Understanding Forex Brokers and Trading Platforms

A forex broker provides access to the interbank market through an online terminal. Clients can open positions on major, minor, and exotic currency pairs, as well as CFDs on indices, metals, and cryptocurrencies. Most brokers operate under regulatory supervision from authorities like CySEC, FCA, or ASIC. Licensing ensures fair operations and transparency in client fund management.

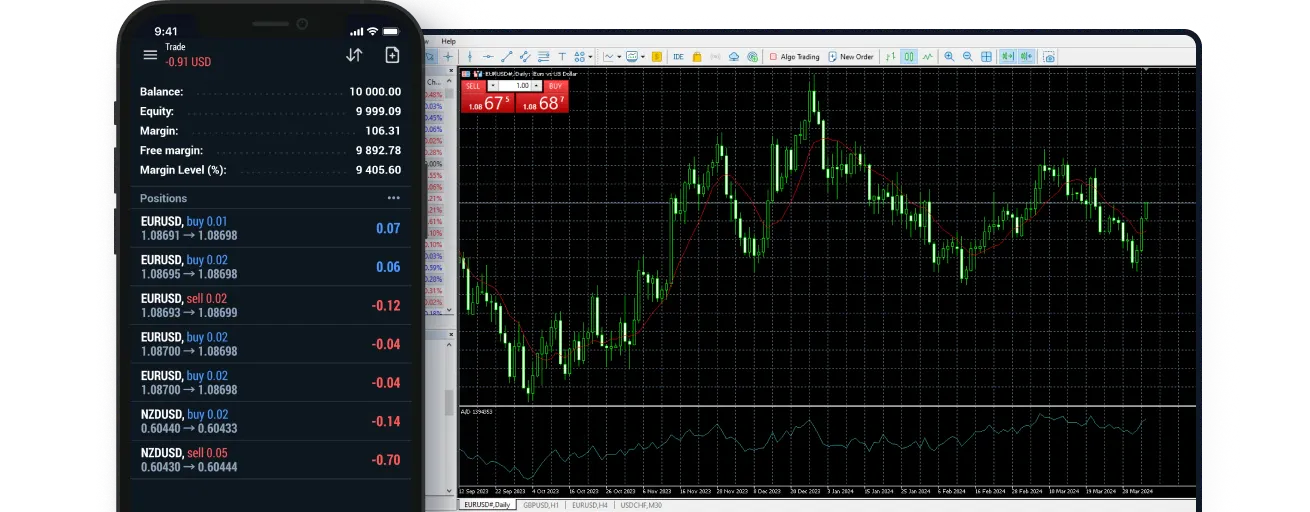

Trading platforms form the technical base of the brokerage service. The most common are:

- MetaTrader 4 (MT4) – Known for reliability and custom indicators.

- MetaTrader 5 (MT5) – Offers multi-asset trading and an economic calendar.

- cTrader – Preferred for its modern interface and fast execution speed.

- Proprietary platforms – Built by brokers to integrate specific tools or services.

Each platform provides real-time charts, technical indicators, and order management options. A well-chosen platform simplifies trading operations and improves reaction time in volatile markets.

Key Features to Look for in a Forex Broker

When comparing brokers, several elements directly influence trading efficiency. Beginners often focus on spreads or bonuses, but professionals analyze deeper metrics.

Main aspects include:

- Regulation and licensing – A verified license from a recognized authority ensures client protection.

- Execution speed – Fast order execution reduces slippage, especially during high volatility.

- Spreads and commissions – Lower transaction costs lead to higher net profit over time.

- Leverage options – Flexible leverage helps adapt strategies to different market conditions.

- Deposit and withdrawal methods – Reliable financial operations are crucial for account safety.

- Customer service quality – Efficient communication channels add confidence to daily trading.

Below is a comparison of typical broker parameters used by experienced traders:

| Parameter | Description | Optimal Value |

| Regulation | Legal oversight by a trusted financial authority | FCA, CySEC, ASIC |

| Minimum Deposit | Starting amount required to open a live account | $5–$100 |

| Average Spread on EUR/USD | Cost of trading the most popular currency pair | 0.1–1.0 pips |

| Maximum Leverage | Ratio between trader’s capital and available position size | 1:500 or higher |

| Execution Type | Market or ECN | ECN preferred for precision |

Traders often build a personal checklist before opening an account. It helps narrow down suitable brokers according to budget, strategy, and risk profile.

Top Forex Brokers in 2026

The market continues to evolve with stronger regulation and improved technology. The companies listed below are recognized for reliability, speed, and competitive trading conditions. Each offers a strong balance between transparency, platform stability, and customer confidence.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No commission, spreads from 0.6 pips | Forex Stocks Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 | ||

| Low commission on Raw Spread accounts | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.0 pips | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| No commission, spreads from 0.1 pips | Forex Commodities Indices Crypto | $100 | Up to 1:500 | MT4 MT5 cTrader FXPro App | ||

| Low commission, spreads from 0.0 pips | Forex Commodities Indices | $100 | Up to 1:500 | MT4 | ||

| From $5 per lot | Forex Commodities Indices Crypto | $100 | Up to 1:400 | AvaTradeGo MT4 MT5 |

XM

XM

XM is known for its low entry barrier and strong regulatory background. It provides both standard and micro accounts with fast order execution. The company also offers swap-free accounts for specific regions and transparent pricing without hidden fees. Educational materials are integrated into its trading platform, helping users better understand risk management.

IC Markets

IC Markets

IC Markets specializes in raw spread accounts suitable for algorithmic and scalping strategies. Its connection to Tier-1 liquidity providers ensures consistent execution. The broker supports multiple base currencies and provides access to detailed analytical reports.

Pepperstone

Pepperstone

Pepperstone combines institutional-grade infrastructure with user-friendly tools. It is often chosen for its low latency and broad range of CFDs. The broker integrates TradingView and Autochartist for enhanced market analysis.

FXPro

FXPro

FXPro has built a reputation for flexibility in order types and execution models. It supports various platforms, including cTrader and proprietary terminals. Clients can access both market and instant execution, depending on account type.

Tickmill

Tickmill

Tickmill focuses on ECN trading and transparency. Its spreads start from zero, and commission rates remain competitive. The broker’s strong reputation among professional traders comes from its reliability and execution speed.

AvaTrade

AvaTrade

AvaTrade is known for its wide range of trading instruments, from forex to cryptocurrencies. Its proprietary AvaTradeGO platform offers an intuitive mobile interface and integrated market sentiment tools. The company is regulated in multiple jurisdictions and follows strict operational standards.

How to Choose the Right Forex Broker

Selecting a broker is one of the most strategic decisions in trading. It requires not only comparing numbers but also understanding how each element affects long-term results. A good starting point is to define personal trading goals — short-term speculation or systematic portfolio building. From there, each trader can match their preferences to a broker’s offer.

Here are the main steps to make an informed choice:

- Check regulation and reputation – Always confirm that the company is licensed and transparent about its operating address.

- Analyze spreads and commissions – Even a small difference in costs can influence profitability after hundreds of trades.

- Evaluate platform performance – Test demo accounts to measure execution speed and charting stability.

- Consider available instruments – The broader the selection of assets, the easier it is to diversify.

- Review withdrawal conditions – Fast and fee-free transactions indicate reliability.

- Compare customer service availability – Response time matters, especially during volatile sessions.

Common Trading Platforms Explained

Every broker connects traders to the market through a trading platform. The platform determines how orders are executed, analyzed, and managed. Below is a brief overview of the most frequently used systems in forex trading:

MetaTrader 4 (MT4)

MT4 remains one of the most popular terminals worldwide. It offers a large library of technical indicators, expert advisors (EAs), and customizable chart layouts. Its compact interface works efficiently even on low-performance devices.

MetaTrader 5 (MT5)

MT5 is an upgraded version of MT4, designed for multi-asset trading. It includes more timeframes, additional order types, and an integrated economic calendar. The platform also allows hedging and netting modes, giving traders flexibility in position management.

cTrader

Favored by ECN traders, cTrader features transparent pricing and a modern visual layout. It allows depth-of-market view and advanced order execution settings, which are essential for scalping and algorithmic strategies.

Proprietary Platforms

Some brokers develop their own terminals with unique features. These systems often include built-in analysis dashboards, quick-trade panels, and direct integration with mobile apps. Examples include AvaTradeGO and FXPro Edge.

Advantages of professional platforms:

- Real-time charting and advanced indicators.

- Fast execution with minimal slippage.

- Compatibility with automated strategies.

- Secure connection to trading servers.

Different platforms suit different trading styles. Scalpers prefer cTrader for its speed, while long-term investors often choose MT5 for its advanced analytics.

Tips for Safe and Effective Forex Trading

Forex trading requires discipline, patience, and a structured plan. Even the best broker cannot guarantee results if a trader lacks a systematic approach. The points below help maintain stability and avoid common mistakes.

Practical recommendations:

- Start with a demo account – Test strategies without risking capital.

- Set realistic goals – Expect steady growth rather than overnight success.

- Apply stop-loss and take-profit levels – Risk management protects against emotional decisions.

- Follow market news – Economic data and central bank updates affect currency movement.

- Keep a trading journal – Recording trades helps identify patterns and areas for improvement.

- Avoid over-leverage – Excessive exposure can quickly erase profits.

Traders who plan carefully often rely on consistent position sizing and percentage-based risk per trade. Maintaining emotional control is equally important; impulsive trading usually leads to losses.

Frequently Asked Questions

What is a forex broker?

A forex broker is a financial intermediary that provides traders with access to currency markets through online platforms. It executes buy and sell orders for clients and earns through spreads or commissions.