FXCM (Forex Capital Markets) is one of the most established and trustworthy brokers in the global forex industry. Founded in 1999, FXCM has built a reputation for reliability, transparency, and advanced technology. Indonesian traders appreciate the broker’s strong regulatory foundation, professional educational resources, and easy access to multiple trading platforms.

Regulatory Background and Security

One of FXCM’s biggest strengths is its strict regulation under leading global authorities. This ensures the safety of client funds and trading transparency.

Before diving into the broker’s technical features, here’s an overview of its regulatory framework:

| Regulatory Body | Country | Key Protection Features |

|---|---|---|

| FCA (Financial Conduct Authority) | United Kingdom | Segregated client funds, negative balance protection |

| ASIC (Australian Securities and Investments Commission) | Australia | Fair trading standards, compliance monitoring |

This structure gives Indonesian traders confidence that FXCM operates under international best practices and that their investments are managed in a secure environment.

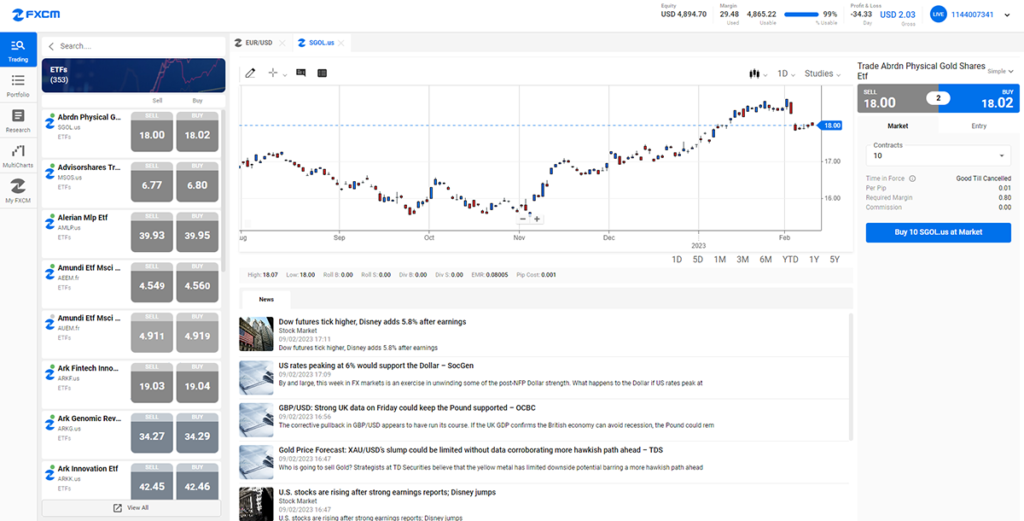

Trading Platforms and Technology

FXCM offers several platforms tailored for different types of traders — from beginners learning technical analysis to professionals running automated strategies.

Below is a list of platforms available to FXCM clients and their key benefits:

- MetaTrader 4 (MT4): The industry’s most popular platform, featuring Expert Advisors (EAs), customizable charts, and technical indicators.

- Trading Station: FXCM’s proprietary platform designed for manual trading, detailed analysis, and backtesting strategies.

- NinjaTrader: Suitable for high-frequency traders seeking fast order execution and advanced charting tools.

All platforms support real-time market data, efficient order execution, and smooth performance across desktop and mobile devices — ensuring that Indonesian traders can trade anytime, anywhere.

Trading Conditions and Account Types

FXCM provides competitive spreads, lightning-fast execution, and flexible account options to meet diverse trading needs.

| Account Type | Ideal For | Features |

|---|---|---|

| Standard Account | New and intermediate traders | Tight spreads, free educational tools, low minimum deposit |

| Active Trader Account | Professionals and high-volume traders | Lower spreads, rebates, priority support, advanced execution speed |

Both account types come with transparent pricing, no hidden commissions on most instruments, and access to global liquidity pools.

Educational Resources and Market Research

One of FXCM’s strongest advantages is its commitment to trader education. The broker provides a wide range of training tools and learning materials, designed to help users grow their skills and confidence.

Here’s what Indonesian traders can access for free:

- Live webinars covering forex basics, strategies, and risk management.

- Video tutorials on using platforms and indicators.

- Daily market analysis, news updates, and trading signals.

- Economic calendars and trading guides in multiple languages.

These resources make FXCM an excellent choice for traders in Indonesia who want to improve continuously through structured, high-quality education.

Customer Support and Localization

FXCM’s customer support team offers assistance in multiple languages through live chat, email, and phone. The broker’s website and trading platforms are also optimized for mobile devices, ensuring accessibility for traders across Indonesia.

Support agents can assist with account verification, deposit and withdrawal issues, and platform navigation — ensuring smooth day-to-day operations.

Why Indonesian Traders Choose FXCM

Indonesian traders choose FXCM because it combines strong regulation, competitive trading conditions, and comprehensive education. Its transparent environment, reliable execution, and multilingual support make it one of the best forex brokers for Indonesia.

In summary, FXCM offers:

- Proven reliability with 25+ years in the market

- Global regulation by FCA and ASIC

- Multiple advanced trading platforms

- Tight spreads and fast execution

- Free webinars and training resources

- Responsive, multi-language customer support