AvaTrade stands out in the online trading landscape as a globally recognized and regulated broker that offers a robust and flexible trading environment. It is particularly suitable for traders who value innovation, automation, and mobile-first strategies.

Whether you’re a novice looking for simplicity or an experienced trader needing advanced tools, AvaTrade combines convenience with functionality across its trading solutions.

Global Regulation & Trust

AvaTrade is licensed by several top-tier regulatory authorities, including:

- Central Bank of Ireland

- ASIC (Australia)

- FSCA (South Africa)

- ADGM (UAE)

- FSA (Japan)

These licenses provide traders with confidence in AvaTrade’s operational transparency and client fund protection measures.

Education & Research Tools

AvaTrade offers free access to:

- Market analysis

- Trading signals

- Economic calendars

- Video tutorials

These resources empower traders to make informed decisions and improve their market understanding over time.

Who Should Use AvaTrade?

AvaTrade is well-suited for:

- Mobile Traders who want to manage their accounts on the go.

- Copy Traders looking to benefit from professional strategies.

- Options Traders using AvaOptions for advanced risk management.

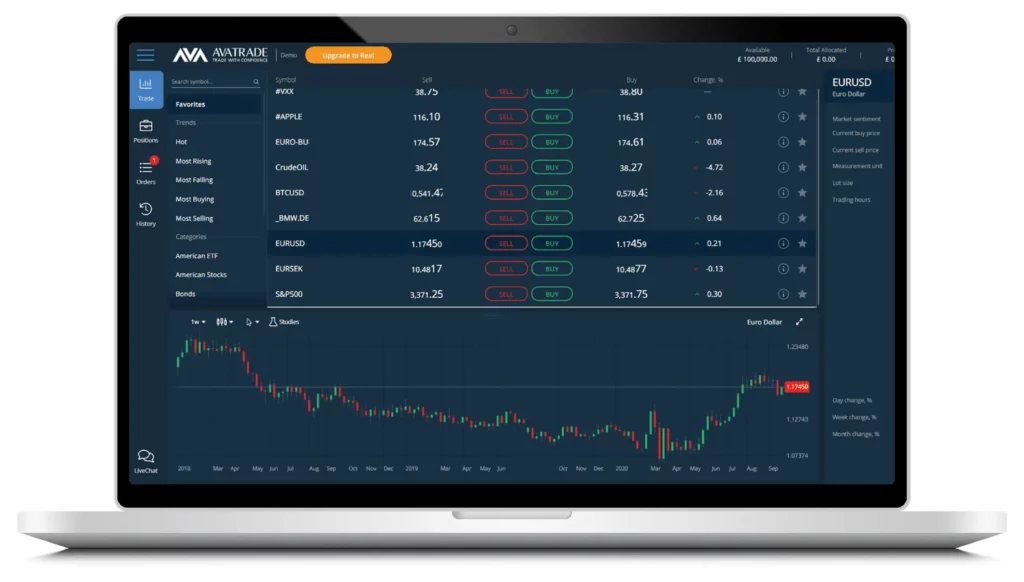

- Forex and CFD Traders utilizing MT4/MT5 for complex strategies.

- Beginner Traders who appreciate educational support and fixed spread pricing.

Account Types & Customization Options

AvaTrade caters to various trading profiles by offering:

- Standard Retail Accounts for individuals trading on a personal level.

- Islamic Accounts (swap-free) for clients following Sharia law.

- Professional Accounts for high-volume or institutional clients with reduced margin requirements and higher leverage.

Account customization enables users to adapt platform features, leverage levels, and interface layouts to fit their personal strategies and goals.

Range of Tradable Assets

Traders can diversify their portfolio with access to:

- Forex – 50+ currency pairs

- Commodities – Gold, oil, silver, etc.

- Indices – Global indices like S&P 500, FTSE 100

- Stocks – Major companies from the US, UK, EU, and Asia

- Cryptocurrencies – BTC, ETH, LTC, XRP, and more

- ETFs & Bonds – For broader exposure to financial markets

AvaTrade’s wide asset selection allows users to hedge positions or explore new markets—all under one platform.

Risk Management Tools

AvaTrade includes built-in safeguards to protect client funds and limit losses:

- Negative Balance Protection – Ensures traders never lose more than their account balance.

- Stop-Loss & Take-Profit Orders – Set automatic exit points to manage risk effectively.

- Guaranteed Stop Loss (GSL) – Offered in select jurisdictions for added certainty during volatile conditions.

These features are particularly valuable for beginner and risk-averse traders.

Platform Compatibility & APIs

Beyond MT4/MT5 and proprietary apps, AvaTrade supports:

- WebTrader – No installation needed, browser-based platform for accessibility on any device.

- Mac & Windows Applications

- Third-party integrations – Compatible with trading APIs for developers or firms wanting custom automation solutions.

Advanced users can even connect AvaTrade accounts to custom bots or data-driven analytics tools.

AvaAcademy – Educational Hub

The broker’s educational ecosystem is ideal for self-directed learning:

- Video Tutorials: Cover basics to advanced strategies.

- EBooks: On technical analysis, options trading, and forex principles.

- Webinars: Live sessions with expert traders, covering real-time market movements and Q&A.

- Glossary & FAQ Section: For new traders navigating unfamiliar terminology.

These tools are particularly helpful for those looking to transition from demo to live trading.

Demo Account & Strategy Testing

AvaTrade offers a free, unlimited demo account with virtual funds. This allows traders to:

- Test strategies in real market conditions.

- Get familiar with platform features.

- Experiment with indicators and trading tools without financial risk.

This is a vital step for beginners and experienced traders alike before committing capital.