Interactive Brokers (IBKR) is one of the most respected and technologically advanced brokers in the world, providing access to a vast range of financial instruments and markets. Established in 1978, the company has built a reputation for transparency, innovation, and extremely low trading costs.

For Indonesian traders, Interactive Brokers is an outstanding choice for those seeking global market access, professional-grade tools, and institutional-level execution within a highly regulated environment.

Regulation and Trustworthiness

Interactive Brokers is among the most strictly regulated financial institutions globally. It operates under the supervision of several top-tier authorities, ensuring the highest levels of client protection and financial integrity.

| Regulatory Authority | Country | Key Protection Features |

|---|---|---|

| FINRA (Financial Industry Regulatory Authority) | United States | Oversight of brokerage operations, investor protection programs |

| FCA (Financial Conduct Authority) | United Kingdom | Segregated client funds, negative balance protection |

| ASIC (Australian Securities and Investments Commission) | Australia | Compliance with international financial standards and fair trading rules |

In addition, Interactive Brokers Group (IBKR) is publicly listed on the NASDAQ Stock Exchange, which adds another layer of transparency and trust. As a listed company, IBKR regularly publishes audited financial statements and complies with strict disclosure requirements.

Global Market Access

Interactive Brokers stands out for its unmatched access to more than 150 global markets across 33 countries and 25 currencies. This makes it one of the few brokers that allow Indonesian traders to diversify globally through a single account.

Available asset classes include:

- Forex – Major, minor, and exotic currency pairs with tight spreads

- Stocks – Access to over 90 global stock exchanges

- ETFs and Mutual Funds – Thousands of investment products worldwide

- Options and Futures – Advanced derivatives for risk management and speculation

- Commodities – Gold, oil, metals, and agricultural products

- Bonds and Fixed Income Securities – Global government and corporate bonds

- Cryptocurrencies – Bitcoin, Ethereum, and others via regulated exchanges

This broad selection enables Indonesian traders to diversify portfolios and hedge positions across multiple asset classes without relying on multiple brokers.

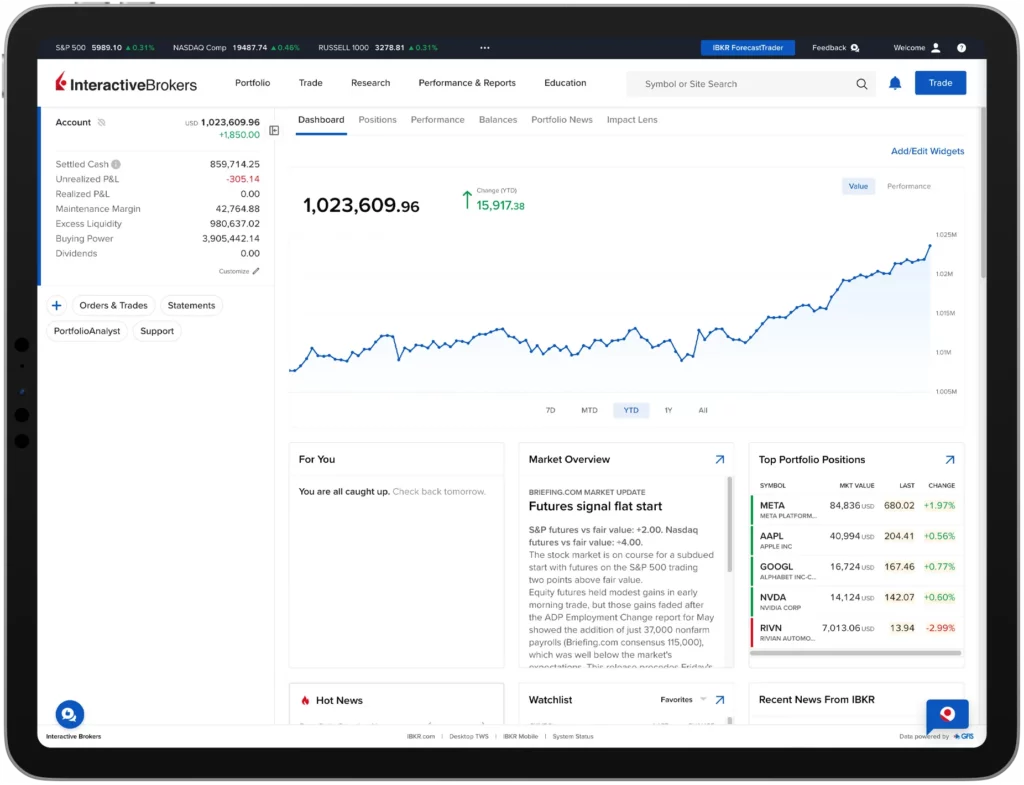

Trading Platform: Trader Workstation (TWS)

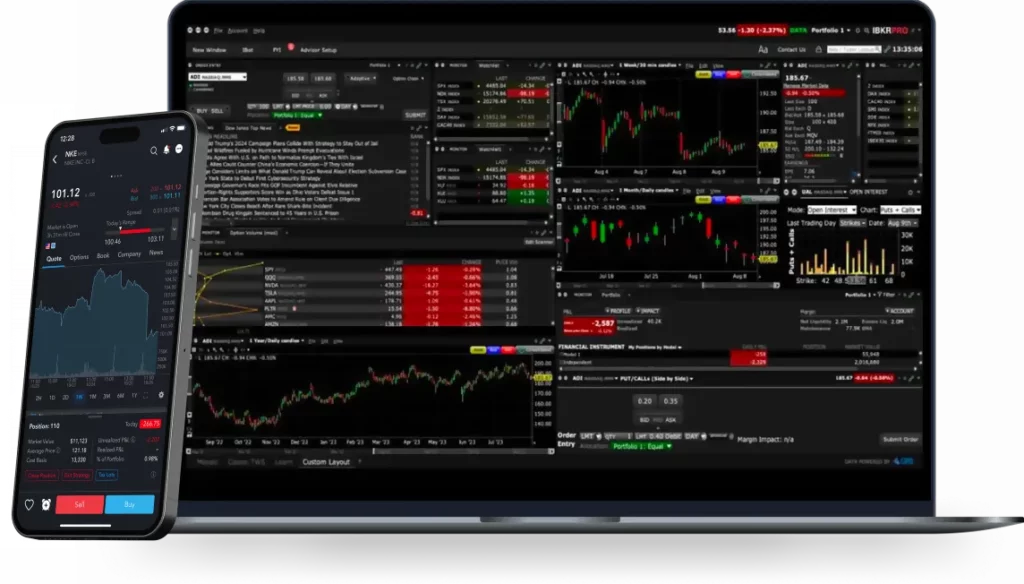

Interactive Brokers’ proprietary platform, Trader Workstation (TWS), is one of the most sophisticated trading platforms available globally. Designed for professional and institutional traders, it provides an extensive range of analytical tools, advanced order types, and real-time market data.

| Platform | Best For | Key Features |

|---|---|---|

| Trader Workstation (TWS) | Advanced and professional traders | Real-time analytics, 100+ order types, customizable charts, algorithmic trading tools, and portfolio management |

| IBKR Mobile App | On-the-go traders | Full market access, live price alerts, position tracking, and charting tools |

| Client Portal (Web) | Casual or new traders | Simplified interface for trading, funding, and performance tracking |

The platform is known for its speed, depth of data, and customization capabilities, making it ideal for Indonesian traders who require precision and flexibility in managing multiple markets simultaneously.

Trading Costs and Commissions

One of Interactive Brokers’ most attractive features is its ultra-low commission structure. The broker offers some of the most competitive pricing in the industry, with spreads and commissions significantly lower than most competitors.

| Asset Type | Typical Cost Structure | Notes |

|---|---|---|

| Stocks (US) | From $0.0005 per share | Minimum $1 per trade |

| Forex | Tight spreads, $2–$4 per 100,000 traded | No hidden markups |

| CFDs and Futures | Exchange-based pricing | Transparent and low-cost model |

These low fees, combined with direct market access and deep liquidity, make IBKR particularly suitable for active Indonesian traders and institutional investors.

Analytics and Research Tools

Interactive Brokers offers world-class market research and analytical tools to help traders make data-driven decisions.

Key tools include:

- IBKR GlobalAnalyst: Compare stocks across global markets by fundamentals and performance.

- PortfolioAnalyst: Track and analyze portfolio performance in real time.

- IBKR Trader’s Insight: Daily commentary and research from market professionals.

- Real-time news feeds: Integrated access to Dow Jones, Reuters, and other major sources.

- Advanced risk management tools: Monitor margin exposure and simulate “what-if” scenarios.

These resources are especially valuable for Indonesian traders who need reliable insights when trading international assets.

Customer Support and Accessibility

Interactive Brokers provides multilingual customer support, available via phone, live chat, and email. While the main support language is English, assistance for Southeast Asian clients — including Indonesia — is available during regional market hours.

The broker also offers localized funding options via bank transfers and electronic payment services, ensuring a smoother deposit and withdrawal process for Indonesian users.

Why Indonesian Traders Choose Interactive Brokers

Interactive Brokers combines global reach, regulatory safety, and ultra-low trading costs, making it ideal for professional Indonesian traders who need a single account to access global markets. Its advanced tools, data-rich platform, and transparent fee structure make it one of the most respected brokers worldwide.

In summary, Interactive Brokers offers:

- Regulation by FINRA, FCA, and ASIC

- Public listing on NASDAQ (IBKR)

- Access to 150+ global markets

- Trader Workstation (TWS) platform

- Low commissions and tight spreads

- Professional analytics and research tools