- What Are Forex Signals and How Do They Work?

- Popular Platforms for Receiving Forex Signals

- Top Forex Signal Providers in 2026

- How to Choose a Reliable Forex Signal Provider

- Free vs Paid Forex Signals: What’s the Difference?

- Risks of Following Forex Signals Without Strategy

- How to Use Forex Signals in Real Trading

- Frequently Asked Questions

What Are Forex Signals and How Do They Work?

Forex signals are trade suggestions based on market analysis performed by professionals or automated systems. They include information such as the currency pair, entry price, stop-loss, and take-profit levels. Signals are generated using technical indicators, price action, or fundamental data.

Typically, traders receive these alerts through apps, email, or messaging platforms. Once the signal is received, a trader can decide whether to execute the trade manually or use automation tools to do it instantly.

Example of a Forex Signal:

| Parameter | Example Value |

| Currency Pair | EUR/USD |

| Entry Price | 1.0860 |

| Take Profit | 1.0900 |

| Stop Loss | 1.0830 |

Such precision allows users to trade based on calculated probabilities rather than emotions.

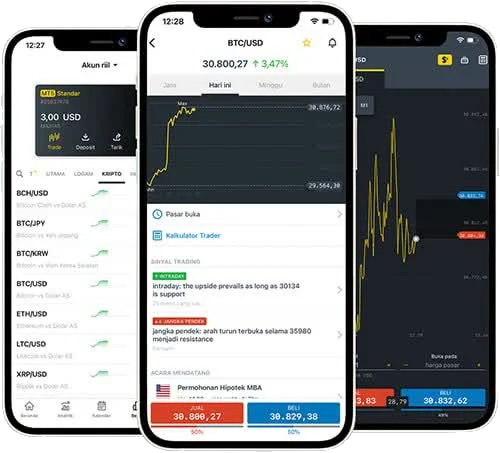

Popular Platforms for Receiving Forex Signals

Traders can access forex signals through several channels. Each method has unique features suited for different trading styles and levels of experience.

MetaTrader 4 (MT4)

MT4 remains one of the most common tools for receiving signals directly within the platform. It supports integration with signal providers who share trades in real-time. Users can copy trades automatically or receive alerts for manual execution. MT4 also allows detailed chart analysis alongside signal tracking.

MetaTrader 5 (MT5)

MT5, a newer version of MetaTrader, expands analytical tools and supports more instruments, including stocks and CFDs. It’s popular among professional traders who want multi-asset trading and faster execution. Signal services in MT5 can be linked through its internal marketplace, providing both free and paid options.

Telegram Channels

Telegram is widely used for forex signals because of its real-time communication and privacy features. Many providers post entries, exits, and updates directly in group chats. These channels can include hundreds of traders sharing ideas and outcomes.

Email and SMS Alerts

Some traders prefer receiving signals via email or text for instant notifications. Although less interactive than chat apps, this method is reliable and ensures delivery without needing to be online constantly.

Copy Trading Platforms

Copy trading services let users automatically mirror trades of professional investors. This system suits those who lack time for manual analysis but still want exposure to forex markets. Traders can select experts based on past performance, risk score, and profit statistics.

Top Forex Signal Providers in 2026

The market for forex signals continues to evolve, with more focus on transparency and verified results. Below are the most trusted signal providers in 2026, known for accuracy and professional analysis.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No commission, tight spreads | Forex Indices Shares Commodities | $0 | 1:500 | xStation 5 | ||

| Raw spread + commission, from 0.0 pips | Forex Indices Commodities Crypto | $50 | 1:500 | MT4 MT5 | ||

| Spread-only | Forex Indices Commodities Shares Bonds | $0 | 1:30 | MT4 Proprietary | ||

| From 0.2 pips | Forex Indices Commodities | $100 | 1:500 | MT4 MT5 | ||

| Variable, low spreads | Forex Indices Commodities | $50 | 1:400 | MT4 NinjaTrader Trading Station | ||

| From 0.0 pips (Raw) | Indices Forex Crypto Commodities | $100 | 1:500 | MT4 MT5 TradingView |

XTB

XTB

XTB offers built-in trading ideas within its xStation platform. The service provides real-time updates, daily analysis, and automatic notifications. It’s suitable for traders who want integrated tools for both execution and education.

Vantage

Vantage

Vantage delivers signal access through Trading Central and AI-based analytics. The platform includes clear entry and exit points and daily insights across forex pairs, indices, and commodities.

Spreadex

Spreadex

Spreadex combines traditional spread betting with signal-based trading. Users can access professional-level alerts and apply them to both forex and indices. The system is valued for its detailed reporting and transparency.

HYCM

HYCM

HYCM integrates forex signals through its expert advisors and educational materials. The broker provides structured recommendations supported by historical data, helping traders understand the reasoning behind each trade.

FXCM

FXCM

FXCM offers a broad range of trading tools and automated signals. Its in-platform service integrates well with MetaTrader and NinjaTrader, giving access to performance tracking and portfolio optimization.

Eightcap

Eightcap

Eightcap partners with advanced analytics firms to deliver AI-driven forex signals. Traders can view alerts directly on TradingView or connect them to MT4/MT5 via plug-ins.

How to Choose a Reliable Forex Signal Provider

Selecting a signal provider requires checking both credibility and consistency. Not every service suits all trading strategies. To find a dependable one, focus on measurable results and realistic performance.

Key factors to consider:

- Verified track record – look for third-party audited results.

- Transparency – signals should include full trade parameters.

- Communication speed – delayed notifications reduce accuracy.

- Risk management – reliable providers include stop-loss in every trade.

- User feedback – genuine reviews from experienced traders add credibility.

Providers offering trial periods are useful for evaluating performance without immediate commitment.

Free vs Paid Forex Signals: What’s the Difference?

Free signals attract many beginners but often lack accuracy and consistency. Paid services, especially those verified by brokers or analysts, offer more structured data and ongoing support. The main differences are shown below:

| Feature | Free Signals | Paid Signals |

| Accuracy | Often inconsistent | Generally verified |

| Source | Public channels | Professional analysts |

| Customization | Limited | High |

| Risk management | Basic | Included in every trade |

| Frequency of updates | Irregular | Daily or hourly |

Paid signal providers usually integrate with trading platforms, allowing direct execution and better monitoring.

Risks of Following Forex Signals Without Strategy

Depending solely on signals without personal analysis increases exposure to losses. Market conditions can change rapidly, and even accurate signals may fail under strong volatility. Traders who rely blindly on third-party inputs often face issues like overtrading or emotional decision-making.

To reduce risks:

- Always confirm signals with personal analysis.

- Manage position sizes carefully.

- Avoid using excessive leverage.

- Maintain a consistent trading plan regardless of short-term losses.

How to Use Forex Signals in Real Trading

Signals should complement strategy, not replace it. Successful traders combine external recommendations with personal judgment. Many choose hybrid systems, using signals for entry confirmation and manual exits.

Steps to apply signals effectively:

- Subscribe to a trusted provider.

- Verify the trade parameters.

- Execute or automate via trading platform.

- Record each trade result for analysis.

- Adjust settings or providers if accuracy declines.

Consistent performance tracking helps refine both strategy and provider selection.

Frequently Asked Questions

Can forex signals guarantee profit?

No. Even high-quality signals depend on market conditions and user execution. They are tools, not profit guarantees.