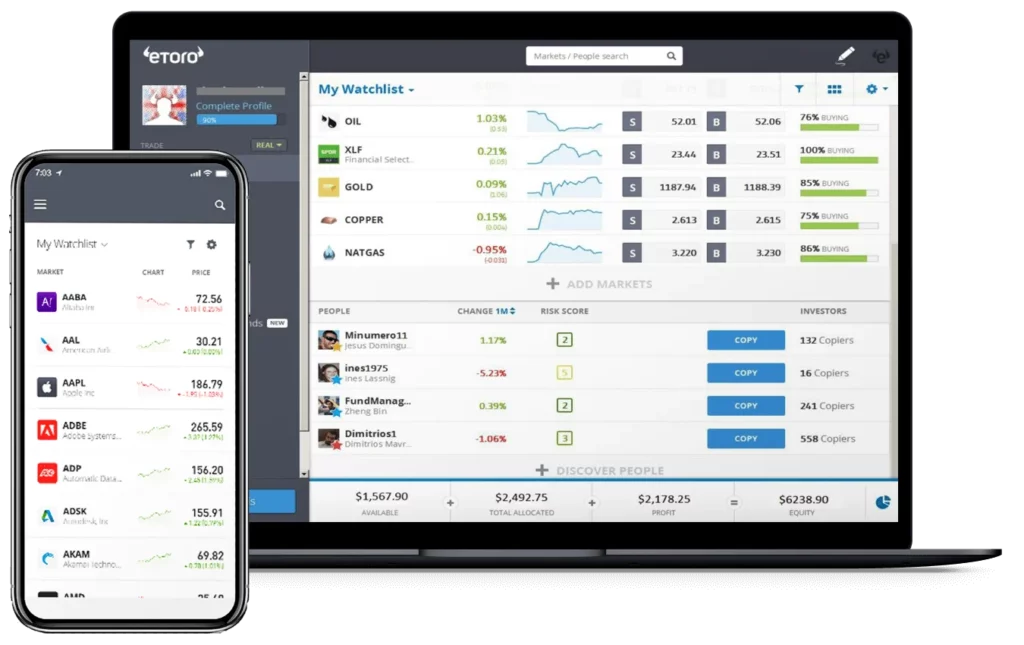

eToro is a multi-asset broker known for blending traditional investing with modern social trading tools. It gives Indonesian traders access to global markets, from cryptocurrencies and stocks to commodities, all within one account. The broker stands out for its CopyTrader system, which lets users automatically replicate the trades of successful investors in real time — ideal for beginners who want exposure to the market without deep technical analysis.

Trading Environment and Features

Before looking at eToro’s core details, it’s important to understand what makes the broker stand out. The system was designed to simplify trading while giving users full control over their investments. The platform combines analytical tools with a social network of traders, making it easier to study strategies and improve decision-making.

Below is a summary of eToro’s key features and background information:

| Key Feature | Details |

|---|---|

| Headquarters | Israel, UK |

| Main Strength | Copy trading and portfolio diversification |

| Accepted Currencies | USD, EUR, GBP |

| Regulation | FCA (UK), CySEC (Cyprus), ASIC (Australia) |

eToro’s multi-asset system helps users diversify their portfolios. The broker also provides a demo account where Indonesian traders can practice trading with virtual funds before moving to live markets.

Advantages and Disadvantages

Understanding eToro’s pros and cons helps traders decide if the broker matches their goals. Each point below reflects key aspects of performance, reliability, and trading costs.

Advantages:

- User-friendly platform that suits both beginners and experienced traders

- Strong global regulation under several financial authorities

- Extensive learning resources including webinars, guides, and demo tools

Disadvantages:

- Limited access in some regions due to local regulations

- Fees for withdrawals and currency conversions may apply

Trading Tools and Copy Features

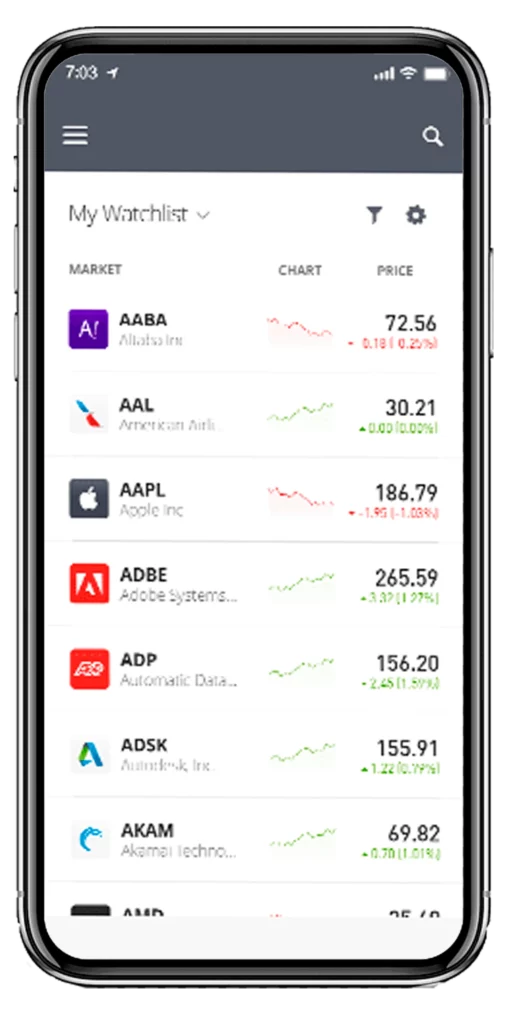

Before exploring the social trading system, it’s useful to note that eToro integrates several tools to help traders analyze markets effectively. The charting system includes technical indicators, risk metrics, and portfolio tracking. Users can follow expert investors, check their performance, and copy trades in one click through CopyTrader.

This feature is especially valuable for beginners in Indonesia. It allows exposure to markets like crypto and forex without requiring deep analytical skills. Traders can select portfolios based on performance data, trading style, or risk score — making it easier to learn and invest simultaneously.

Educational Resources

eToro offers structured educational materials for those who want to improve their trading knowledge. Before accessing advanced courses or webinars, users can start with eToro’s Trading Academy, which covers basics like order types, risk control, and market psychology.

The broker regularly updates tutorials, webinars, and video content. Indonesian traders can benefit from these resources to understand not only crypto trading but also global stock and ETF markets. Learning materials are available in multiple languages, making them accessible to a broader audience.

Fees and Account Management

Before funding a live account, it’s important to understand eToro’s cost structure. The broker does not charge commissions on stock trades but earns through spreads. For crypto and forex, spreads vary depending on market liquidity.

Withdrawals have a fixed fee, and conversions apply when using currencies other than USD. eToro also offers tiered account levels that provide access to additional tools like premium analysis or dedicated support. Indonesian traders should always review these details before depositing to optimize their costs.