Why Traders Choose Tickmill

Tickmill’s reputation is built on a foundation of competitive pricing and reliable execution. The broker combines advanced trading technology with regulatory credibility, making it suitable for both beginners and professionals who seek a secure and efficient environment.

Key Features & Benefits

- Spreads from 0.0 pips – Ideal for traders who execute multiple short-term positions daily, ensuring minimal cost per trade.

- Pro and VIP accounts with reduced costs – Designed for high-volume traders who want to maximize their profit margins through lower fees.

- Negative balance protection – Safeguards your account from going below zero, providing peace of mind in volatile markets.

- MT4 trading platform – A globally recognized interface known for stability, fast order execution, and advanced analytical tools.

- Swap-free accounts available – Suitable for traders who follow Islamic finance principles or prefer not to pay overnight interest.

Account Types and Trading Conditions

Tickmill offers several account categories to suit various trading styles and investment goals:

- Classic Account – No commission, with spreads starting from 1.6 pips; ideal for beginners or low-volume traders.

- Pro Account – Raw spreads from 0.0 pips and a small commission per lot; best for experienced traders and scalpers.

- VIP Account – Designed for high-volume clients, offering the lowest commission rates and personalized support.

All accounts include access to the same trading instruments, negative balance protection, and fast market execution. The minimum deposit starts at a level accessible to most traders, allowing easy entry into professional-grade trading conditions.

Trading Instruments and Market Access

Tickmill provides a diverse range of markets under one account:

- Forex: More than 60 currency pairs, including majors, minors, and exotics.

- Indices: Access to global indices such as S&P 500, DAX, FTSE 100, and others.

- Commodities: Precious metals, oil, and natural gas for hedging or diversification.

- Bonds: Government securities for traders seeking lower volatility exposure.

- Crypto CFDs (availability varies by region): Select digital assets traded through CFDs with leverage options.

All instruments can be traded with leverage up to 1:500 (depending on regulation), allowing strategic flexibility for both retail and professional clients.

Regulation and Security

Tickmill operates under strict international regulations, maintaining multiple licenses to ensure compliance and client protection.

It is regulated by:

- FCA (Financial Conduct Authority) – United Kingdom

- CySEC (Cyprus Securities and Exchange Commission) – European Union

- FSCA (Financial Sector Conduct Authority) – South Africa

- FSA (Financial Services Authority) – Seychelles

Client funds are held in segregated bank accounts, separate from the company’s operational funds. Additionally, the broker’s participation in investor compensation schemes enhances financial safety for traders under specific jurisdictions.

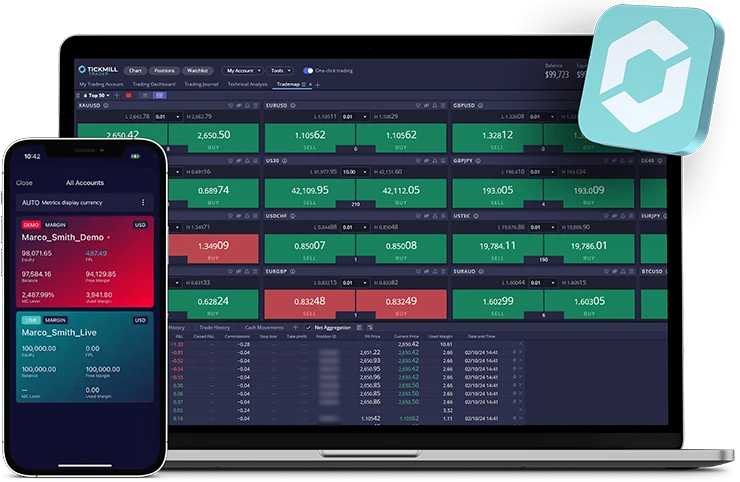

Trading Platforms and Tools

While Tickmill primarily supports MetaTrader 4 (MT4), the platform is enhanced with additional tools and plugins that extend its analytical and execution capabilities.

MT4 Highlights:

- Advanced charting with multiple timeframes.

- Over 50 built-in technical indicators.

- Support for custom Expert Advisors (EAs).

- One-click trading and order management.

- Availability on desktop, mobile, and web versions.

The broker also provides VPS hosting for algorithmic traders who need 24/7 connectivity with minimal latency. In addition, traders gain access to Autochartist, Myfxbook copy trading, and economic calendars directly within their accounts.

Mobile App and Accessibility

The Tickmill mobile app allows full control of trading operations on the go. It supports real-time charting, one-click execution, and order management with built-in security encryption.

All account types and features are accessible from the app, which integrates seamlessly with the MT4 desktop platform.

Mobile users can:

- Open and close positions in real time.

- Analyze market data and access charts.

- Deposit and withdraw funds securely.

- Set custom alerts for price changes or trade conditions.

Education and Market Analysis

Tickmill provides free resources aimed at developing trading skills and improving decision-making. These include:

- Webinars and video tutorials led by market professionals.

- Daily analysis and forecasts for major instruments.

- E-books covering trading psychology, risk management, and technical analysis.

- Economic calendar and news updates for macroeconomic awareness.

These materials help traders interpret market conditions objectively and refine their strategies over time.