Plus500 is one of the most recognized CFD brokers globally, known for its clean interface, fast performance, and strong regulatory oversight. For traders in Indonesia, the broker offers a secure environment to trade cryptocurrencies, indices, shares, commodities, and forex — all through a single account.

Unlike traditional multi-layered systems, Plus500 focuses on simplicity. Its web and mobile apps provide a minimalistic design where all core trading tools are integrated directly into the dashboard. This approach helps users concentrate on market analysis and trade execution without distractions.

Core Features and Trading Environment

Before opening an account, Indonesian traders should understand Plus500’s trading setup. The broker offers real-time price charts, stop-loss and take-profit options, and negative balance protection, ensuring users can control exposure even during volatile market moves.

Plus500’s infrastructure supports fast order execution and smooth position management. It doesn’t require external plugins or add-ons to access advanced functions, making it accessible for those who prefer clarity and reliability.

Regulation and Security

Before committing funds, traders should consider Plus500’s regulatory status. The company operates under multiple financial authorities, including ASIC (Australia), FCA (UK), and CySEC (Cyprus). This multi-jurisdiction regulation provides a higher level of trust and transparency.

For Indonesian users, these regulatory safeguards mean account protection, segregated client funds, and compliance with international financial standards.

Advantages and Disadvantages

Understanding both the strengths and limits of Plus500 helps traders decide if it matches their goals. Below are the main points to consider.

Pros:

- Licensed in multiple regions, including the EU, UK, and Australia

- Fast account setup with mobile verification available

- No hidden fees for deposits or withdrawals

Cons:

- Limited advanced indicators compared to MT4/MT5 platforms

- Inactivity fee charged after 90 days of no trading activity

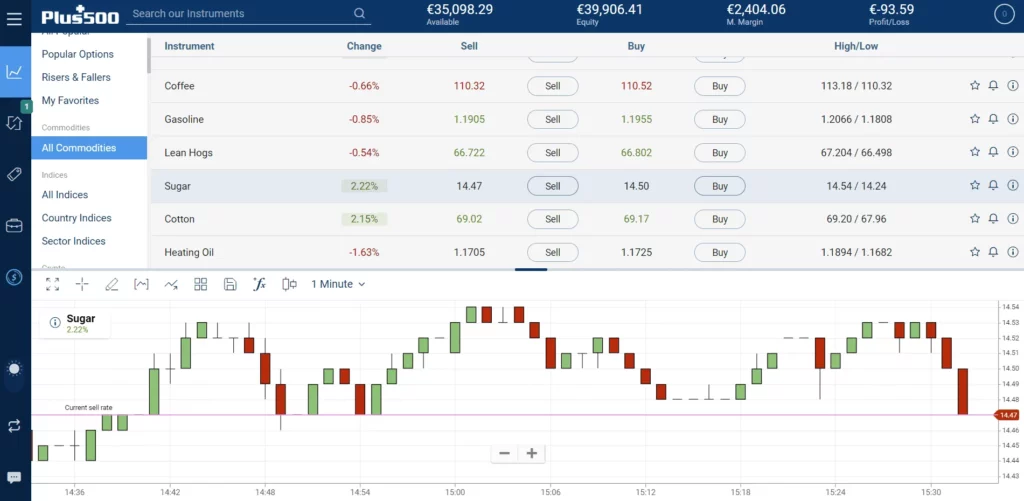

Trading Instruments and Market Access

Before choosing Plus500, traders should know the range of available instruments. The broker covers multiple asset classes suitable for short-term and long-term strategies:

- Cryptocurrency CFDs (Bitcoin, Ethereum, Litecoin, and more)

- Forex pairs with competitive spreads

- Stock CFDs from global markets

- Indices and commodities for diversified exposure

All assets can be traded through the same web or mobile interface, ensuring simplicity for Indonesian users who value fast market access and low maintenance.

Platform and User Experience

The Plus500 platform is designed for traders who value usability over complexity. It includes built-in charts, technical indicators, and customizable layouts. Orders such as Stop Limit, Trailing Stop, and Guaranteed Stop are supported, helping traders automate risk control.

The app works smoothly on desktop, iOS, and Android, with synchronized updates across devices. It’s particularly appealing for traders in Indonesia who want a lightweight but efficient system for daily monitoring and quick execution.