BlackBull Markets is a New Zealand-based forex and CFD broker that has earned strong recognition among Indonesian traders. Known for its ECN (Electronic Communication Network) model, it provides lightning-fast execution speeds, transparent pricing, and tight spreads starting from 0.0 pips. This broker is especially popular with experienced traders and those using automated trading strategies on MetaTrader 4, MetaTrader 5, and TradingView.

Regulation and Safety

BlackBull Markets operates under strict supervision by top-tier regulators — the Financial Markets Authority (FMA) in New Zealand and the Australian Securities and Investments Commission (ASIC).

These licenses guarantee that the broker follows international financial standards, ensuring fair dealing, fund protection, and transparent operations.

All client funds are kept in segregated accounts with leading banks, separate from company operating funds. In addition, the broker applies advanced data encryption and negative balance protection, safeguarding Indonesian traders from losing more than their initial deposits.

Trading Platforms

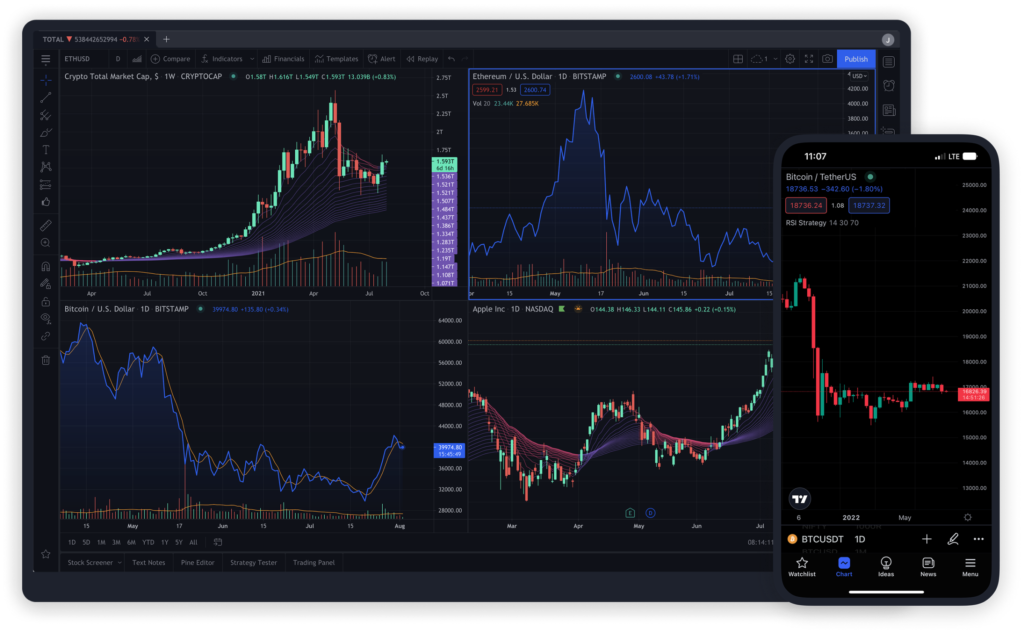

Before exploring specific platforms, it’s important to highlight that BlackBull Markets focuses on flexibility, performance, and speed. Every platform supports real-time trading and advanced analytics, ideal for both manual and automated traders.

The broker supports the following trading platforms:

- MetaTrader 4 (MT4) – a reliable and widely used platform for Forex and CFD trading, known for its custom indicators and Expert Advisors (EAs).

- MetaTrader 5 (MT5) – an advanced version with more chart types, timeframes, and integrated market depth.

- TradingView – ideal for traders who rely on in-depth charting and social trading insights.

All platforms are available on desktop, web, and mobile devices, allowing Indonesian traders to stay connected wherever they are.

Trading Conditions and ECN Model

BlackBull Markets stands out for its true ECN environment, connecting traders directly with liquidity providers without dealing desk interference. This ensures faster execution and transparent pricing, especially beneficial for scalpers and algorithmic traders.

The broker offers raw spreads from 0.0 pips and leverage up to 1:500, providing flexibility for various trading strategies.

There are multiple account types — Standard, Prime, and Institutional — each designed to suit different experience levels and trading volumes.

Execution quality is a major strength of BlackBull Markets. The broker operates through advanced Equinix data centers in New York (NY4), London (LD4), and Tokyo (TY3), reducing latency and improving trade speed for Indonesian clients.

Available Markets and Instruments

BlackBull Markets gives traders access to a wide range of global markets.

Before exploring the instruments, note that the broker supports multi-asset trading, ideal for diversification and portfolio growth.

Available instruments include:

- Forex: More than 70 currency pairs, including Majors, Minors, and Exotics.

- Indices: Global indices such as NASDAQ, Dow Jones, and Nikkei.

- Commodities: Gold, Silver, Oil, and other energy products.

- Shares & CFDs: Access to top global companies.

- Cryptocurrencies: Popular crypto pairs with competitive spreads.

This diverse selection helps Indonesian traders build well-balanced strategies in both volatile and stable market conditions.

Deposits and Withdrawals for Indonesian Traders

For traders in Indonesia, BlackBull Markets ensures fast and secure local payment methods.

Before listing them, it’s important to emphasize that all transactions are encrypted and processed under international compliance standards.

Deposits and withdrawals can be made through local bank transfers, credit/debit cards, and popular e-wallets. The broker cooperates with major Indonesian banks, allowing for convenient and cost-effective funding.

Processing times are quick, and most withdrawals are completed within one business day.

Education and Research

BlackBull Markets also focuses on trader development through a broad set of educational and analytical tools.

The goal is to help Indonesian traders improve their understanding of the markets and develop profitable strategies.

Educational materials include:

- Webinars and video tutorials on trading psychology, strategies, and risk management.

- Market analysis and daily news updates.

- Economic calendar and technical insights for informed decision-making.

These resources are available in multiple languages, making them easily accessible for Indonesian clients.

Customer Support

Reliable support is a key factor for active traders. BlackBull Markets provides 24/5 multilingual customer service via live chat, phone, and email.

The support team is well-trained and can assist with account setup, deposits, withdrawals, or platform-related issues quickly and efficiently.

Why Choose BlackBull Markets in Indonesia?

To summarize the advantages, the following table highlights key features that make BlackBull Markets a preferred choice for Indonesian traders:

| Feature | Description |

|---|---|

| Regulation | FMA (New Zealand) & ASIC (Australia) |

| Trading Model | True ECN, No Dealing Desk |

| Platforms | MT4, MT5, TradingView |

| Spreads | From 0.0 pips |

| Leverage | Up to 1:500 |

| Payments | Local bank transfers & e-wallets |

| Support | 24/5 multilingual assistance |