Both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) remain two of the most widely used terminals in retail trading. They serve as gateways to the financial markets, giving traders access to forex, commodities, indices, and various CFDs. While MT4 has built a reputation for reliability and simplicity, MT5 brings a more advanced infrastructure and improved functionality. The challenge lies in understanding which one best suits a trader’s strategy, preferred markets, and analytical needs.

Key Differences Between MT4 and MT5

MT4 was released in 2005, primarily designed for forex trading. It quickly became an industry standard because of its lightweight build and fast execution. MT5, launched five years later, was intended as a multi-asset upgrade. It introduced more technical features, an improved programming language, and broader market access, including stocks and futures.

| Feature | MT4 | MT5 |

| Release Year | 2005 | 2010 |

| Programming Language | MQL4 | MQL5 |

| Market Coverage | Mainly Forex | Forex, Stocks, Futures, CFDs |

| Order Types | 4 | 6 |

| Economic Calendar | No | Yes |

| Strategy Tester | Single-threaded | Multi-threaded |

| Netting System | No | Yes |

| Hedging Support | Yes | Yes |

| Depth of Market | Limited | Available |

MT4 remains favored by those who rely on forex-based algorithms, while MT5 attracts traders needing faster processing and more comprehensive data handling.

Performance and Speed

The stability and speed of a terminal affect order precision and slippage control. Both MT4 and MT5 are fast, but MT5 is built on a more modern architecture that improves order processing and data flow.

Order Execution Speed

MT5 offers better multi-threading support, meaning it can process multiple orders or analyses simultaneously. MT4, while still fast, works on a single-threaded model, which may limit its ability to handle numerous charts or Expert Advisors (EAs) at once.

In practice, the difference is noticeable when backtesting or using complex scripts. Traders using high-frequency or automated strategies often find MT5 slightly faster in placing and closing orders.

Tools for Analysis

Technical analysis is a major reason traders choose MetaTrader platforms. Both terminals provide advanced charting, but the level of detail and flexibility differs.

Built-in Indicators and Drawing Tools

MT4 contains 30 standard indicators and 31 drawing tools. MT5 extends this with 38 indicators and 44 analytical tools. The added tools help traders fine-tune market entries with higher accuracy.

| Tool Type | MT4 | MT5 |

| Standard Indicators | 30 | 38 |

| Drawing Tools | 31 | 44 |

| Timeframes | 9 | 21 |

| Chart Types | 3 | 3 |

MT5 also allows more granular timeframes (such as 2-minute or 12-hour charts), giving traders flexibility when building custom analyses.

Support for Custom Indicators and Scripts

Both versions allow integration of custom indicators and Expert Advisors. However, MT5 uses MQL5, a faster and more structured programming language compared to MQL4. It supports object-oriented coding, making it easier to create complex systems or modify existing algorithms.

The MQL5 community also offers an integrated marketplace and code library for automated strategies, scripts, and indicators. MT4 users, while having a larger legacy base of tools, may find certain new features unavailable unless rewritten for MT5.

Backtesting and Strategy Testing Options

Backtesting accuracy can influence a trader’s confidence in algorithmic systems. MT4’s tester operates in a single-thread mode and uses tick-based simulations. MT5, in contrast, uses multi-threaded and cloud-based testing. This makes strategy optimization faster and more reliable.

For those running portfolio-level EAs, MT5 provides real tick data and multi-currency backtesting — something MT4 cannot replicate natively.

Compatibility and Device Support

Accessibility is another deciding factor. A modern trading setup requires synchronization across multiple devices.

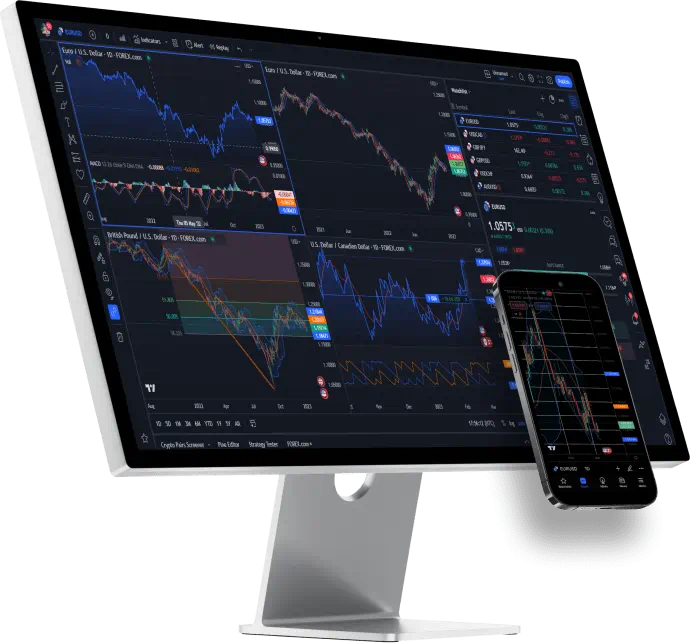

Desktop, Web, and Mobile Access

Both MT4 and MT5 are available for Windows, macOS, Android, and iOS. MT5’s web terminal offers better charting performance and synchronization between desktop and mobile versions. The mobile apps for both platforms are nearly identical in layout but differ in chart precision and the number of available indicators.

Operating System Requirements

MT4 runs well even on older systems and virtual private servers (VPS). MT5, though more demanding, remains lightweight compared to other modern trading terminals.

| Requirement | MT4 | MT5 |

| Minimum RAM | 512 MB | 1 GB |

| Processor | Single-core | Multi-core |

| Disk Space | 100 MB | 200 MB |

For VPS hosting, MT4 still remains preferred among algorithmic traders who prioritize low latency over graphical performance.

Broker Availability

Most brokers still offer both MT4 and MT5, but the adoption rate of MT5 continues to grow. Some brokers provide additional asset classes exclusively through MT5. For instance, while forex pairs remain identical on both terminals, stocks, futures, and ETFs are generally available only on MT5 accounts.

This flexibility helps traders expand beyond currency markets without switching systems entirely.

Account Management and Hedging

Efficient account handling can affect how quickly positions are opened, managed, or closed. Both MT4 and MT5 give access to multiple account types, but the internal mechanics differ slightly, especially in the handling of trade positions.

Support for Hedging vs Netting Systems

MT4 was originally designed with a hedging system that allows holding multiple positions for the same asset — even in opposite directions. For example, a trader can open both a buy and a sell position on EUR/USD simultaneously. This flexibility benefits those using short-term or grid-based strategies.

MT5, on the other hand, introduced an optional netting system, where all trades for the same instrument merge into a single position. It’s a structure borrowed from exchange-based trading, suitable for those following strict risk-control frameworks. Some brokers enable users to select their preferred mode when creating an MT5 account, offering the flexibility of either system.

| Feature | MT4 | MT5 |

| Hedging | Supported | Supported |

| Netting | Not Supported | Supported |

| Trade Aggregation | Separate Orders | Merged Orders |

| Ideal For | Scalpers, Hedgers | Stock and Futures Traders |

Traders focusing on forex pairs and scalping often prefer MT4’s classic hedging model. Those who trade exchange-traded assets or wish to simplify exposure management may lean toward MT5.

Account Types and Switching Options

Brokers may offer several account types on both platforms — typically Standard, Pro, or Raw Spread accounts. MT5 accounts sometimes come with access to a wider instrument list, including equities and commodities. Switching between MT4 and MT5 usually requires creating a separate account, as the two operate on different infrastructure levels.

However, account transitions are simple. Most brokers allow parallel operation on both systems, enabling traders to compare execution quality or performance before fully migrating.

Pros and Cons of Each Platform

Each platform has its strengths and weaknesses depending on how it’s used. The best choice depends on strategy complexity, instrument focus, and automation requirements.

MT4: Pros and Cons

Pros:

- Stable and lightweight — runs smoothly on older computers and VPS setups.

- Large library of custom indicators, Expert Advisors, and trading scripts.

- Highly compatible with most brokers and trading services.

- Easy learning curve for beginners focusing on forex.

- Lower hardware demand for automated strategies.

Cons:

- Limited to forex and CFD instruments.

- Single-threaded processing reduces backtesting efficiency.

- Fewer timeframes and analytical tools.

- Less flexibility for multi-asset or stock-based strategies.

- Future updates may be limited as development focuses on MT5.

MT5: Pros and Cons

Pros:

- Multi-asset access, including forex, stocks, and futures.

- Faster backtesting with multi-threaded and cloud support.

- Extended list of indicators and timeframes.

- Integrated economic calendar and Depth of Market (DOM) view.

- Improved order management and partial order filling.

Cons:

- Slightly higher system requirements.

- Smaller collection of third-party indicators compared to MT4.

- Incompatibility between MQL4 and MQL5 scripts.

- Requires adjustment for traders used to MT4’s hedging-only structure.

Which One to Choose?

The final decision depends on the trader’s focus and technical preferences.

- For Forex-focused trading: MT4 remains more than sufficient. Its simplicity, wide community base, and compatibility with numerous EAs make it ideal for intraday trading, scalping, or manual operations.

- For multi-asset trading or automation: MT5 delivers better performance and flexibility. Its faster processing, additional order types, and broader instrument support make it more suitable for mixed portfolios.

Frequently Asked Questions

Can MT4 and MT5 be used on the same device?

Yes, both can be installed on the same computer or mobile phone without conflict. Each runs independently.