A demo platform serves as a training ground for traders who want to test crypto and forex strategies without financial exposure. It replicates real trading conditions using virtual funds, allowing users to understand order execution, price movement, and the mechanics of leverage in a safe setup. For both newcomers and experienced participants, a demo environment helps refine analytical methods, observe market volatility, and verify technical setups before committing real capital.

Core Features Found on Demo Accounts

Most demo systems mirror live platforms, though execution may differ slightly due to the absence of liquidity providers. Common components include:

- Virtual balance: Simulated funds that can be adjusted to match planned account sizes.

- Live or delayed market data: Quotes are usually real-time but may sometimes lag.

- Full access to indicators: Tools for technical analysis—moving averages, oscillators, and Fibonacci retracements—are typically available.

- Charting and order panels: Interface elements identical to live trading software.

- Risk management tools: Stop-loss and take-profit functions for practicing trade discipline.

Example Comparison:

| Feature | Crypto Demo Account | Forex Demo Account |

| Market Hours | 24/7 | 24/5 |

| Instruments | BTC, ETH, altcoins | Major/minor pairs |

| Leverage Range | 1:1–1:100 (varies) | 1:1–1:200 or higher |

| Volatility | High and continuous | Variable, event-driven |

Why Demo Platforms Are Useful

Trading simulations help develop consistency. Many traders start by using them to:

- Test algorithmic systems in changing market phases.

- Compare spread behavior during high-volume sessions.

- Assess emotional control under profit or loss situations.

- Analyze how margin and leverage affect equity drawdowns.

The flexibility of demo platforms makes them essential for evaluating strategies before risking capital.

Setting Up Your Demo Account

Creating a demo account requires only a few steps, yet configuration accuracy determines how useful the simulation will be. Traders should aim to replicate conditions close to their future live setups.

Choosing a Broker or Exchange with a Reliable Demo Option

Select a provider that offers both forex and crypto assets in a unified interface. Factors to consider include:

- Execution speed: Delays may distort strategy results.

- Data reliability: Prices must mirror live feeds as closely as possible.

- Charting tools: The platform should include customizable layouts, drawing instruments, and order history.

- Order types available: Market, limit, and stop orders should function identically to real trading.

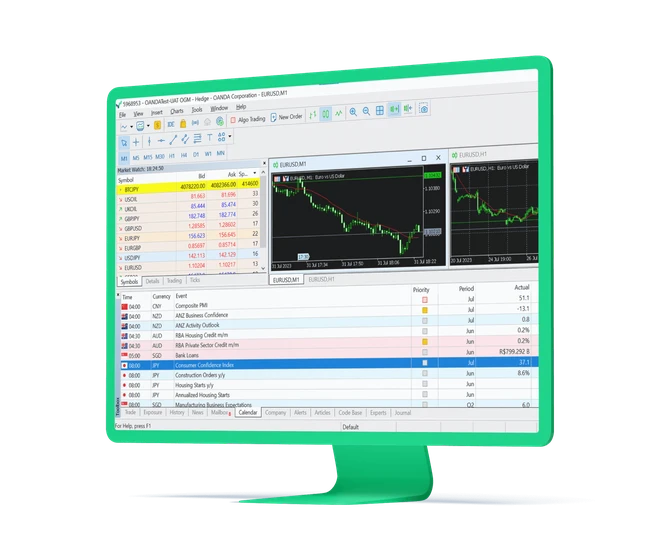

A brief comparison of popular demo environments:

| Broker/Exchange | Demo Duration | Asset Range | Order Types Supported |

| MetaTrader 5 Demo | Unlimited | Forex, indices, metals, crypto CFDs | Market, limit, stop, trailing |

| Binance Demo | 30 days (renewable) | Spot and futures crypto | Limit, market, OCO |

| cTrader Demo | 90 days | Forex, indices, commodities | Advanced order management |

Registration Process and Initial Configuration

Most demo setups require basic information—email, password, and sometimes region—for compliance reasons. After verification, users select their desired trading software (for example, MT5 or web terminal). At this stage, traders define key parameters:

- Account type: Standard, ECN, or Pro simulated structure.

- Virtual currency balance: Choose a realistic figure; testing with $1,000,000 can distort perception of risk.

- Leverage level: Begin with a moderate ratio like 1:50 to observe margin consumption.

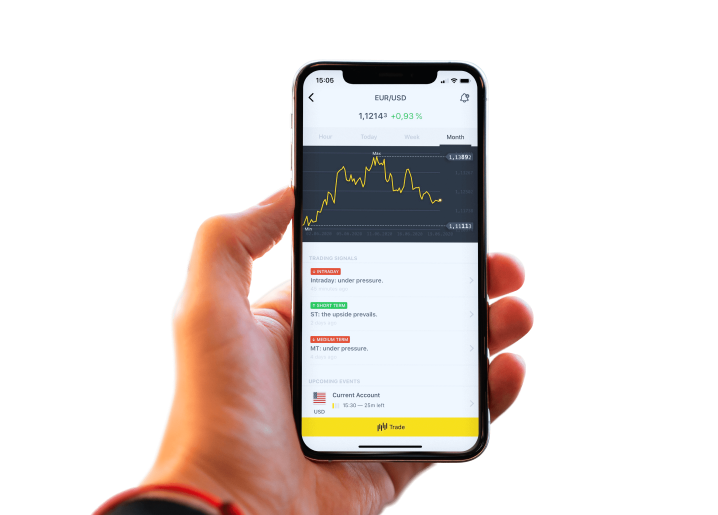

The system then generates login credentials, granting access through desktop, web, or mobile terminals.

Adjusting Virtual Balances and Leverage Settings

Setting a proper demo balance shapes trading discipline. For accurate testing:

- Match the virtual balance to your intended deposit size.

- Use the same leverage ratio as planned for a live account.

- Track margin levels manually to simulate capital pressure.

This process builds awareness of drawdowns, margin calls, and overall capital exposure—skills critical for consistent performance.

Practicing Crypto and Forex Trading Strategies

A demo platform is most valuable when used systematically. Random trades or impulsive entries bring little insight. Structured testing allows traders to understand how different strategies react under various market conditions.

How to Test Technical Analysis Tools

Technical analysis shapes most short-term trading decisions. On a demo, each indicator can be tested without risk:

- Trend tools: Moving averages (MA), MACD, and Parabolic SAR show direction and momentum.

- Volatility measures: Bollinger Bands or ATR (Average True Range) help gauge breakout potential.

- Support and resistance mapping: Drawing horizontal lines across key levels highlights reaction zones.

- Pattern recognition: Practice identifying flags, triangles, and double tops using past price data.

A practical exercise involves choosing one trading pair—such as EUR/USD or BTC/USDT—and logging indicator reactions at specific price levels. This habit builds precision in technical interpretation.

Trying Out Different Order Types

The demo environment allows experimentation with all available order types:

- Market orders for instant execution.

- Limit orders for precise entries at predefined levels.

- Stop orders to enter when price breaks through a certain point.

- OCO (One Cancels the Other) orders for simultaneous profit and protection settings.

Each order type influences strategy outcomes differently. For instance, scalpers rely on market execution speed, while swing traders prefer limit orders to enter at support. Testing these interactions without financial pressure improves operational accuracy.

Developing Risk Management Habits

Consistent risk control distinguishes long-term success from random outcomes. In a demo setting, one can measure exposure and test position sizing.

Key practices include:

- Fixed-percentage risk: Limiting exposure to 1–2% of virtual equity per trade.

- Stop-loss calibration: Setting stop distances based on volatility rather than guesswork.

- Reward-to-risk ratio: Aim for setups with ratios above 1.5:1 to maintain positive expectancy.

- Trade journaling: Recording every virtual trade outcome builds data for later optimization.

Recognizing the Limits of Demo Trading

While demo environments mirror market dynamics, they lack certain psychological and liquidity elements. Understanding these differences prevents overconfidence before trading live capital.

Emotional Differences Between Virtual and Real Trades

Virtual money does not trigger the same emotions as real capital. In demo conditions:

- Fear and greed are largely absent.

- Losses carry no financial consequence.

- Overtrading and excessive risk-taking often go unchecked.

This difference can create an illusion of skill. The same trader who performs flawlessly in a demo may struggle when real profits or losses appear. Therefore, emotional control must be consciously practiced—treating every virtual trade as if actual money were at stake.

Market Conditions That May Differ in Real Accounts

Certain aspects of real trading are difficult to replicate.

- Slippage: Price may move between order placement and execution.

- Requotes: Some brokers adjust prices under high volatility.

- Liquidity gaps: Crypto assets often face sudden volume drops.

- Execution delays: Large orders may fill at multiple price points.

A trader using a demo should simulate these by adding slight manual variations to entry or exit levels to test system resilience.

When to Move from Demo to Live Trading

Transitioning from practice to live execution requires measurable readiness. The move should occur only when:

- The strategy has been profitable for at least two consecutive months.

- A trade journal shows consistent rule-based entries.

- Drawdowns remain within planned limits.

- The trader feels confident managing emotion after simulated losses.

A gradual switch using micro or cent accounts helps bridge psychological differences.

Tips for Getting the Most from Your Demo Practice

Practicing with structure and intent helps convert demo time into measurable skill. Without discipline, even months of virtual trading may add little value. The following principles increase efficiency and prepare for live execution.

1. Set Clear Objectives

Before starting, define what needs improvement—timing entries, risk control, or trade management. Each week, focus on one element. For instance, analyze 20 demo trades where stop-loss placement determined success or failure. Tracking such patterns highlights weaknesses that can be corrected before real exposure.

2. Simulate Real Conditions

Trade only during your intended market sessions. If planning to trade London or New York hours, stick to them on the demo. Use realistic position sizes, spreads, and account balances. Avoid extreme leverage that would not be used with actual funds. Replicating real trading rhythm helps form accurate expectations.

3. Keep a Detailed Journal

Every virtual trade should include:

- Entry and exit prices.

- Reason for taking the position.

- Screenshot of chart setup.

- Notes on outcome and emotional state.

After several weeks, patterns emerge showing whether poor results come from timing, strategy, or impulsive decisions. Journaling is among the most practical methods to refine behavior and strategy simultaneously.

4. Review Performance Weekly

Schedule a fixed review—preferably every weekend. Sort trades by instrument, direction, and timeframe. Identify average profit, loss, and maximum drawdown. Simple performance metrics can be summarized as follows:

| Metric | Ideal Benchmark | Purpose |

| Win Rate | 50–60% | Shows strategy reliability |

| Average R:R Ratio | Above 1.5:1 | Evaluates profitability per trade |

| Maximum Drawdown | Under 15% | Tracks capital protection |

| Consistency Period | 8–12 weeks | Confirms readiness for real market |

Tracking data with this format helps maintain accountability and realistic expectations.

5. Avoid Endless Simulation

Demo trading should be temporary. Staying too long in simulated mode reduces psychological readiness. Once consistent results appear over several weeks and all processes feel routine—entries, exits, position sizing—it’s time to progress. Moving gradually, for example using a live cent or micro account, allows adaptation while limiting risk.

6. Continue Learning While Practicing

Study market structure, new asset correlations, and macro events affecting volatility. Crypto and forex markets react differently to global news, interest rate policies, and liquidity shifts. Use demo charts to observe these reactions in real time. Continuous observation strengthens analytical intuition.

Frequently Asked Questions

How long should a trader stay on a demo account?

There is no universal duration. However, remaining for at least two to three months helps form consistent habits. Transition only after achieving steady virtual profits and confidence in execution.