Why Choose OANDA?

For traders looking for a secure, efficient, and modern trading environment, OANDA offers several standout advantages. Here’s why it remains a top pick among global brokers:

Trusted Legacy Since 1996

OANDA has been a reliable player in the financial markets for over two decades. Its longevity in a competitive industry speaks to its strong business ethics, customer service, and consistent performance.

No Minimum Deposit

One of OANDA’s most attractive features is the no minimum deposit requirement. This makes it accessible for beginners or traders who prefer to start small and scale gradually. It’s ideal for those testing strategies or seeking a low-risk entry into the markets.

Tight Spreads and No Requotes

OANDA offers tight spreads on major currency pairs and indices. Combined with no requotes, traders get fast and fair order execution. This is especially valuable in high-volatility markets where slippage can impact profitability.

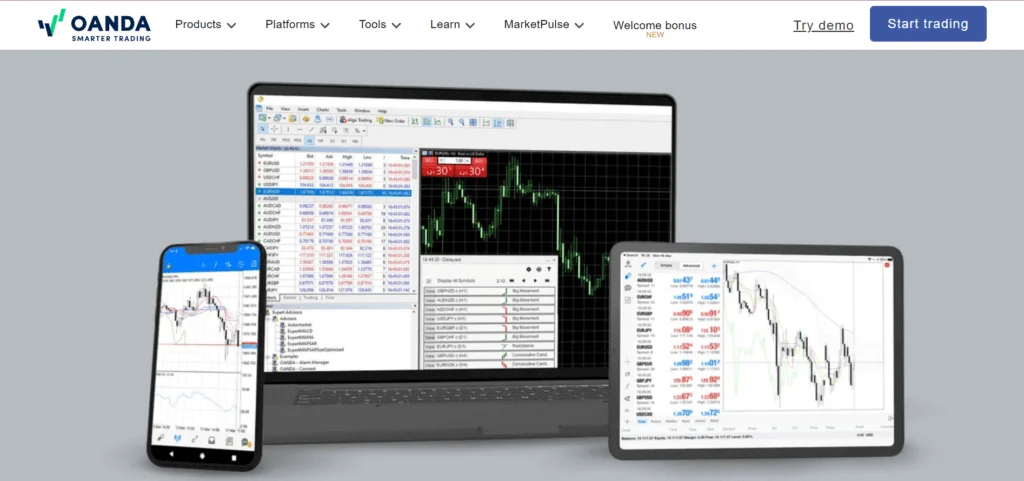

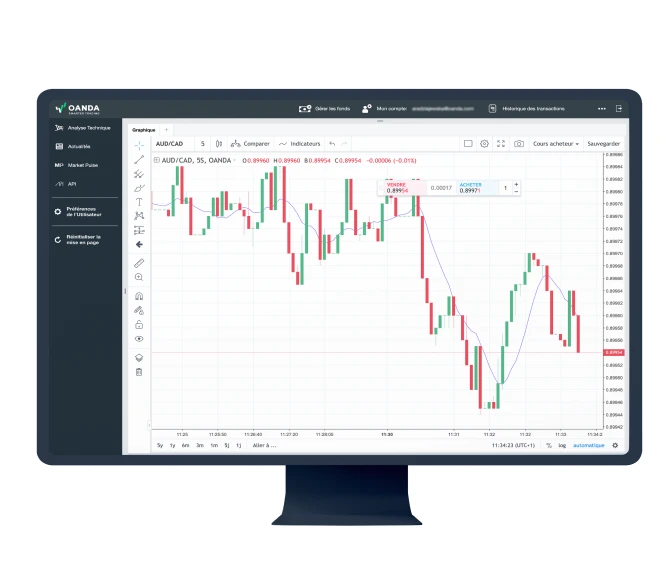

Advanced Trading Tools & App

OANDA provides robust tools to support technical and fundamental analysis:

- Advanced charting software with a wide selection of indicators.

- Customizable trading interface via the OANDA Web and Desktop platforms.

- Mobile trading app for iOS and Android that allows you to manage positions on the go, receive alerts, and perform real-time analysis.

Strong Global Regulation

OANDA operates under strict regulatory oversight from multiple major financial authorities:

- United States (CFTC, NFA)

- United Kingdom (FCA)

- Singapore (MAS)

- Canada (IIROC)

- Australia (ASIC)

- Japan (FSA)

This multi-jurisdictional regulation ensures high levels of client fund protection, transparency, and ethical trading practices.

Key Benefits Summary

| Feature | Details |

|---|---|

| Founded | 1996 |

| Minimum Deposit | None |

| Spreads | Tight spreads, no requotes |

| Trading Platforms | Web, Desktop, Mobile App, MetaTrader 4 (MT4) |

| Regulatory Oversight | US, UK, Singapore, Canada, Australia, Japan |

| Instruments | Forex, Indices, Commodities, Cryptocurrencies, Bonds |

| Execution | Market execution with no dealing desk intervention |

Account Types and Trading Conditions

OANDA simplifies the account structure by offering a single account type with full access to all trading tools, instruments, and features. This eliminates confusion often found with brokers offering multiple tiers or hidden restrictions.

What You Get with an OANDA Account:

- Real-time pricing with no requotes

- Flexible lot sizing (micro, mini, and standard)

- Access to all platforms, including MT4 and TradingView

- Fast deposits and withdrawals using local or international payment methods

For Indonesian traders, OANDA’s integration with local banking systems and payment gateways also helps reduce transaction costs and improve fund access.

Trading Education and Research Tools

OANDA is not just a broker—it also acts as a resource hub for traders who want to improve their skills. Whether you’re a beginner or an intermediate trader, you can benefit from its free educational tools, including:

- Webinars & video tutorials

- Market analysis and economic news

- Forex and CFD guides

- Technical analysis powered by Autochartist and TradingView

In addition, OANDA offers a demo account with full functionality, allowing traders to practice in real-time market conditions without risking capital.

Pros and Cons of Trading with OANDA

Like any broker, OANDA has strengths and potential limitations. Here’s a clear breakdown:

Pros:

- Highly regulated and trusted globally

- No minimum deposit – beginner-friendly

- Fast execution, low latency trading

- User-friendly app and strong analytical tools

- Reliable customer support and multilingual service

Cons:

- No support for MetaTrader 5 (MT5)

- Limited product range compared to multi-asset brokers

- No cent accounts or copy-trading features