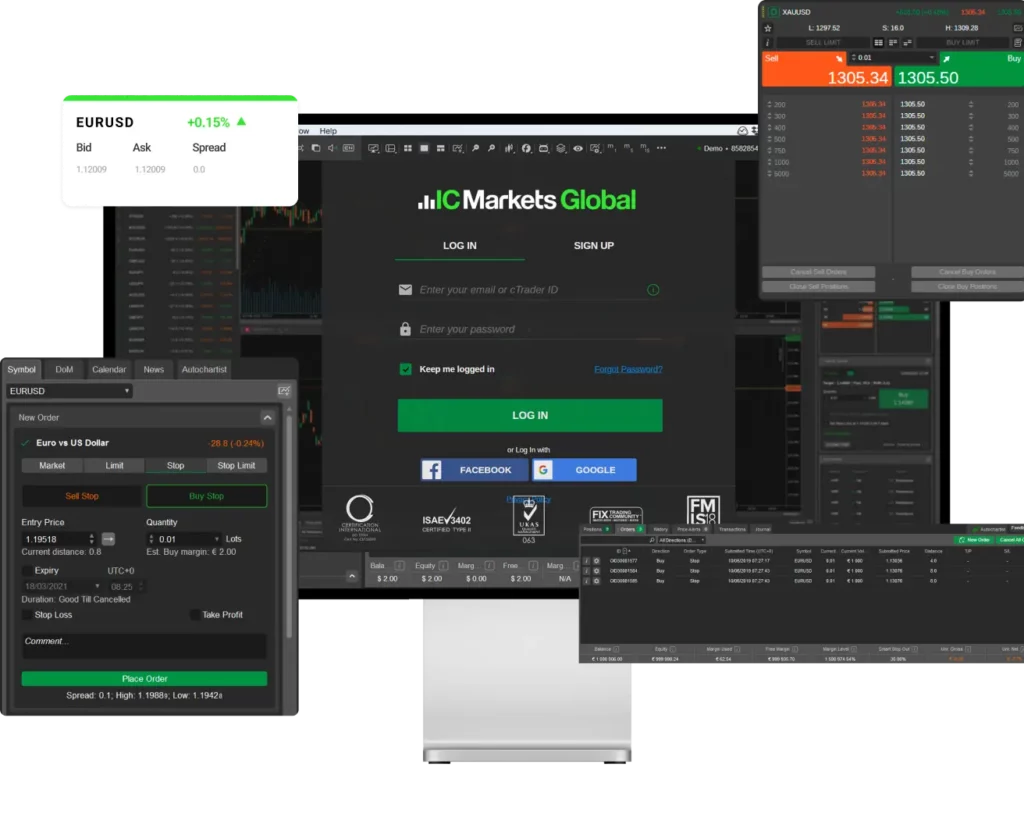

IC Markets is widely recognized as a broker that delivers institutional-grade trading conditions for retail traders. Known for its ultra-tight spreads, lightning-fast execution speeds, and compatibility with advanced strategies, IC Markets is a go-to choice for traders who prioritize precision, speed, and flexibility.

Whether you’re a scalper, algorithmic trader, or someone seeking reliable execution in volatile markets, IC Markets offers the tools and infrastructure to support high-performance trading.

Why Choose IC Markets?

IC Markets stands out for its commitment to transparency, performance, and trader-centric infrastructure. Unlike many retail brokers, it provides a true ECN (Electronic Communication Network) environment, giving traders direct access to liquidity providers without dealing desk intervention. This means faster execution, tighter spreads, and no price manipulation, even during high-volatility events. Its pricing model and trading conditions are ideal for strategies that require precision — such as scalping, news trading, or automated algorithmic systems. Combined with professional tools, flexible platforms, and regulated trust, IC Markets delivers a trading experience aligned with institutional standards.

Institutional Liquidity Access

IC Markets connects traders directly with top-tier liquidity providers, enabling deep market access with minimal slippage – essential for those executing large volume trades or using high-frequency strategies.

Perfect for Algorithmic Trading

The broker’s infrastructure is built for automation, with support for EAs, low-latency VPS hosting, and compatibility with custom trading bots. Its servers are co-located in Equinix data centers in New York and London, ensuring stable performance even during market spikes.

IC Markets Mobile App

For traders on the go, the IC Markets mobile app offers full account management, live quotes, one-click trading, and secure deposit/withdrawal functionality. Available on both iOS and Android.

Account Types & Trading Instruments

| Account Type | Spreads From | Commission | Ideal For |

|---|---|---|---|

| Raw Spread | 0.0 pips | $3.5/lot | Scalpers, EA users |

| Standard | From 0.6 pips | None | Manual traders, swing traders |

Tradeable Instruments Include:

- Forex (60+ pairs)

- Commodities (gold, oil, etc.)

- Indices (NASDAQ, DAX, FTSE, etc.)

- Stocks & Cryptocurrencies (via CFDs)

Deposit & Withdrawal

IC Markets supports various local and international funding methods:

- Bank transfers (including local Indonesian banks)

- E-wallets (Skrill, Neteller, FasaPay)

- Credit/Debit Cards

- No deposit or withdrawal fees from IC Markets’ side.

Regulatory Protection & Trust

Operating under the strict regulations of the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), IC Markets maintains segregated client funds and adheres to international compliance standards.

IC Markets: Best Use Cases

| Trader Type | Benefits at IC Markets |

|---|---|

| Scalpers | Raw spreads, instant execution, low latency |

| EA Users | VPS support, MT4/MT5 integration, deep liquidity |

| Day Traders | Fast order fills, transparent pricing, mobile access |

| Swing Traders | Choice of platforms, robust charting tools |

| Crypto CFD Traders | 24/5 access, leverage, diverse crypto pairs |

Execution Speed and Order Reliability

One of the defining strengths of IC Markets is its ultra-low latency infrastructure. The broker utilizes fiber-optic connections and co-located servers in Equinix data centers, allowing orders to be executed in milliseconds. This infrastructure is particularly advantageous for:

- News traders who rely on rapid execution during high volatility events.

- Scalpers placing dozens or hundreds of trades per day.

- Institutional-style strategies where microsecond precision matters.

IC Markets reports an average execution time of under 40ms, with over 95% of orders filled without requotes or slippage, making it one of the most reliable brokers for fast-moving markets.

Advanced Tools for Smart Trading Decisions

To empower analytical traders, IC Markets offers more than just platform access – it provides advanced tools and plugins designed for better decision-making:

- Depth of Market (DoM) – See real-time liquidity levels.

- Market Sentiment Tools – Monitor long vs. short trader ratios.

- Economic Calendar Integration – Plan trades around key events.

- One-Click Trading Tools – Enter or exit positions instantly.

- Autochartist & Trading Central – Integrated technical analysis solutions for identifying setups.

These features are available across MetaTrader and cTrader platforms and are ideal for traders who combine discretionary and technical trading approaches.