Gold and oil remain two of the most traded commodities across global financial markets. Each serves a distinct function in economic cycles — gold as a hedge against inflation and uncertainty, oil as a driver of industrial production and energy supply. Traders analyze both markets closely due to their volatility, liquidity, and connection to macroeconomic indicators such as interest rates, inflation, and geopolitical risk.

Gold Trading Fundamentals

Gold is quoted in U.S. dollars per troy ounce and traded on major exchanges such as the COMEX and London Metal Exchange. Price movements often correlate inversely with the strength of the dollar and bond yields. In times of economic instability, gold prices tend to rise as investors shift capital toward safe-haven assets.

The metal’s long history in central bank reserves and its use in jewelry, electronics, and ETFs adds further layers of demand stability.

Oil Trading Fundamentals

Crude oil, on the other hand, reflects global industrial activity. Brent and WTI are the most traded benchmarks. Their prices respond directly to production levels set by OPEC, transportation logistics, and global demand projections. Unlike gold, oil also involves physical storage and delivery considerations, which influence futures pricing through contango and backwardation.

High volatility in oil markets attracts speculative traders seeking short-term price swings, especially around inventory reports and policy announcements.

| Asset | Main Benchmark | Key Influences | Typical Volatility | Common Trading Instruments |

| Gold | XAU/USD | Inflation, USD Index, Interest Rates | Moderate | Spot, Futures, CFDs, ETFs |

| Oil | WTI, Brent | OPEC Decisions, Supply/Demand, Geopolitical Tension | High | Futures, CFDs, Options |

Types of Trading Platforms Available

Commodity trading platforms differ in functionality and performance. Some focus on accessibility, while others prioritize analytical depth. The right choice depends on a trader’s strategy, location, and the markets being traded.

Broadly, platforms fall into two categories — web-based or desktop — and are often complemented by mobile apps for flexibility.

Web-Based vs Desktop Trading Platforms

Web-based trading platforms operate directly through browsers. They eliminate the need for installation and suit traders who prefer quick access from multiple devices. While convenient, browser-based interfaces may depend heavily on internet stability and can show reduced performance during high traffic periods.

Desktop platforms, in contrast, offer more robust charting tools, faster data feeds, and direct server connections. These are ideal for active traders who rely on custom indicators, algorithmic strategies, or high-frequency execution. For commodities such as gold and oil, milliseconds can determine trade profitability, making desktop execution a preferred choice for professional users.

| Platform Type | Advantages | Limitations | Best For |

| Web-Based | Accessible from any device, no installation required | May lag under heavy load | Beginners and casual traders |

| Desktop | Faster execution, supports automation and advanced analytics | Requires installation and updates | Active and professional traders |

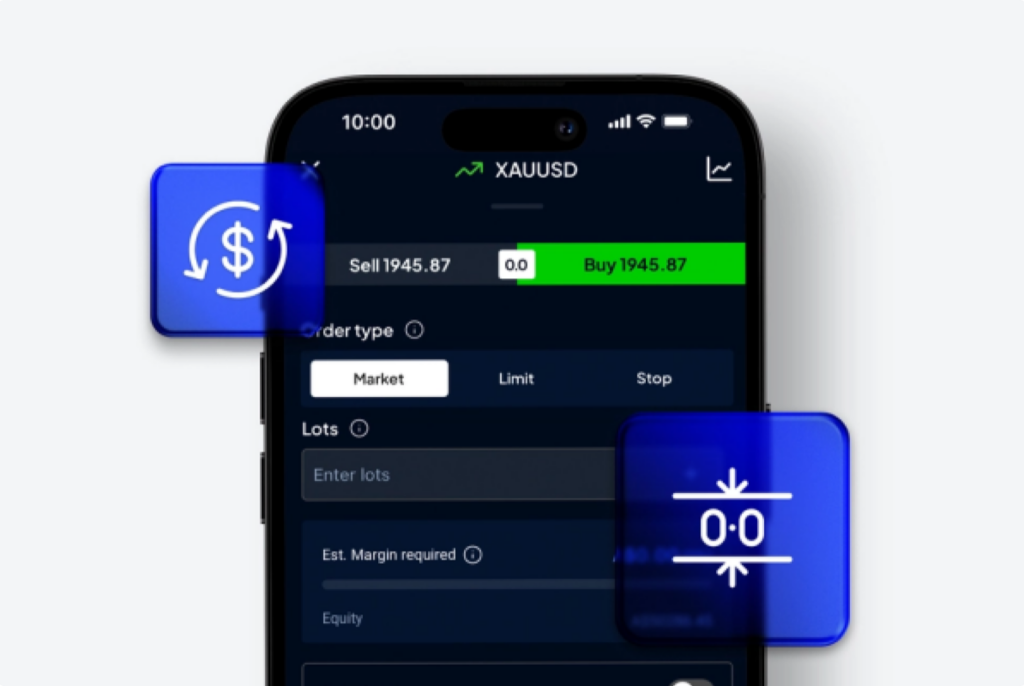

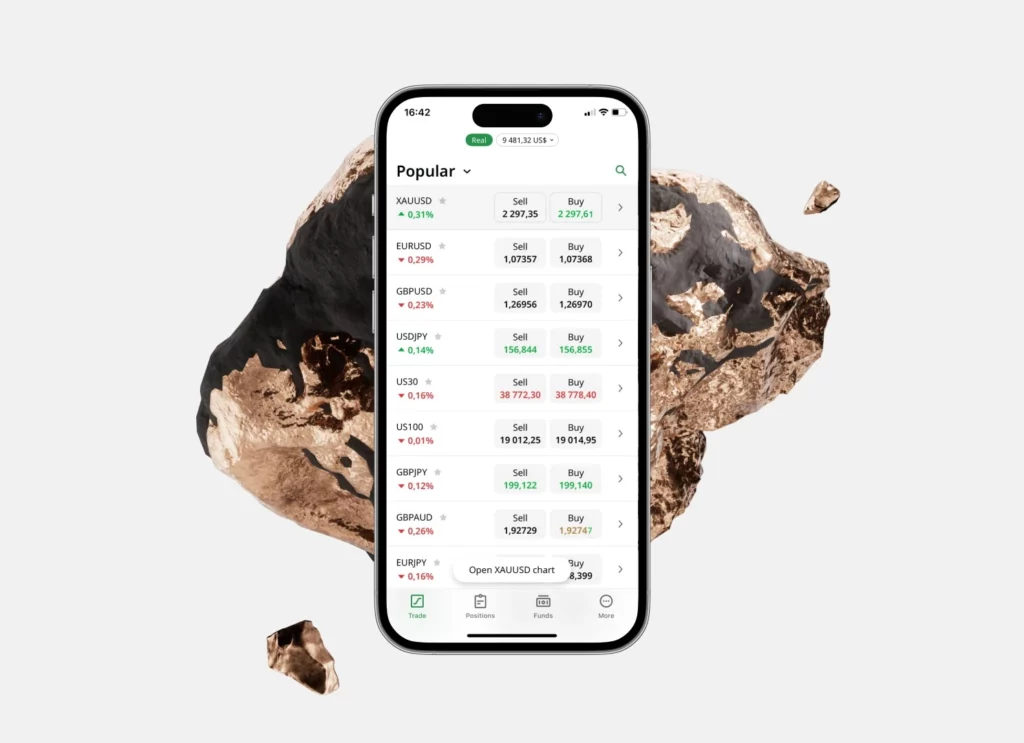

Mobile Trading Apps for Commodities

Mobile apps bring commodity trading to smartphones and tablets. These applications allow traders to track live prices, manage open positions, and execute trades while away from a computer. Modern apps replicate most desktop functions, offering technical indicators, push notifications, and customizable layouts.

However, chart precision and order placement speed may be limited compared to desktop terminals. Mobile apps are best suited for monitoring trades or adjusting stop-loss and take-profit levels rather than performing complex analysis.

Key Features to Look for in a Trading Platform

The effectiveness of gold and oil trading depends heavily on the platform’s core features. A reliable trading interface should combine analytical depth, execution precision, and protective mechanisms for risk control. Traders comparing platforms such MetaTrader 5, or cTrader often prioritize three functional areas: data accuracy, execution speed, and risk management.

Real-Time Price Feeds and Charting Tools

For commodities, a delay of even one second can distort analysis. Real-time feeds display continuous bid-ask updates and order-book activity. Charting tools should include indicators like RSI, MACD, Bollinger Bands, and Fibonacci retracements. Multi-timeframe analysis — from 1-minute to weekly charts — helps traders detect both intraday momentum and long-term trend reversals.

Platforms with customizable layouts, multiple chart types, and overlay options allow traders to align analysis precisely with their strategy.

Execution Speed and Order Types

Speed defines the quality of trade execution. A reliable platform must process market and limit orders instantly to reduce slippage. For volatile assets such as oil, delays can turn profitable setups into losses.

Order diversity also matters:

- Market orders for immediate entry

- Limit orders for targeted pricing

- Stop orders for trend continuation

- Trailing stops for automated profit protection

Fast servers and low latency connections are key metrics when comparing providers. Some systems offer order aggregation and smart routing to access multiple liquidity pools, further improving fill quality.

Risk Management Tools and Settings

Volatility in gold and oil prices requires strict control over exposure. A platform with flexible risk management tools allows traders to define losses and protect profits effectively. The most common tools include stop-loss, take-profit, and trailing stop orders, which automate exit levels once predefined thresholds are hit.

Margin settings are also crucial. A system that displays real-time margin usage, free margin, and liquidation levels helps traders avoid forced closures. Many platforms add margin call alerts, notifying users when equity falls below a critical point.

Risk calculators can estimate position size based on account balance and desired risk percentage. Advanced users often use hedging and netting modes to manage opposite positions in volatile conditions.

| Risk Tool | Function | Ideal Use |

| Stop-Loss | Closes position at fixed loss level | Prevents large drawdowns |

| Take-Profit | Closes position at preset profit target | Locks in gains automatically |

| Trailing Stop | Adjusts with price movement | Protects profits during trends |

| Margin Alerts | Warns before margin call | Keeps account balance above risk threshold |

Platforms like MetaTrader 5, and cTrader include all these settings and allow parameter adjustment in real time, giving traders control over their exposure in both trending and uncertain markets.

Comparing Popular Oil Trading Platforms

Oil trading attracts both short-term speculators and long-term investors. Popular trading systems differ in execution quality, analytical depth, and liquidity access. Below is a comparison of leading platforms commonly used for oil CFDs and futures.

| Platform | Order Execution | Analysis Tools | Supported Instruments | Average Spread (WTI) |

| MetaTrader 5 | Market Execution | Custom indicators, Expert Advisors | Oil CFDs, Spot Metals | From 0.4 pips |

| cTrader | ECN model, low latency | Depth of Market (DoM), volume analysis | Oil, Natural Gas | From 0.5 pips |

Each platform offers distinct advantages. cTrader focus on fast order routing through liquidity providers, minimizing slippage during active sessions. MetaTrader 5 remains widely used for its automation capabilities through Expert Advisors and script integration.

For oil trading, execution consistency and spread stability during volatile events — such as U.S. inventory data releases — often outweigh other factors like interface design.

Costs and Fees Involved

Every trade carries costs that influence net profit. Understanding how fees are structured across different platforms is vital for accurate planning. Costs typically fall into three categories: spreads, commissions, and overnight charges.

Spreads, Commissions, and Overnight Charges

The spread represents the difference between the bid and ask price. Tight spreads are critical for scalping and day trading, where frequent entries amplify transaction costs.

Some accounts feature raw spreads starting near zero, offset by a fixed commission per lot. For example, ECN accounts may charge $3 to $7 per side, depending on liquidity and volume.

Overnight swaps (or rollover charges) apply when positions remain open after the market closes. These rates vary by commodity and can turn negative or positive depending on interest differentials and broker policy.

| Fee Type | Description | Typical Range |

| Spread | Bid-Ask difference per trade | 0.1–0.5 pips for major commodities |

| Commission | Fixed fee per traded lot | $3–$7 per side |

| Overnight Swap | Interest adjustment on open trades | ±0.5%–1.5% annualized |

Traders focusing on short-term oil or gold positions often compare both spread tightness and swap policies, as they can differ widely between providers.

Account Minimums and Deposit Options

The entry threshold also varies across platforms. Some brokers offer standard accounts with low deposit requirements (as little as $10), while professional or ECN accounts may demand $500 or more. Deposit and withdrawal options generally include bank transfers, e-wallets, and cards. The speed and cost of funding methods can affect trade timing — a factor often overlooked by beginners.

Most systems process deposits instantly but may take one to three business days for withdrawals, depending on the chosen payment provider. Transparency in transaction fees and available currencies is essential to avoid conversion losses.

Regulation and Security of Trading Platforms

Security is a defining factor when trading commodities with real capital. A platform operating under strict financial regulation offers greater reliability. Top brokers are licensed by authorities such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia). These regulators enforce capital adequacy rules, segregated accounts, and periodic audits.

Encryption protocols, two-factor authentication (2FA), and secure socket layers (SSL) are now standard. Users should verify that the trading environment employs data protection measures to safeguard both funds and personal information.

Additionally, regulated brokers are required to disclose risk warnings and maintain transparent execution policies. This ensures all traders, from beginners to professionals, operate under consistent market conditions. Avoiding unregulated entities is critical, particularly in volatile commodity markets where pricing manipulation may occur.

User Experience and Platform Stability

The usability of a trading interface directly affects trade efficiency. Speed of navigation, order placement accuracy, and visual clarity of market data all contribute to consistent performance. Equally important is system stability during high-volume events.

Interface Usability for Day and Swing Traders

Day traders prioritize rapid order placement, quick chart updates, and customizable layouts. Swing traders, on the other hand, require reliable analytical tools for long-term trend evaluation.

An intuitive design reduces cognitive load, allowing the trader to focus on execution instead of navigating through menus. Platforms such as MetaTrader 5 include shortcut keys, drag-and-drop order adjustments, and customizable dashboards that adapt to various trading styles.

Platform Downtime and Reliability

System downtime can interrupt open positions or delay exits, leading to avoidable losses. Stable trading infrastructure with 99.9% uptime ensures continuous access even during market surges. Platforms operating through redundant servers and data centers across regions reduce the risk of disconnection.

Users should test demo environments during major economic releases — such as Non-Farm Payrolls or OPEC meetings — to verify how the system performs under stress.

Frequently Asked Questions

What makes gold and oil popular for traders?

Both markets combine high liquidity and volatility, allowing precise technical and fundamental analysis. Gold acts as a hedge against currency fluctuations, while oil reflects economic cycles.