When considering an online forex broker, one of the most important factors to consider is the type of account that suits your trading style. Exness offers two standout accounts: the Zero Spread and Raw Spread accounts. These accounts cater to traders who seek low-cost trading but with distinct features and conditions. Understanding the differences between these accounts is key to making a smart decision that aligns with your trading goals.

Exness Zero Spread Account

The Zero Spread Account is designed for traders who require near-zero spreads. This account eliminates the spread, which is typically the first cost associated with each trade. However, the trade-off is that commissions are charged on each trade. The Zero Spread account is often favored by scalpers and day traders, who need ultra-tight spreads to execute quick trades and capitalize on small price movements.

Features and Conditions:

- Spread: As low as 0 pips. There is no spread cost added to the market price, which is a huge plus for short-term traders.

- Commission: A flat fee is charged per lot, typically higher than the Raw Spread account. This can be $13.75 per lot on both the opening and closing trades.

- Execution: Fast execution, optimized for traders who need to get in and out of the market in a matter of seconds.

- Leverage: Up to 1:2000, providing substantial leverage for traders.

- Platform Support: Available on both MT4 and MT5, giving traders flexibility with their preferred trading platform.

Pros and Cons

Pros:

- Extremely tight spreads

- Ideal for scalpers and short-term traders

- Fast order execution

Cons:

- Higher commission fees make it expensive for low-volume traders

- Commission structure can add up quickly if making frequent trades

Exness Raw Spread Account

The Raw Spread Account provides access to the most competitive market spreads. Unlike the Zero Spread account, it doesn’t offer zero spreads, but instead, it allows traders to access real market spreads, which start from 0 pips. Traders pay lower commissions than in the Zero Spread account, making this account type suitable for traders who prioritize a low-cost environment without the need for tight spreads.

Features and Conditions:

- Spread: Raw market spreads starting from 0 pips, but spreads can widen depending on market liquidity and volatility.

- Commission: $3.50 per lot for both opening and closing trades—far cheaper than the Zero Spread account.

- Execution: Slightly slower execution than the Zero Spread account due to slightly higher spreads. However, the difference is typically negligible for most traders.

- Leverage: Up to 1:2000, allowing for aggressive trading if needed.

- Platform Support: Available on MT4 and MT5, ensuring compatibility with expert advisors (EAs) and automated trading.

Pros and Cons

Pros:

- Lower commission fees compared to the Zero Spread account

- Access to real, raw market spreads

- Suitable for long-term and swing traders

Cons:

- Spread might widen during volatile conditions

- Slightly higher spreads compared to Zero Spread accounts

Cost Breakdown: Zero Spread vs Raw Spread Account

One of the main considerations when choosing between these accounts is the total cost involved. This includes not only the spreads but also commissions. Let’s break it down:

| Category | Zero Spread Account | Raw Spread Account |

| Commission | $13.75 per lot (round turn) | $3.50 per lot (round turn) |

| Spread | Zero pips on major pairs (e.g., EUR/USD, GBP/USD), may vary with other pairs and conditions | Raw market spreads from 0 pips, may fluctuate slightly |

| Total Trade Cost | High commission can add up with frequent trades; best for short-term strategies | Lower commissions make it cost-effective for fewer or larger trades |

| Best For | High-frequency traders who need tight spreads | Traders with larger positions or longer-term strategies |

Suitability for Various Trading Strategies

When choosing between the Exness Zero Spread and Raw Spread accounts, understanding which account best suits your trading strategy is key. Whether you’re a scalper, a swing trader, or someone using automated systems, each account type offers unique advantages based on your trading approach. Let’s dive into how these accounts match various trading styles and help you make the most informed decision.

For Scalpers and Day Traders

- Zero Spread Account: Ideal for traders who execute multiple trades within a short time frame, seeking to capitalize on micro price movements. With zero spread, scalpers can get in and out of positions without worrying about spread widening.

- Raw Spread Account: Though this account offers lower commissions, the spread might widen slightly during high volatility. Scalpers may find this less favorable if they require extremely tight execution on every trade.

For Swing Traders and Position Traders

- Zero Spread Account: Swing traders, especially those who hold positions for a few hours to a day, may find the Zero Spread account less cost-effective due to the high commission fees. However, for those who focus on quick entries and exits, it might still be a good option.

- Raw Spread Account: Better suited for longer-term traders, as the lower commission balances out the slightly higher spreads. Traders looking for raw, unaltered market conditions may find the Raw Spread account more suited to their style, particularly when holding trades for longer durations.

For Algorithmic and Automated Traders

- Zero Spread Account: Provides fast execution with ultra-tight spreads, making it attractive for traders using Expert Advisors (EAs) that require fast, accurate entry and exit points.

- Raw Spread Account: Offers real, unfiltered market data, which is preferred for algorithmic trading. The lower commission also makes it a more cost-effective option for automated trading strategies that open many positions over time.

Risk and Trading Costs

Both accounts come with different implications when it comes to managing risk and trading costs.

- Zero Spread Account: The lack of a spread allows for immediate execution, but the high commission can add risk if you’re executing a large number of trades in a short amount of time. It’s crucial to ensure that your strategy justifies the higher commission cost.

- Raw Spread Account: The slightly wider spread could increase your entry cost, but lower commission makes this account ideal for traders who don’t mind a minor increase in spread as long as it reduces overall costs. This can also minimize risk during volatile periods when spread widening could be an issue.

Which Account is Right for You?

The decision between the Zero Spread and Raw Spread accounts boils down to the cost structure and the trader’s strategy.

- Zero Spread Account: Best suited for traders who trade high-frequency strategies and require tight spreads for short-term trading. The higher commission is justified for those making many quick trades.

- Raw Spread Account: A more cost-efficient choice for traders who don’t mind a slightly wider spread but prefer a lower commission cost. It’s ideal for swing traders and long-term investors who don’t need lightning-fast execution but appreciate the market’s true price.

Conclusion

Exness offers two powerful options for traders: the Zero Spread and Raw Spread accounts. While both accounts are geared towards reducing trading costs, each has its advantages and disadvantages depending on trading frequency, strategy, and overall risk tolerance. Traders should evaluate their needs—whether they require tighter spreads with higher commissions or more flexibility with lower commission fees—before deciding on the best account for their trading approach.

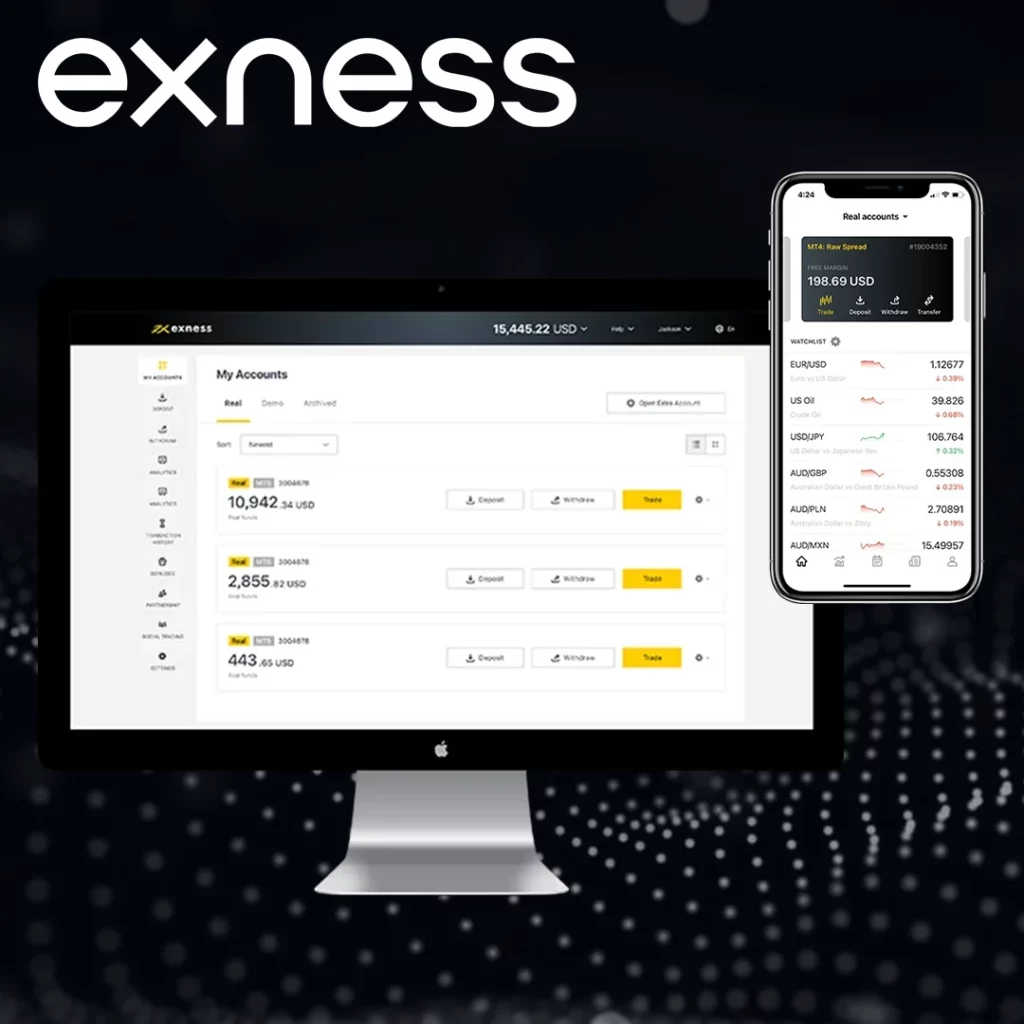

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs

What is the main difference between the Zero Spread and Raw Spread accounts?

The Zero Spread account offers zero spreads, meaning no cost is added on the spread itself. However, traders pay a higher commission per trade. This account is typically preferred by scalpers and traders who execute a high volume of trades within short time frames. On the other hand, the Raw Spread account offers real market spreads, starting from 0 pips, but charges a lower commission. This makes the Raw Spread account more suitable for traders who prefer lower commission fees and don’t mind slightly wider spreads.