In Forex trading, the concept of swap points is often misunderstood. These are the interest rates applied to positions that remain open overnight. Swap points can either be a cost or a source of income for traders, depending on the direction of the trade and the interest rate differential between the two currencies being traded. The value of swap points is usually small in comparison to the overall position size, but they can accumulate over time, making them significant for long-term traders.

In simpler terms, swap points represent the difference between the interest rates of the two currencies in a currency pair. If the interest rate of the currency you’re buying is higher than the one you’re selling, you’ll earn a positive swap. If the opposite is true, you’ll pay a negative swap.

Exness Swap Points Explained

Exness offers a transparent and user-friendly approach when it comes to swap points. The rates are designed to reflect market conditions and are updated regularly. For traders, this means that swap charges or credits can vary depending on several factors, including the currency pair, market liquidity, and global interest rate changes.

When you enter a position on Exness, it is important to keep in mind that different account types may offer different swap rates. For example:

- Standard Account: Commonly used by most traders and provides competitive swap rates for a wide range of instruments.

- Pro Account: Typically designed for more experienced traders, this account offers tighter spreads and different swap points.

- Raw Spread Account: Offers the lowest spreads but might have slightly higher swap costs depending on the instrument being traded.

- Zero Spread Account: Best for high-frequency traders, but may come with variable swap points that change based on market conditions.

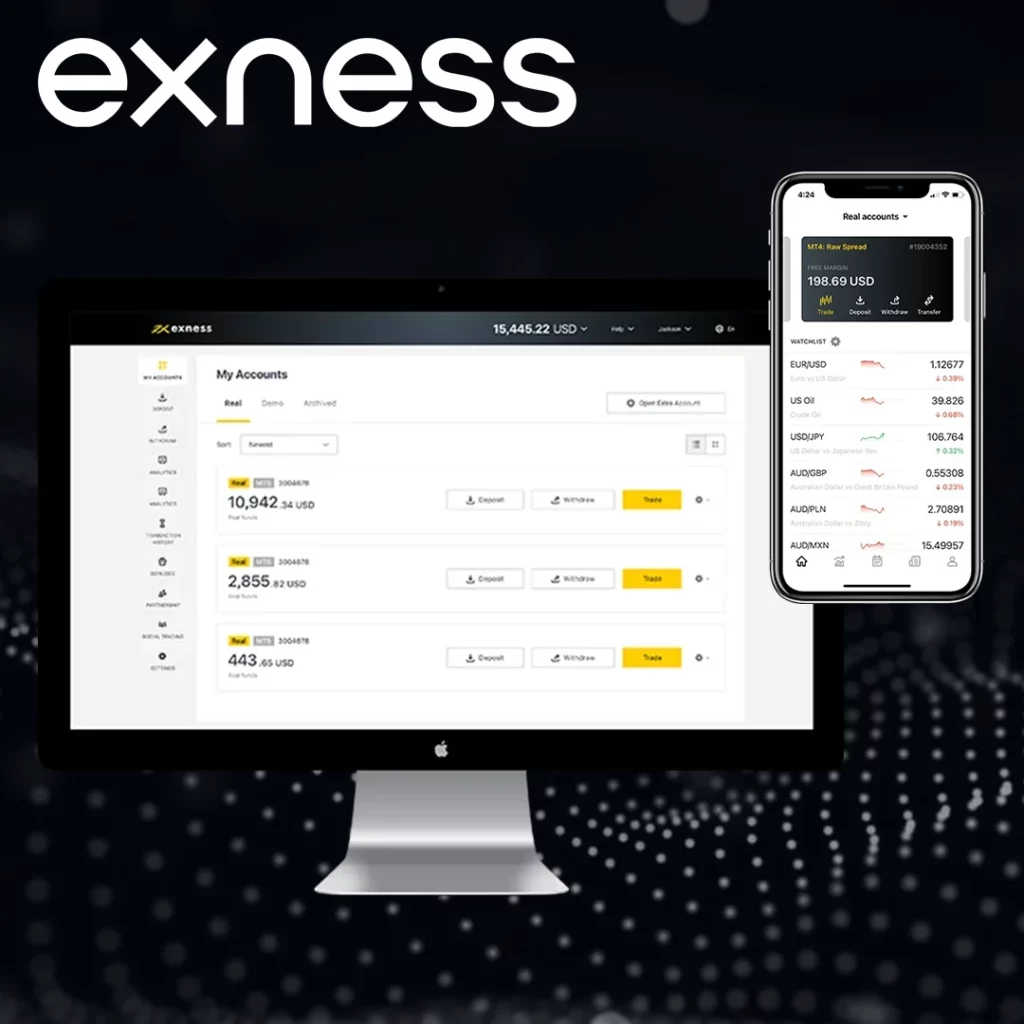

How to Check Swap Points on Exness

Checking swap points on Exness is fairly simple and can be done using various platforms provided by the broker. Below are some of the most effective methods to view these rates:

Using MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

MetaTrader 4 and MetaTrader 5 are popular platforms for Forex traders, and Exness offers full integration with both. Here’s how to check swap points on these platforms:

- Open the Market Watch window where all the available instruments are listed.

- Right-click on the instrument (currency pair or asset) you wish to check.

- Select Specification from the drop-down menu.

- In the specifications window, you’ll find the swap values listed under “Swap Long” and “Swap Short.” These values indicate the swap points for both buying (long) and selling (short) positions.

Exness Trader App

The Exness Trader app is another easy-to-use platform for managing trades. To check swap points:

- Open the app and navigate to the instrument you are trading.

- Tap on Contract Specifications to view detailed information.

- You’ll find the swap rates listed here, both for long and short positions.

Exness Personal Area

Your Exness Personal Area is another useful resource for checking swap points. This area gives you direct access to real-time data about your trades, including swap charges for different instruments. Simply go to the Trade section, select the instrument you are interested in, and look for the Swap Points listed in the details.

Key Benefits of Knowing Swap Points

| Key Benefit | Description |

| Predictable Costs | Knowing the swap points lets traders anticipate costs for holding positions overnight. |

| Effective Risk Management | With the right information, traders can manage risk by selecting currency pairs with favorable swap rates. |

| Increased Profitability | By minimizing swap costs, traders can maximize the potential profitability of their trades. |

Factors Affecting Swap Points

Several factors come into play when determining swap points, and these can vary depending on the market and your account type:

Interest Rate Differentials

The most significant factor impacting swap points is the difference in interest rates between the two currencies in a currency pair. For example, if you’re buying the USD/JPY pair, you’re essentially borrowing JPY and lending USD. If the interest rate for USD is higher than that for JPY, you’ll likely receive a positive swap. If the JPY interest rate is higher, you may have to pay a negative swap.

Economic Conditions and Central Bank Policies

Global economic conditions have a huge impact on interest rates, and by extension, swap points. Central banks such as the U.S. Federal Reserve or the European Central Bank set interest rates, which influence swap rates in the currency markets. When central banks raise interest rates, the swap for buying that currency becomes more attractive, while the swap for selling it becomes more costly.

Market Liquidity

Liquidity plays an essential role in determining swap points. Major currency pairs like EUR/USD and GBP/USD usually have lower swap rates due to their liquidity. However, less-traded currency pairs may come with higher swap rates because they are less liquid and carry more risk.

Market Volatility

When volatility increases, swap points may change as brokers adjust their rates to reflect the increased risk in the market. This often happens during times of financial crises or major geopolitical events that impact global economies.

Exness Swap-Free Accounts

For traders who prefer not to pay swap fees, Exness offers swap-free accounts. These accounts are ideal for traders who want to avoid swap charges for religious or strategic reasons. However, swap-free accounts may come with other conditions, such as different spreads or additional fees. It’s important to fully understand the terms and conditions before opting for a swap-free account.

The Importance of Monitoring Swap Points

For any trader, understanding and managing swap points is key to long-term profitability. Here’s why it matters:

Cost Control

Swap charges can add up over time, especially for positions held for weeks or months. Traders need to monitor swap points regularly to ensure that their strategies are cost-effective. By understanding the cost of swap points, traders can plan their trades more efficiently, ensuring that the potential profit outweighs the cost of overnight financing.

Strategic Planning

Traders who hold positions overnight or for several days need to take swap points into account as part of their broader strategy. For example, traders who use a swing trading strategy may want to avoid instruments with high swap fees to prevent those fees from eating into their profits.

Optimizing Trading Strategies

Swap points can also be a factor in optimizing trading strategies. Traders who rely on technical analysis, for example, can include swap points in their risk-reward analysis to make more informed decisions.

Common Misconceptions About Swap Points

Many traders misunderstand swap points, either overestimating or underestimating their impact. Some key myths include:

- Myth 1: Swap points are always significant: While swap points can add up, they are usually relatively small in comparison to the overall trade size. The biggest factor in a trade’s profitability remains the currency pair’s price movement.

- Myth 2: Swap points are fixed: Swap points are not static and can fluctuate based on market conditions, interest rate changes, and broker adjustments.

- Myth 3: Swap-free accounts are always the best: While swap-free accounts may seem appealing, they come with other conditions that might not make them the best choice for every trader. Be sure to evaluate your overall trading strategy before opting for this option.

Conclusion

Swap points are an important yet often overlooked aspect of Forex trading. Whether you’re a long-term trader or someone who prefers shorter trades, knowing how to check swap points and understanding what influences them can significantly improve trading outcomes. Exness provides transparency and easy access to swap point information, making it simple for traders to stay informed and manage their positions effectively.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs

What are swap points?

Swap points are the interest rates applied to positions that remain open overnight. They can either be positive or negative, depending on the currency pair and the interest rate differential between the two currencies.