- What Is a Forex Broker and Why Leverage Matters

- Top High-Leverage Forex Brokers in 2026

- Key Factors to Consider Before Choosing a High-Leverage Broker

- Risk Management Tips for High-Leverage Forex Trading

- Pros and Cons of High-Leverage Forex Trading

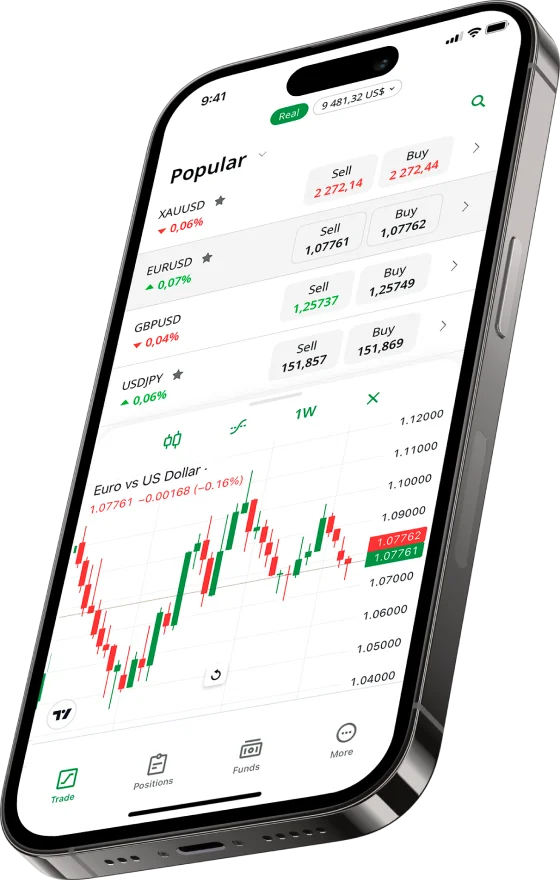

- Trading Platforms Supporting High Leverage (MT4, MT5, cTrader)

- How to Start Trading with a High-Leverage Broker

- Frequently Asked Questions

What Is a Forex Broker and Why Leverage Matters

A forex broker acts as an intermediary between traders and the international currency market. Through advanced trading platforms, brokers allow individuals to buy and sell currency pairs using different instruments such as CFDs, metals, indices, and cryptocurrencies.

Leverage enables traders to open positions larger than their account balance. For example, with leverage of 1:500, a trader can control $500 for every $1 of their own funds. This magnifies both potential gains and possible losses. High leverage, therefore, demands precise strategy and strong risk management.

Example of leverage calculation:

| Account Balance | Leverage Ratio | Total Position Size |

| $100 | 1:100 | $10,000 |

| $200 | 1:500 | $100,000 |

| $500 | 1:1000 | $500,000 |

Traders choose leverage based on their experience level and market volatility. While it can accelerate profit growth, it can also drain the account quickly if trades go against expectations.

Top High-Leverage Forex Brokers in 2026

The following platforms stand out for reliability, regulation, trading tools, and high-leverage options. Each offers distinct advantages depending on the trader’s goals and preferred strategies.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No commission, spreads from 0.6 pips | Forex Stocks Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 | ||

| Low commission on Raw Spread accounts | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.0 pips | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.1 pips | Forex Commodities Indices Crypto | $10 | Up to 1:2000 | MT4 MT5 | ||

| From 0.0 pips (Raw) | Indices Forex Crypto Commodities | $100 | 1:500 | MT4 MT5 TradingView |

XM

XM

XM remains one of the leading choices for retail traders. It offers flexible leverage up to 1:1000, depending on account type and jurisdiction. The broker supports MetaTrader 4 and MetaTrader 5, along with a broad range of assets including forex, commodities, indices, and shares.

Key features of XM:

- Minimum deposit from $5

- Negative balance protection

- Tight spreads from 0.0 pips

- Regulated by CySEC, ASIC, and IFSC

IC Markets

IC Markets

IC Markets is known for institutional-grade liquidity and transparent pricing. It offers leverage up to 1:500 with spreads starting from 0.0 pips on raw accounts. The broker provides access to MetaTrader 4, MetaTrader 5, and cTrader, making it ideal for scalping and algorithmic trading.

Main advantages of IC Markets:

- Execution speed under 40ms

- No requotes or price manipulation

- Large range of currency pairs and CFDs

- Supports automated trading and VPS hosting

IC Markets combines reliability and competitive conditions suitable for high-frequency traders who need consistent execution quality.

Pepperstone

Pepperstone

Pepperstone has built its reputation through transparency and strong regulation under ASIC, FCA, and DFSA. Its leverage reaches 1:500, offering tight spreads and advanced trading infrastructure.

Highlights:

- No dealing desk model

- Support for MetaTrader and cTrader

- Low commission structure

- 24/5 multilingual customer assistance

Pepperstone’s infrastructure ensures minimal latency, making it attractive for traders using Expert Advisors or manual short-term strategies.

FXTM (ForexTime)

FXTM

FXTM stands out for its flexible account structure and educational approach. The broker offers leverage up to 1:2000, one of the highest in the industry. Its accounts are tailored for different experience levels, from Cent to ECN.

FXTM Key Parameters:

| Account Type | Maximum Leverage | Minimum Deposit |

| Cent Account | 1:2000 | $10 |

| Standard | 1:1000 | $100 |

| ECN | 1:500 | $200 |

The broker’s extensive analytics, daily market updates, and copy trading features appeal to both independent and social traders.

Eightcap

Eightcap

Eightcap is a reputable forex and CFD broker regulated by ASIC and SCB. It provides traders with leverage up to 1:500, competitive spreads, and a strong focus on transparency and execution quality. The broker’s infrastructure supports both manual and automated trading strategies through MetaTrader 4 and MetaTrader 5.

Key Advantages of Eightcap:

- Regulation by ASIC and SCB

- Maximum leverage of 1:500

- Minimum deposit from $100

- Access to over 1,000 instruments including forex, indices, commodities, and cryptocurrencies

- Supports algorithmic trading and social copy trading via Capitalise.ai

Eightcap is particularly valued for its integration of modern automation tools and a secure trading environment, making it a solid choice for both beginners and experienced traders seeking high-leverage opportunities.

Key Factors to Consider Before Choosing a High-Leverage Broker

Selecting a broker with high leverage requires more than just checking the maximum ratio. It involves assessing security, trading costs, and operational transparency. Below are the main factors to evaluate before creating an account.

- Regulation and Licensing – A regulated broker must follow strict financial standards, ensuring fair order execution and fund protection. Look for brokers registered with FCA, ASIC, CySEC, or IFSC.

- Leverage Flexibility – Some brokers allow adjustable leverage based on account balance or instrument type, helping traders control exposure.

- Spreads and Commissions – Tight spreads are vital when trading with high leverage, as every pip can influence profit or loss.

- Execution Speed – Fast order execution prevents slippage, which is especially critical for scalping or automated trading systems.

- Account Protection Tools – Negative balance protection and margin call alerts reduce the risk of losing more than the deposit.

- Available Platforms – Compatibility with MT4, MT5, or cTrader ensures access to advanced analytical tools.

Comparison of Broker Parameters

| Broker | Regulation | Max Leverage | Minimum Deposit | Trading Platforms |

| XM | CySEC, ASIC, IFSC | 1:1000 | $5 | MT4, MT5 |

| IC Markets | ASIC, CySEC | 1:500 | $200 | MT4, MT5, cTrader |

| Pepperstone | FCA, ASIC, DFSA | 1:500 | $200 | MT4, MT5, cTrader |

| Eightcap | ASIC, SCB | 1:500 | $100 | MT4, MT5 |

| FXTM | FSC, FCA, CySEC | 1:2000 | $10 | MT4, MT5 |

When evaluating these parameters, traders should align broker choice with their trading strategy, risk tolerance, and capital level.

Risk Management Tips for High-Leverage Forex Trading

High leverage can expand profit potential, but it also magnifies loss exposure. To maintain balance, disciplined risk management is essential.

Practical tips for risk control:

- Use Stop-Loss Orders: Set a stop-loss before opening every trade. This limits losses and prevents emotional decision-making.

- Risk Only a Small Percentage: Professionals usually risk no more than 1–2% of account balance per trade.

- Monitor Margin Level: Avoid using maximum leverage on every position. Maintain free margin above 100% to prevent liquidation.

- Keep a Trading Journal: Record trade entries, exits, and outcomes to identify mistakes and improve future performance.

- Diversify Instruments: Avoid overexposure to a single currency pair. Include assets from different markets when possible.

- Control Trading Frequency: Overtrading increases transaction costs and emotional pressure, especially under high leverage.

These measures help stabilize account performance and prevent excessive drawdowns, even in volatile market conditions.

Pros and Cons of High-Leverage Forex Trading

Leverage is a double-edged mechanism—it increases potential gains but also heightens risk. The table below outlines its main advantages and disadvantages.

| Pros | Cons |

| Enables larger positions with minimal capital | Increases potential losses significantly |

| Allows traders to diversify more instruments | Margin calls may occur rapidly |

| Enhances profit potential on short-term trades | Requires precise money management |

| Suitable for active and experienced traders | Psychological pressure during volatility |

Summary of Key Points:

- High leverage is suitable for advanced strategies and short-term trading.

- It demands strict control of capital and emotional discipline.

- New traders should start with moderate ratios (1:50–1:200) before scaling higher.

Trading Platforms Supporting High Leverage (MT4, MT5, cTrader)

Modern forex trading depends heavily on robust platforms capable of executing high-leverage strategies. The three most trusted systems are MetaTrader 4, MetaTrader 5, and cTrader. Each offers unique features optimized for various trading styles.

| Platform | Strengths | Best for |

| MetaTrader 4 (MT4) | Simple interface, large community, supports automated trading via Expert Advisors | Beginners, scalpers, and algorithmic traders |

| MetaTrader 5 (MT5) | Extended order types, integrated economic calendar, faster processing | Intermediate to advanced traders |

| cTrader | Depth of Market (DoM), one-click trading, customizable layout | Professional and high-frequency traders |

Brokers such as IC Markets and Pepperstone integrate all three platforms, giving clients freedom to select the environment that best matches their trading methods.

How to Start Trading with a High-Leverage Broker

Starting with high leverage requires structured preparation. The process is straightforward but demands discipline at each stage.

Step-by-step outline:

- Choose a regulated broker offering the desired leverage ratio and trading platform.

- Complete registration by verifying identity and address according to KYC rules.

- Select account type — Micro, Standard, or ECN, depending on deposit and strategy.

- Deposit funds using a secure method such as bank transfer or e-wallet.

- Adjust leverage in account settings before placing trades.

- Test strategies on a demo account to analyze performance and risk behavior.

- Move to live trading only after consistent results and defined money management rules.

Building a structured approach from the start increases long-term sustainability in leveraged trading.

Frequently Asked Questions

What leverage ratio suits beginners?

New traders should use moderate leverage (1:50–1:200) until they gain experience and confidence in managing risk.