What Are PayPal Brokers?

PayPal brokers are online trading companies that accept PayPal as a method for deposits and withdrawals. These brokers allow clients to transfer funds between their trading account and PayPal wallet without relying on traditional banking systems.

Using PayPal offers greater transaction flexibility, instant funding, and easier management of trading capital. This method is particularly valued by traders who want a reliable and quick way to move money while maintaining control over their funds.

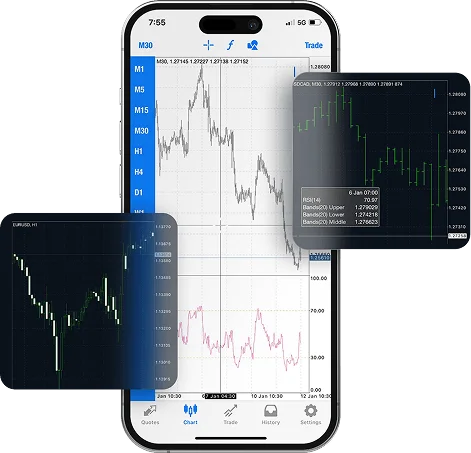

Most PayPal brokers operate under strict financial regulations. This ensures the safety of traders’ accounts, proper handling of funds, and compliance with anti-money laundering laws. The platforms typically provide access to Forex, indices, commodities, and cryptocurrencies, all through trading platforms like MetaTrader 4, MetaTrader 5, or proprietary web terminals.

Advantages of Using PayPal in Trading

PayPal has become one of the most trusted online payment systems, and its integration with trading platforms offers several strong advantages. Traders using PayPal often highlight the following points:

- Speed and Efficiency: Deposits made through PayPal are processed almost instantly, enabling traders to open or modify positions without delay. Withdrawals are also faster than with most traditional banking methods.

- Security and Data Protection: PayPal operates with advanced encryption and fraud prevention technology. This minimizes exposure of personal and financial information to third parties, keeping trading transactions confidential and safe.

- Global Accessibility: As PayPal operates in over 200 countries, traders can fund their accounts and trade internationally without currency conversion issues or cross-border restrictions.

- Transparency and Control: All transactions are visible in the PayPal dashboard, making it easier for traders to track deposits, withdrawals, and trading expenses.

- Compatibility with Major Platforms: Most reputable brokers have integrated PayPal into their payment systems, making it simple to connect the e-wallet with MetaTrader, cTrader, or custom-built trading terminals.

Top PayPal Brokers for 2026

The best PayPal brokers combine financial transparency, strong regulation, and user-friendly payment solutions. In 2026, the most reputable platforms continue to improve transaction security and trading functionality while maintaining instant access to PayPal deposits and withdrawals.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No commission, spreads from 0.6 pips | Forex Stocks Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 | ||

| From $5 per lot | Forex Commodities Indices Crypto | $100 | Up to 1:400 | AvaTradeGo MT4 MT5 | ||

| No commission, spreads from 0.0 pips | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.1 pips | Forex Commodities Indices Crypto | $10 | Up to 1:2000 | MT4 MT5 | ||

| Spread-only, from 0.6 pips | Indices Forex Commodities | $250 | 1:200 | MT4 proprietary |

XM

XM

XM is a regulated broker known for flexible account types and competitive spreads. Traders can start with as little as $5 and fund their account via PayPal without fees. XM supports both MetaTrader 4 and MetaTrader 5 platforms, suitable for automated trading strategies.

Its fast execution, broad educational library, and multilingual interface make it appealing to global users.

Advantages:

- Low deposit requirement

- Over 1,000 financial instruments

- Instant PayPal funding and withdrawals

AvaTrade

AvaTrade

AvaTrade offers a well-balanced combination of advanced tools and user simplicity. It integrates PayPal for deposits and withdrawals in supported regions, ensuring efficient transaction handling.

The broker provides access to Forex, stocks, indices, commodities, and cryptocurrencies through platforms like MetaTrader and AvaTradeGO.

Main Features:

- Fixed and floating spreads

- Regulated across multiple jurisdictions

- Free demo account and mobile trading tools

Pepperstone

Pepperstone

Pepperstone combines low spreads with institutional-grade liquidity. It is particularly popular among scalpers and algorithmic traders due to its execution speed and PayPal payment flexibility.

Users can choose between MT4, MT5, and cTrader, all optimized for automation.

Notable Details:

- No minimum deposit

- Strong regulatory oversight

- PayPal transactions processed within 24 hours

FXTM

FXTM

FXTM stands out for its focus on global accessibility and educational resources. Traders can fund their accounts via PayPal in multiple currencies and enjoy low spreads on major pairs.

The broker’s platform stability and customer-centric approach make it a frequent choice among developing-market traders.

Features:

- Wide range of account types

- Segregated client funds

- 24/5 multilingual customer service

IG

IG

IG Markets is one of the oldest regulated brokers, providing a vast selection of instruments and solid technical infrastructure. PayPal payments are accepted for both deposits and withdrawals, usually processed within a few hours.

The broker supports advanced charting and trading tools ideal for professionals, yet remains accessible for beginners.

Overview:

- 17,000+ tradable assets

- Regulated in multiple top-tier jurisdictions

- Excellent research and analysis tools

How to Choose the Best PayPal Broker

Selecting a reliable PayPal broker involves more than just checking if the payment option is available. It requires a detailed evaluation of the platform’s regulation, trading conditions, and transparency. The goal is to find a broker that aligns with specific trading goals and capital management preferences.

Here are the main criteria to consider when choosing a PayPal-compatible broker:

- Regulation and Licensing: Always verify that the broker operates under recognized authorities such as the FCA, ASIC, or CySEC. Regulated brokers must follow strict financial rules, keeping client funds separate from operational capital and maintaining transparency.

- Trading Fees and Spreads: Competitive pricing is essential for long-term profitability. Compare spreads, overnight swap rates, and commissions across brokers to determine which offers the best overall trading cost.

- Payment Processing Speed: PayPal transactions should be almost instant for deposits and completed within one to two business days for withdrawals. Delayed transfers may indicate internal inefficiencies or restrictions.

- Platform and Tools: The broker should support modern trading software such as MT4, MT5, or cTrader, along with advanced analytics, indicators, and automated strategy options.

- Customer Service and Accessibility: Although PayPal handles financial transactions, issues such as payment holds or verification delays should be quickly resolved by the broker’s support team. Efficient communication via live chat or email is key.

Below is a simple reference table summarizing what to look for:

| Criteria | Why It Matters |

| Regulation | Ensures fund safety and compliance |

| Fees | Affects profitability |

| PayPal Speed | Determines transaction convenience |

| Platforms | Impacts trading flexibility |

| Support Quality | Improves issue resolution time |

Choosing a broker that meets these standards allows traders to focus on analysis and execution instead of worrying about administrative barriers.

How to Deposit and Withdraw Using PayPal

PayPal deposits and withdrawals are straightforward, but understanding the process helps avoid common mistakes. Most brokers have similar procedures, which can be completed within minutes.

Steps to Deposit via PayPal:

- Log in to the trading account on the broker’s website.

- Navigate to the “Deposit” or “Funding” section.

- Select PayPal from the list of payment methods.

- Enter the desired amount and confirm the transaction.

- The funds usually appear instantly in the trading balance.

Steps to Withdraw Funds via PayPal:

- Access the “Withdrawal” section on the broker’s dashboard.

- Choose PayPal as the withdrawal method.

- Specify the amount to transfer.

- Confirm the withdrawal request and verify if needed.

- The transaction typically completes within 24 to 48 hours.

Important Notes:

- Withdrawals must usually be made to the same PayPal account used for deposits.

- Some brokers may impose minimum withdrawal limits or small processing fees.

- Currency conversion charges can apply if the trading account and PayPal wallet use different currencies.

The process is simple yet effective, allowing traders to manage capital without depending on bank transfers or credit card networks.

Pros and Cons of Using PayPal Brokers

While PayPal offers one of the most efficient ways to manage trading funds, it also comes with certain limitations. Understanding both sides helps traders make informed decisions and choose a broker that fits their operational style.

Pros

PayPal has long been recognized for its simplicity and reliability. In the trading industry, its use can improve capital management efficiency, especially for active traders. Below are the most significant advantages:

- Instant Funding and Fast Withdrawals: Traders can deposit funds into their accounts almost instantly and withdraw profits in one to two business days. This eliminates the waiting periods common with wire transfers and card payments.

- Strong Security Protocols: Each transaction is encrypted, protecting financial and personal information. PayPal also uses two-step authentication and buyer protection systems that add an extra layer of safety.

- No Exposure of Banking Data: Since PayPal acts as an intermediary, traders don’t need to share their card or bank details with brokers. This helps maintain privacy and reduces the risk of financial data misuse.

- Multi-Currency Functionality: PayPal supports more than 20 currencies, simplifying international transactions. Traders can fund accounts and withdraw in local currency, minimizing conversion fees.

- Compatibility with Leading Brokers: Most reputable trading companies now integrate PayPal due to client demand and its reliability across global financial systems.

Cons

Despite its benefits, PayPal is not without drawbacks. Some traders may encounter restrictions or costs depending on their country and broker.

- Geographic Restrictions: PayPal is not supported in certain regions, limiting access for traders in countries where the service is unavailable or partially restricted for financial transactions.

- Currency Conversion Fees: If trading in a different base currency than the PayPal wallet, conversion fees may apply. These can reduce profit margins for frequent withdrawals.

- Withdrawal Limits and Verification: Some brokers or PayPal itself may impose withdrawal limits until full account verification is completed. This can delay fund access for new users.

- Broker Availability: Although PayPal is widely used, not every regulated broker offers it as a payment option. This can narrow the choice for traders seeking specific account types or instruments.

- Occasional Transaction Fees: While deposits are usually free, certain withdrawals or currency exchanges may incur small charges.

Frequently Asked Questions

Do all brokers accept PayPal?

No. Only regulated brokers that have integrated PayPal into their payment systems offer this method. It’s best to check the broker’s deposit options before opening an account.