Online trading platforms have reshaped how traders approach global markets. Today, investors no longer rely on single-asset exposure. Instead, they prefer tools that allow access to multiple instruments — from currencies to stocks, commodities, and indices — all in one interface. Multi-asset investing helps balance risks while capturing opportunities across market cycles. The growing availability of professional platforms makes this approach practical even for those trading from home.

What Is Multi-Asset Investing

Multi-asset investing refers to allocating capital across different financial markets rather than focusing on one type of instrument. A trader can open positions in currencies, equities, or commodities through a single online account. This structure creates flexibility and stability since various markets rarely move in the same direction at once.

The concept of diversification across asset classes

Diversification is the backbone of multi-asset investing. It aims to reduce exposure to volatility by spreading capital among unrelated assets. For instance, when stock indices decline, precious metals like gold or certain bonds may rise. By holding positions in several categories, traders can offset losses in one sector with gains in another.

A simplified example of a balanced setup might include:

- 40% in major currency pairs

- 30% in global stocks or ETFs

- 20% in commodities such as gold or oil

- 10% in fixed-income instruments

This combination helps protect overall equity and allows smoother performance during turbulent conditions. The principle remains the same regardless of account size — diversification limits dependence on a single market’s direction.

Why multi-asset portfolios attract modern traders

Modern traders look for flexibility and control. A multi-asset approach allows them to react quickly to shifts in monetary policy, corporate earnings, or commodity demand. Instead of being tied to one market cycle, they can move capital to where volatility or growth potential is strongest.

There are three main reasons behind the growing preference for such portfolios:

- Dynamic risk management. Exposure is spread among markets with different drivers, reducing drawdowns during uncertain periods.

- Efficient capital use. With leverage and cross-margin options, traders can maintain several positions without tying up excessive margin.

- Broader opportunity range. Global events affect multiple sectors simultaneously, and having access to many asset types enables faster adaptation.

Multi-asset trading reflects how financial markets function today — interconnected, fast-moving, and heavily influenced by both macroeconomic data and regional developments.

Key Benefits of Multi-Asset Trading Platforms

Online multi-asset platforms combine technology and market access in a single trading ecosystem. Their main advantage lies in the ability to manage positions across several asset types without switching accounts or interfaces. For active traders, this integration improves decision-making and execution quality.

Here are the main benefits such systems provide:

| Feature | Practical Impact on Trading |

| Unified interface | All instruments visible in one terminal, reducing execution delays. |

| Centralized account balance | Margin and equity managed across multiple markets. |

| Integrated analysis tools | Technical indicators and charting available for every asset class. |

| Automation support | Compatibility with Expert Advisors, scripts, and APIs for algorithmic strategies. |

| Risk visibility | Real-time monitoring of total exposure across correlated markets. |

The technical infrastructure behind these platforms usually includes low-latency order routing and advanced charting modules. Such tools enable traders to react quickly during high-volatility sessions and keep strategies consistent across instruments.

A well-built system also offers access to historical data for backtesting. This feature helps traders assess how a mixed portfolio might behave during different market cycles — an important step when managing risk dynamically.

Main Asset Classes Available for Online Trading

The main asset categories on multi-asset platforms allow a trader to build portfolios that mix growth and stability. Each class carries its own drivers and volatility profile. Understanding these elements helps form balanced exposure and manage margin requirements effectively.

Forex — global currency trading basics

Foreign exchange is one of the most liquid financial markets. It operates 24 hours a day and involves trading currency pairs such as EUR/USD or GBP/JPY. Movements depend on interest rate policies, inflation data, and geopolitical developments.

Most online brokers provide access to:

- Major pairs (EUR/USD, USD/JPY, GBP/USD)

- Cross pairs (EUR/GBP, AUD/NZD)

- Exotic pairs (USD/TRY, USD/ZAR)

Leverage often ranges between 1:30 and 1:500 depending on jurisdiction. This makes forex suitable for short-term trading strategies. The absence of central exchanges allows tight spreads and rapid execution.

Stocks — investing in company shares

Stocks represent ownership in publicly listed companies. Through multi-asset platforms, traders can speculate on price movements or build longer-term portfolios. Shares from sectors such as technology, healthcare, and energy dominate trading volumes.

Key factors influencing share prices include:

- Earnings reports and dividends

- Interest rate outlook

- Market sentiment and sector rotation

Some brokers offer fractional shares, allowing access to high-value stocks with smaller deposits. Integration with indices and ETFs enhances the ability to diversify equity exposure.

Commodities — metals, energy, and agricultural assets

Commodity trading adds an inflation hedge and diversification layer to a portfolio. Gold, silver, oil, and natural gas are among the most traded instruments. Agricultural assets such as wheat or coffee also attract attention during supply disruptions.

| Commodity Type | Typical Drivers | Trading Hours (GMT) |

| Precious metals | Inflation expectations, USD strength | 00:00 – 21:00 |

| Energy products | Global demand, OPEC decisions | 01:00 – 23:00 |

| Agricultural goods | Weather patterns, export data | 02:00 – 19:00 |

Commodities often respond differently to equity market stress, providing diversification benefits when other asset classes face volatility.

Indices — tracking regional and sector performance

Indices reflect the average performance of groups of companies within a region or sector. They simplify exposure to entire economies. Popular instruments include the S&P 500, NASDAQ 100, DAX 40, and Nikkei 225.

Advantages of trading indices:

- Lower volatility compared to individual stocks

- Exposure to macroeconomic trends

- Lower margin per position

Indices are ideal for traders focusing on economic cycles or sector rotation rather than single-company performance.

ETFs and Bonds — balancing growth and stability

Exchange-traded funds (ETFs) replicate baskets of assets such as indices, commodities, or bonds. They combine liquidity with diversification. Bonds, in contrast, provide predictable yield and act as a stabilizer during equity drawdowns.

A mixed portfolio may include:

- Stock ETFs for long-term growth

- Commodity ETFs for inflation protection

- Government or corporate bonds for fixed income

Together, these instruments form a foundation for conservative or balanced strategies that prioritize capital preservation without abandoning growth potential.

Features That Define a Strong Multi-Asset Platform

A reliable multi-asset trading environment must combine security, stability, and flexibility. These platforms serve traders who manage several positions across asset categories, so execution quality and functionality play a central role. The goal is to create a structure where each trade, regardless of the instrument, follows the same logic and precision.

Essential features include:

- Execution speed and reliability. Millisecond-level execution ensures accurate fills during high-volume sessions.

- Advanced charting tools. Dozens of technical indicators, multi-timeframe views, and drawing utilities assist in planning entries and exits.

- Cross-asset margin management. The system automatically calculates margin across all instruments, preventing account imbalances.

- Customizable interface. Traders can adjust layouts, watchlists, and data feeds to suit personal workflow preferences.

- Secure data protection. Platforms with SSL encryption and segregated client accounts reduce operational risk.

Professional solutions also integrate order types such as stop, limit, trailing stop, and OCO (One Cancels the Other). These options support sophisticated strategies, particularly when several markets move simultaneously.

Automation compatibility further distinguishes advanced systems. Support for algorithmic trading or API access allows the use of quantitative models that react instantly to market data, making strategy execution more disciplined.

Evaluating Trading Costs and Account Types

Each multi-asset platform offers different pricing structures and account levels. Cost transparency is vital because spreads, commissions, and swaps can directly impact profitability. Evaluating these expenses alongside account features helps traders align costs with their trading frequency and capital level.

Spreads, commissions, and overnight fees

Spreads represent the difference between bid and ask prices. Lower spreads benefit short-term strategies such as scalping. Some brokers replace wide spreads with fixed commissions per lot. Overnight or swap fees apply when positions remain open beyond the trading day, reflecting interest rate differentials.

| Fee Type | Applied When | Impact on Strategy |

| Spread | Every trade | Affects entry and exit cost |

| Commission | Per lot/contract | Clearer structure for high-volume trading |

| Overnight swap | Holding overnight | Important for swing or position traders |

Comparing these parameters before opening an account ensures that operational expenses stay under control.

Minimum deposit and leverage options

Deposit requirements vary widely. Some brokers allow access with as little as $10, while others require larger initial balances for accounts with raw spreads or higher leverage. Leverage determines how much exposure a trader can control with available margin. For example, 1:100 leverage allows control of $100,000 with a $1,000 margin.

Responsible use of leverage enhances flexibility but magnifies risk, so professional traders often apply strict stop-loss and position-sizing rules.

Account tiers and their differences

Brokers often structure accounts by experience level and trading volume. Common tiers include:

- Standard Account. Designed for smaller deposits, featuring wider spreads but no commissions.

- Raw Spread Account. Offers tight spreads with added commissions; preferred for high-frequency trading.

- Professional or VIP Account. Provides premium execution, personal account management, and priority withdrawals.

Each tier adjusts leverage limits, spread levels, and minimum deposit size. Understanding these differences allows traders to choose the setup that matches their strategy and capital discipline.

Comparing Popular Multi-Asset Platforms

Technology defines trading efficiency. While hundreds of platforms exist, a few stand out for stability, execution quality, and global adoption. Below is an overview of the most recognized names in multi-asset trading.

MetaTrader 5 — flexible multi-market access

MetaTrader 5 (MT5) is widely used for its broad market coverage and analytical tools. It supports forex, CFDs on indices, metals, energies, and stocks. The interface combines one-click trading, algorithmic support through MQL5 scripting, and multi-threaded backtesting.

Advantages of MT5 include:

- Up to 21 timeframes and 80+ built-in indicators

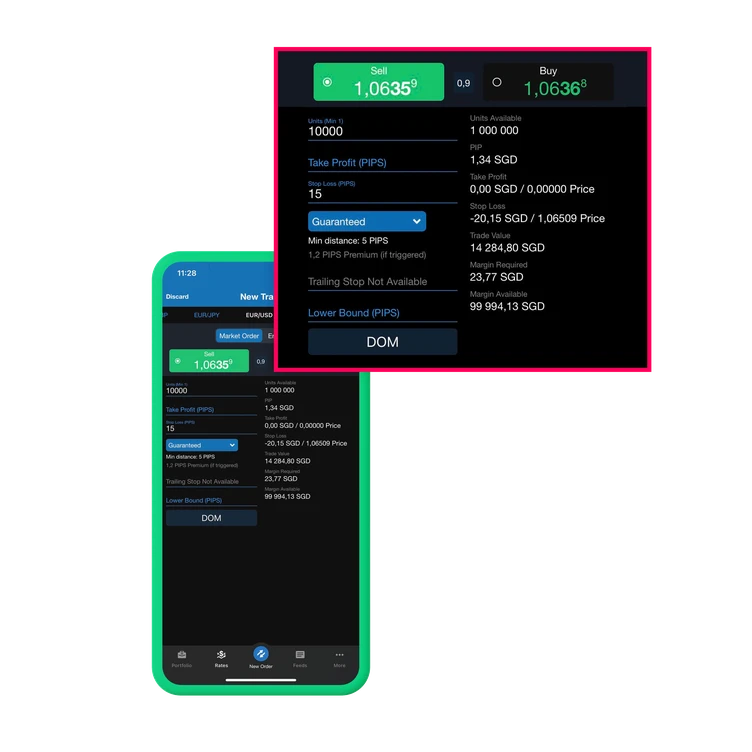

- Depth of market (DOM) window for liquidity visibility

- Integrated economic calendar and trading alerts

Its modular design allows integration with broker liquidity hubs and custom risk management systems, which explains its popularity among multi-asset traders.

cTrader — transparency and customization

cTrader is known for its clear pricing model and modern design. It displays full market depth, showing available bid/ask volumes at every price level. This structure appeals to traders seeking transparency.

Notable elements:

- Detachable charts and multi-screen layouts

- cAlgo interface for automated trading via C#

- Advanced order execution with no dealing desk intervention

Its intuitive layout and execution speed make it suitable for both discretionary and algorithmic strategies.

TradingView — analysis and social trading focus

TradingView began as a charting and analysis platform but evolved into a full trading terminal connected to multiple brokers. It combines professional analytics with a strong social component, where traders share scripts and market ideas.

| TradingView Features | Description |

| Cloud-based access | Runs entirely in a browser without installation |

| Pine Script language | Custom indicators and strategies creation |

| Social feed | Community-based trade ideas and chart sharing |

| Multi-broker integration | Direct order routing via linked accounts |

TradingView suits traders who rely on visual analytics and market sentiment tracking while maintaining execution flexibility through partner brokers.

Frequently Asked Questions

What makes multi-asset investing different from traditional trading?

Traditional trading often focuses on a single market such as forex or equities. Multi-asset investing combines several classes — currencies, stocks, commodities, and more — to stabilize returns and reduce dependency on one sector.