdown, and trade frequency.

Traders can be grouped by strategy type:

| Strategy Type | Description | Ideal Follower |

| Scalping | Quick trades focused on small price changes | Traders seeking frequent activity |

| Swing Trading | Medium-term positions held for days or weeks | Users comfortable with moderate volatility |

| Position Trading | Long-term outlook based on macro trends | Investors preferring stable growth |

| Algorithmic | System-based entries using pre-set rules | Data-driven investors |

Practical tips when selecting a trader:

- Review at least six months of verified performance.

- Compare risk-adjusted returns instead of pure profit percentages.

- Check communication activity—consistent updates reflect professionalism.

- Avoid copying accounts with sudden high gains, as these may signal excessive leverage.

Balancing several traders across different instruments reduces overall risk. This diversification limits losses if one strategy underperforms.

Understanding Risk Management in Copy Trading

Even though copy trading automates execution, it doesn’t eliminate market risk. Effective risk control remains the user’s responsibility. The key principle is to preserve capital by managing exposure and diversification intelligently.

- Diversify Across Traders and Assets: Never allocate the entire account to a single signal provider. Spreading capital among different strategies, timeframes, and assets—forex, indices, commodities, or stocks—helps stabilize performance during volatile periods.

- Control Trade Size: Platforms often allow setting a copy ratio or fixed investment amount per trade. Smaller position sizes prevent overexposure when the master trader opens large orders.

- Use Stop-Loss and Equity Protection: Modern systems let users define maximum drawdown limits. When equity falls below this threshold, the system automatically stops copying new trades or closes open positions.

- Reassess Periodically: Markets evolve. A trader performing well in one quarter may underperform later. Reviewing data monthly helps identify deviations in strategy consistency or risk behavior.

Here’s an example of basic risk allocation:

| Allocation Type | Percentage | Purpose |

| Conservative Traders | 40% | Stability and low drawdown |

| Moderate Traders | 35% | Balanced growth |

| Aggressive Traders | 25% | Higher potential returns |

Good risk management in copy trading mirrors portfolio diversification in traditional investing. The idea is to spread exposure wisely instead of chasing the highest short-term profits.

Advantages and Limitations of Social Trading

Social trading simplifies market participation but still requires understanding its benefits and possible downsides. While it opens access to professional-level strategies, the outcome depends on the quality of traders followed, market conditions, and personal discipline. The table below summarizes its primary strengths and weaknesses.

| Aspect | Advantage | Limitation |

| Accessibility | Easy for beginners to start trading with guidance | Overreliance on other traders’ skills |

| Transparency | Access to detailed performance data | Some traders may manipulate short-term results |

| Automation | Trades are executed instantly and accurately | Limited control over timing or position adjustment |

| Diversification | Multiple strategies can be followed at once | Managing too many can lead to confusion |

| Learning Value | Followers can study real strategies | Requires time to understand risk and strategy behavior |

Understanding both sides helps traders stay realistic. Copy trading works as a supplement to education, not a substitute for it.

Why New Traders Use Copy Trading

Many beginners are drawn to social trading because it shortens the learning process. It allows them to observe expert-level decisions without making the same early mistakes. Three main motivations stand out:

- Learning Through Observation: Watching expert strategies in real time teaches timing, position sizing, and market entry logic. It’s like studying practical trading behavior without extensive theory.

- Reduced Complexity: New traders often struggle with technical indicators and news analysis. Copy trading bypasses this stage by automatically reproducing tested systems.

- Accessible Capital Management: Platforms let users control trade size, allocate funds across multiple providers, and stop copying instantly. This flexibility gives beginners structure and oversight.

However, success depends on discipline. Even with automation, users must monitor results and adjust allocations based on data, not emotion.

Common Mistakes to Avoid

Copy trading removes some technical barriers, yet many users still fail due to avoidable errors. Awareness of these pitfalls can significantly improve long-term outcomes.

- Following Short-Term Stars: Selecting traders based only on recent profits often ends poorly. Sudden spikes in return usually involve high leverage and poor risk control.

- Ignoring Drawdown Statistics: A trader with consistent 10% monthly gains but a 50% drawdown history poses greater danger than a moderate but stable performer.

- Overdiversifying Too Early: Copying too many traders at once can dilute performance and complicate tracking. Start with 2–3 reliable providers before expanding.

- Lack of Periodic Review: Even the best trader can face changing conditions. Failing to review monthly performance can result in unnecessary losses.

- Emotional Decision-Making: Canceling a trader after one losing week or chasing the next high performer shows emotional bias. Copy trading requires patience and a data-driven mindset.

Here’s a brief checklist to stay disciplined:

- Review performance once per month.

- Keep drawdown below 30% of capital.

- Limit total copied traders to five at most.

- Allocate funds gradually, not all at once.

Avoiding these common traps transforms copy trading from a speculative shortcut into a sustainable strategy.

Top Social Trading Platforms to Consider

The market hosts numerous social trading systems, each offering specific tools for automation, analytics, and risk control. The best ones share several characteristics—verified statistics, intuitive dashboards, transparent costs, and reliable regulation.

Key Criteria for Evaluation

Before choosing a platform, traders should analyze its operational and functional quality. The main evaluation criteria include:

| Criterion | Description | Why It Matters |

| Regulation and Licensing | Supervision by financial authorities | Protects user funds and guarantees transparency |

| Execution Speed | Fast trade replication with minimal delay | Reduces slippage between provider and follower |

| Trader Verification | Ensures real performance data | Prevents misleading results |

| Fee Structure | Profit share, spread, or fixed commission | Helps calculate real return after costs |

| Risk Tools | Custom stop-loss and copy limits | Protects account from excessive losses |

Professional traders value execution quality and transparency over appearance or marketing claims. The key is accurate performance replication.

Examples of Popular Platforms

While each platform operates differently, several have become benchmarks in the social trading space due to their transparency and efficiency.

- eToro – One of the earliest networks connecting millions of traders. It supports multiple asset classes and offers easy-to-read performance charts.

- ZuluTrade – Focused on signal ranking, with advanced filters for risk level, asset type, and profit consistency.

- NAGA – Combines social networking with trading automation and clear profit-sharing models.

- FX Junction – Built for forex traders seeking cross-broker connectivity and detailed metrics.

- Myfxbook AutoTrade – Integrates directly with MetaTrader accounts, providing verifiable performance analytics.

Tips for Building Long-Term Success

Copy trading can deliver consistent growth only when treated as a structured process rather than a shortcut. The following guidelines help maintain discipline and improve decision quality over time.

1. Treat Copy Trading Like Portfolio Management

Think of each signal provider as an asset class. Track their performance monthly, note correlations, and rebalance when volatility rises. Reducing exposure to underperformers while increasing capital in consistent accounts keeps returns stable.

2. Monitor Data, Not Emotions

Human bias can distort judgment. Reacting to one losing streak or chasing recent gains often harms results. Base every change on data such as drawdown, Sharpe ratio, or long-term equity curve behavior.

3. Adjust Copy Ratios Gradually

Never double allocations after one good month. Increase or reduce exposure in small steps — for instance, 10–15% per quarter — based on verified consistency.

4. Keep Reserves in Cash

Always hold 10–20% of capital unallocated. This cushion allows flexibility if a new strategy emerges or volatility spikes in the market.

5. Learn From Professionals

Social trading isn’t only about replication. Studying trade entries, exits, and comments from experts helps users develop independent analytical judgment. Over time, followers can evolve into self-sufficient traders.

Frequently Asked Questions

Is copy trading fully automatic?

Yes. Once activated, all trades from the selected provider are executed automatically in the follower’s account. Users can adjust risk settings, stop copying, or close trades manually at any time.