What Is a Forex Trading App?

A forex trading app is specialized software designed to access global currency markets via mobile devices. It connects traders with brokers, providing tools for buying and selling currency pairs, analyzing price movements, and monitoring market trends in real time.

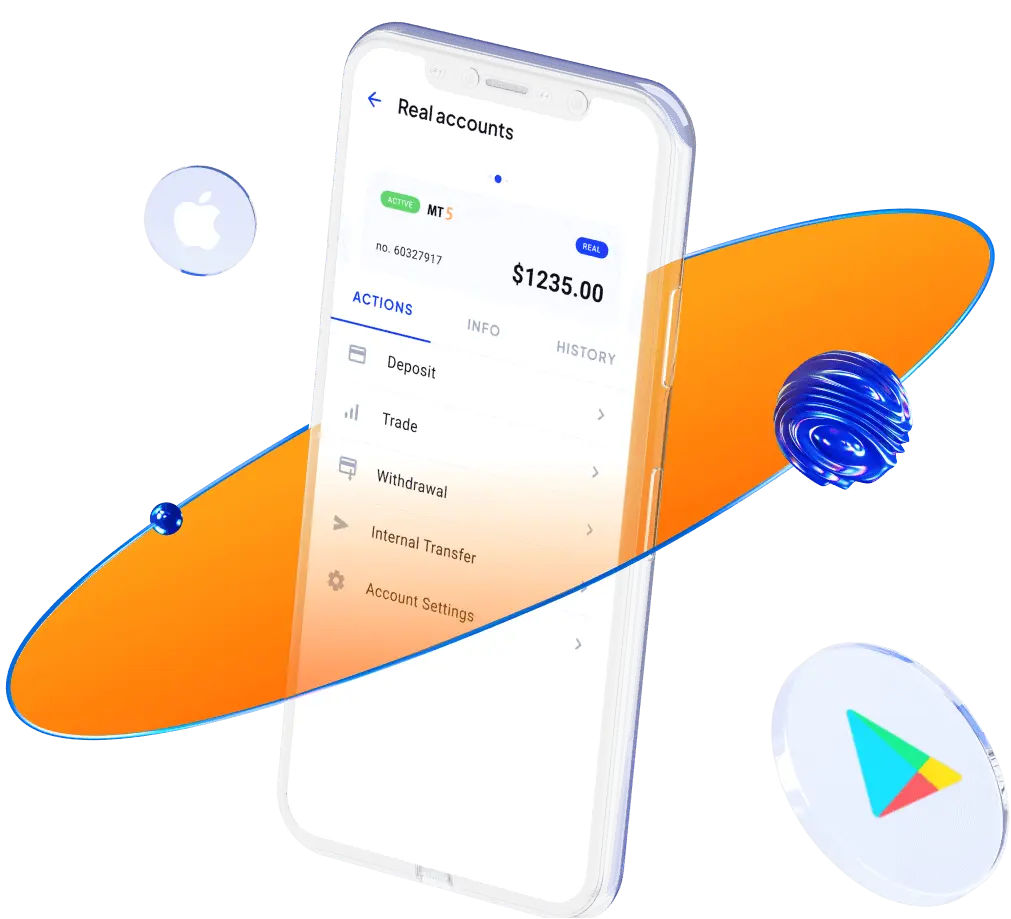

Most modern forex apps integrate functions once available only on professional platforms. These include:

- Interactive charts with multiple timeframes and indicators

- Instant order execution and one-click trading

- Account management and transaction history

- Notifications for price changes and news updates

- Compatibility with both demo and live accounts

Forex apps are now indispensable for those who value flexibility and quick decision-making. They help users react promptly to global events, execute trades while traveling, and stay informed 24/7.

Essential Features to Look for in a Forex App

When selecting a forex trading app, functionality and reliability are crucial. A good mobile platform should not only execute trades accurately but also provide professional-grade tools for analysis and risk management. Below are the key features to evaluate:

| Feature | Description | Why It Matters |

| User Interface | Clean layout, logical navigation, and customizable dashboard | Reduces errors and speeds up trading decisions |

| Execution Speed | Low latency and stable performance under market volatility | Ensures orders are filled at expected prices |

| Security | Encryption, two-factor authentication, and regulatory compliance | Protects personal data and funds |

| Charting Tools | Technical indicators, drawing tools, and real-time data | Supports accurate market analysis |

| Integration | Connection to platforms like MT4, MT5, or cTrader | Offers flexibility and advanced features |

| Account Management | Deposit, withdrawal, and account balance access | Simplifies financial operations |

| Customer Service Access | In-app chat or quick contact options | Essential for problem-solving in real time |

In addition to these elements, professional traders often check for compatibility with various account types, synchronization with desktop versions, and multi-language support.

Below is a short list summarizing what every reliable forex app should include:

- Fast order execution with minimal slippage

- Access to detailed trading history

- Customizable alerts for price movements

- Built-in economic calendar and news feed

- Secure access to deposits and withdrawals

The combination of these functions creates a well-balanced mobile experience, giving traders complete control over their portfolios wherever they are.

Top Forex Trading Apps in 2026

Mobile trading has reached a stage where speed, precision, and usability define success. The market offers dozens of forex apps, yet only a few consistently deliver professional performance and flexibility. Below are five of the most reliable and feature-rich forex trading apps in 2026, favored by both experienced traders and beginners.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| Spread-only | Forex Indices Commodities Shares Bonds | $0 | 1:30 | MT4 Proprietary | ||

| Transparent pricing | Forex Stocks Options Metals | From $0 | 1:50 | Proprietary | ||

| From 0.0 pips | Forex Indices Metals Energies | $10 | 1:500 | MT4 MT5 | ||

| No commission, spreads from 0.6 pips | Forex Stocks Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 | ||

| From $5 per lot | Forex Commodities Indices Crypto | $100 | Up to 1:400 | AvaTradeGo MT4 MT5 |

Spreadex

Spreadex

Spreadex combines traditional financial spread betting with CFD trading, offering a compact yet powerful mobile platform. It’s especially popular among UK and European traders for its balance between simplicity and precision.

| Feature | Description |

| Trading Type | Forex, indices, commodities, and spread betting |

| Interface | Clear and responsive layout optimized for quick execution |

| Charting Tools | Real-time data with customizable indicators |

| Security | Regulated by the FCA, with encrypted data protection |

| Unique Benefit | No commission trading with tight spreads |

Spreadex’s app focuses on flexibility, enabling users to manage multiple trades simultaneously. It also supports risk management tools like stop-loss and guaranteed stop orders, ideal for active retail traders.

Questrade

Questrade

Questrade’s mobile platform is a trusted choice for North American traders seeking transparency and flexibility. While it’s widely known for stock and ETF trading, it also provides access to forex and CFD markets through an integrated platform.

| Feature | Description |

| Assets | Forex, CFDs, stocks, ETFs |

| Regulation | IIROC and CIPF membership (Canada) |

| Charting | Advanced technical tools and detailed analytics |

| Interface | Intuitive dashboard with real-time monitoring |

| Security | Two-factor authentication and encryption |

The Questrade app is designed for investors who want to manage multiple asset classes from one account. With fast execution and robust research tools, it offers a balanced environment for both beginners and professionals.

IUX

IUX

IUX (International Union Exchange) has emerged as a modern, globally accessible forex platform. Its mobile app is optimized for low-latency trading and supports a wide range of instruments with real-time analytics.

| Feature | Description |

| Execution | ECN/STP model ensuring direct market access |

| Assets | Forex, commodities, cryptocurrencies, indices |

| Platform Integration | MT4, MT5, and proprietary IUX Trader |

| Security | Advanced encryption and segregated client funds |

| Support | 24/7 multilingual customer assistance |

The IUX mobile app is known for stability under volatile market conditions and offers one-click order placement, chart customization, and integrated market news — making it a solid choice for traders seeking a global broker with fast execution.

XM

XM

XM has built a strong reputation among global forex brokers, and its mobile app reflects that standard. It supports both MetaTrader 4 and MetaTrader 5 platforms, allowing users to switch between interfaces without losing functionality.

Main Characteristics:

- Real-time quotes and one-click execution

- Over 1,000 instruments, including forex, CFDs, and commodities

- Multi-language interface and localized account settings

- Secure deposits and withdrawals directly in the app

- Economic calendar and integrated trading signals

For traders looking for consistency, XM’s mobile solution offers a smooth transition between mobile and desktop terminals while maintaining identical analytical tools.

AvaTrade

AvaTrade

AvaTradeGO stands out for its modern design and intelligent trading management system, AvaProtect, which limits risk on selected trades. The platform integrates detailed analytics and simplified order placement.

| Feature | Description |

| Risk Management | AvaProtect refunds potential losses for protected trades |

| Interface | Streamlined, beginner-friendly layout |

| Assets | Forex, stocks, cryptocurrencies, and indices |

| Support Tools | Interactive charts and sentiment indicators |

| Security | Multiple regulatory licenses and strong encryption |

The app’s built-in guidance system helps users understand trade performance and track multiple positions simultaneously. For mobile users focused on stability and protection, AvaTradeGO is a smart option.

How to Choose the Right Forex App for Your Trading Style

The ideal forex app depends largely on a trader’s habits and objectives. Scalpers usually prefer platforms like Spreadex for ultra-fast execution, while analytical traders often lean toward Questrade for its charting flexibility. Long-term investors and those interested in copy trading tend to favor IUX.

Below is a table summarizing which app best suits specific trading approaches:

| Trading Style | Recommended App | Reason |

| Scalping / Day Trading | Spreadex | Rapid order execution and low latency |

| Technical Analysis | Questrade | Extensive charting tools and indicators |

| Copy Trading | IUX | Access to a large community of professional traders |

| Multi-Asset Portfolio | XM App | Broad range of CFDs and forex pairs |

| Risk-Control Focused | AvaTradeGO | AvaProtect and clear performance tracking |

When choosing, traders should consider not only the app’s interface but also regulation, supported payment methods, and withdrawal speed. Testing the app with a demo account is a practical way to measure performance before committing funds.

Tips for Safe and Effective Mobile Trading

Trading through mobile apps offers convenience, but it also demands discipline and security awareness. The ability to trade anywhere can be an advantage only if used responsibly. Below are practical tips that help maintain efficiency and safety when using mobile forex platforms.

- Use Secure Internet Connections: Avoid public Wi-Fi when executing trades or accessing your account. Always rely on encrypted connections or mobile data networks. Using VPNs adds an extra layer of security.

- Set Up Two-Factor Authentication: Activating 2FA significantly reduces the risk of unauthorized access. Most reliable forex apps include this feature in their settings.

- Keep the App Updated: New updates often fix vulnerabilities and improve performance. Make sure your app version is always the latest one available on Google Play or the App Store.

- Monitor Market Alerts: Configure push notifications for key events or price changes. This allows you to react faster without constantly monitoring charts.

- Avoid Overtrading: The simplicity of mobile trading can lead to impulsive decisions. Setting daily or weekly limits helps maintain control and discipline.

- Regularly Review Trade History: Analyze previous trades directly in the app. Identifying patterns and mistakes strengthens long-term strategy and decision-making.

- Use Stop-Loss and Take-Profit Orders: Automated risk management tools are crucial for mobile trading. They ensure that trades are executed even when you are offline or distracted.

These measures not only protect the account but also create a professional mindset, transforming mobile trading into a structured and efficient process.

Advantages and Limitations of Trading on Mobile

Mobile forex trading has transformed how global markets are accessed. Yet, while technology makes trading simpler, it also introduces certain limitations. Understanding both sides helps traders choose when and how to rely on mobile platforms.

| Advantages | Limitations |

| Instant access to global markets at any time | Smaller screen may affect detailed analysis |

| Real-time data and chart synchronization | Risk of distraction in public or noisy places |

| Quick order execution and flexible management | Limited ability to use advanced indicators simultaneously |

| Notifications and alerts for rapid decisions | Dependence on internet quality and device battery life |

| Full integration with desktop platforms | May lead to emotional trading if not managed properly |

Mobile trading fits short-term decision-making, monitoring, and quick entries or exits. However, for deep analytical work, large screens and extended charting sessions on desktops remain more efficient.

A practical approach is to use both platforms together — the desktop terminal for research and strategy planning, and the mobile app for execution and monitoring. This balance ensures full market awareness without losing accuracy.

Frequently Asked Questions

Can a mobile trading app replace a desktop terminal?

Yes, for most operations. Mobile apps now offer nearly identical functionality, including technical analysis and order management. However, detailed backtesting and complex strategy development are still easier on desktops.