Spreadex is a reputable UK-based broker known for combining spread betting and CFD trading within a single, fully regulated platform. Founded in 1999, the company operates under the oversight of the Financial Conduct Authority (FCA) — one of the world’s most respected regulators — ensuring a high level of transparency, fairness, and client protection.

For Indonesian traders, Spreadex provides an opportunity to access global markets, manage risk efficiently, and trade under a robust regulatory framework. With competitive spreads, zero commissions, and advanced platforms, it is an excellent choice for traders seeking flexibility and reliability.

Regulation and Security

Spreadex is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. This regulation ensures that all client funds are held in segregated accounts, separate from company capital, and that the broker adheres to strict compliance and risk management standards.

| Regulatory Authority | Country | Key Protection Features |

|---|---|---|

| FCA (Financial Conduct Authority) | United Kingdom | Segregated funds, negative balance protection, transparent trading environment |

This regulatory assurance provides Indonesian traders with a secure and trustworthy platform that meets international safety standards.

Trading Instruments and Market Access

Spreadex allows traders to access a wide range of global markets through both spread betting and CFD trading. While spread betting is more common in the UK and Europe, Indonesian clients can still benefit from the broker’s extensive CFD offering.

Available markets include:

- Forex: Major, minor, and exotic currency pairs with tight spreads

- Indices: Global benchmarks such as NASDAQ, FTSE 100, and Nikkei 225

- Commodities: Gold, oil, silver, and other popular assets

- Shares: Thousands of international stocks

- Cryptocurrencies: Bitcoin, Ethereum, and other leading digital coins

This diversity gives Indonesian traders the flexibility to build balanced portfolios and explore opportunities across multiple asset classes.

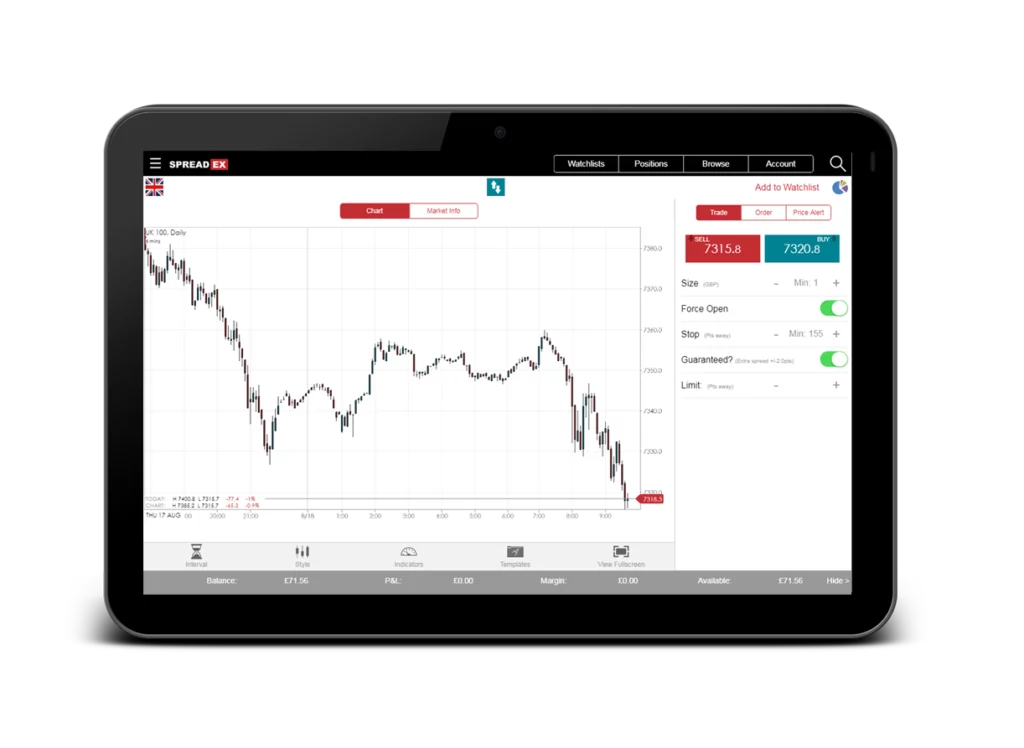

Trading Platforms

Spreadex provides traders with access to two primary trading platforms — MetaTrader 4 (MT4) and its proprietary web platform. Both are designed for ease of use, stability, and performance, catering to traders of all experience levels.

| Platform | Type | Key Features |

|---|---|---|

| MetaTrader 4 (MT4) | Third-party platform | Advanced charting tools, custom indicators, Expert Advisors (EAs), and fast execution |

| Spreadex Web Platform | Proprietary | Intuitive interface, mobile compatibility, integrated risk management tools, and live analytics |

The proprietary platform allows seamless trading directly from a browser without the need for downloads, while MT4 supports algorithmic strategies and technical trading for more advanced users.

Trading Conditions and Costs

Spreadex is well-known for its competitive trading conditions, combining tight spreads, zero commissions, and transparent pricing.

| Feature | Description |

|---|---|

| Minimum spread | From 0.6 pips on major forex pairs |

| Commissions | None (built into spreads) |

| Leverage | Up to 1:30 (for regulated accounts) |

| Order execution | Fast, with minimal slippage |

| Account funding | Multiple methods including bank cards and transfers |

These favorable conditions make Spreadex suitable for both short-term traders who rely on low-cost execution and long-term investors seeking consistent performance.

Risk Management Tools

Effective risk management is a core feature of Spreadex’s trading infrastructure. The broker offers a range of tools to help traders protect capital and control exposure.

Key risk management features include:

- Stop-loss and take-profit orders for automated risk control

- Guaranteed stop orders (for a small premium)

- Negative balance protection for all retail accounts

- Custom margin alerts to prevent overexposure

These tools are particularly useful for Indonesian traders managing multiple open positions in volatile markets.

Education and Trader Support

Spreadex provides strong educational support for both beginner and experienced traders. Its educational resources aim to enhance trading knowledge, improve risk awareness, and strengthen decision-making skills.

Educational resources include:

- Video tutorials explaining trading fundamentals

- Webinars covering strategy development and market analysis

- Glossaries and guides for financial terminology

- Daily market commentary and expert insights

In addition, customer support is available through live chat, email, and phone. The team is professional, responsive, and can assist with technical issues, account setup, or platform navigation.

Why Indonesian Traders Choose Spreadex

For traders in Indonesia, Spreadex stands out for its UK regulation, tight spreads, and comprehensive risk management tools. The combination of spread betting and CFD trading creates flexibility, while educational materials and user-friendly platforms make it easy for traders to grow their skills and confidence.

In summary, Spreadex offers:

- Regulation by the FCA (UK)

- Access to spread betting and CFD trading

- Tight spreads and zero commissions

- MT4 and proprietary trading platforms

- Strong risk management and educational support