Scalping is a high-speed trading strategy where traders aim to profit from very small price movements within short time frames. The goal is to make multiple quick trades, capitalizing on minute changes in the market. The key to successful scalping is precision and speed, and Exness, with its excellent platform features, offers a perfect environment for scalpers.

Scalping Defined

At its core, scalping is all about capturing small profits from rapid, short-term market movements. Scalpers aim to make a profit from tiny price fluctuations by entering and exiting the market swiftly. Trades are typically held for a few seconds to a few minutes, focusing on quick entries and exits.

Characteristics of scalping:

- Short Holding Period: Positions are usually closed within minutes.

- High Frequency: Scalpers execute multiple trades during the day.

- Minimal Profit per Trade: Individual profits per trade are small but accumulate over time.

- Speed and Precision: Scalpers rely on fast execution to avoid slippage.

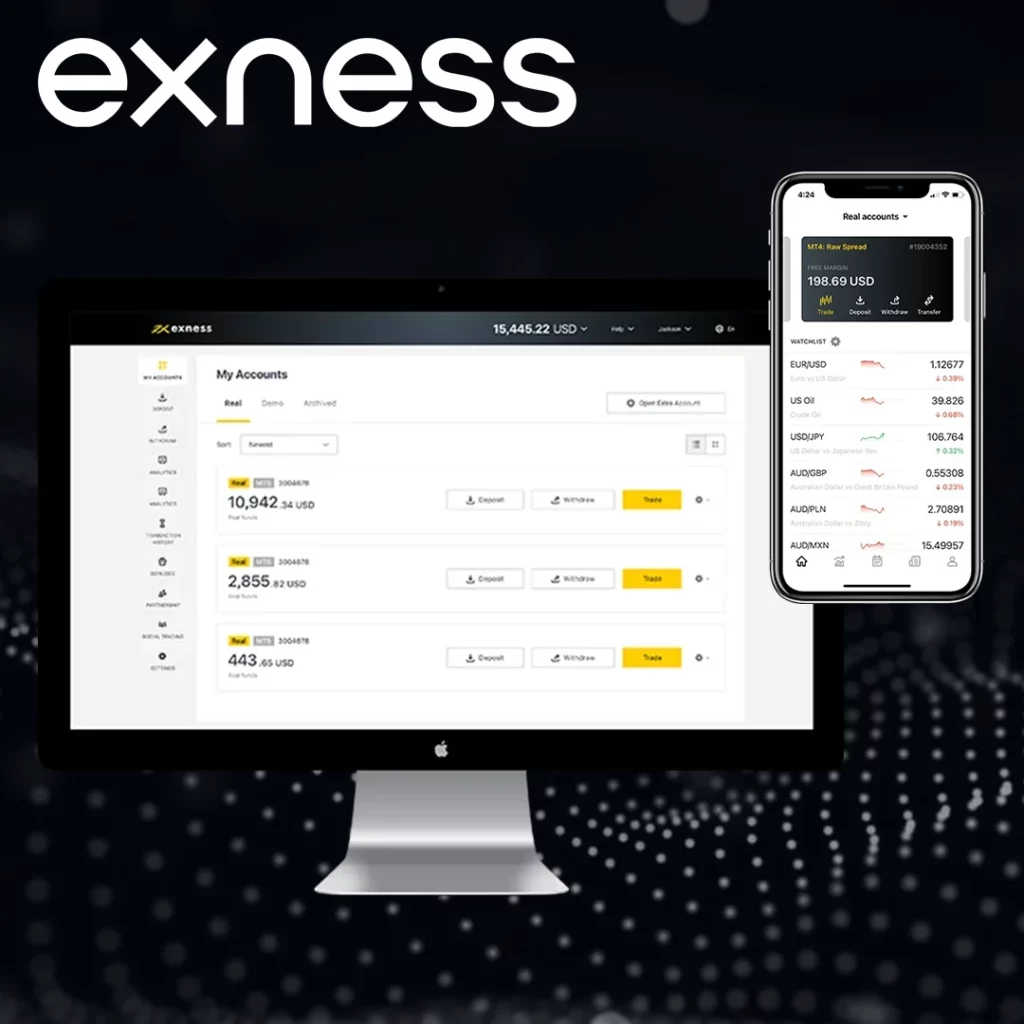

Why Exness is Ideal for Scalping

Exness is particularly attractive to scalpers due to its combination of low spreads, quick execution, and powerful tools. Below are the factors that make Exness a strong contender for scalping traders:

- Competitive Spreads: Exness offers tight spreads on major currency pairs like EUR/USD, which is crucial for scalpers who rely on small price movements.

- Fast Order Execution: Scalpers need their orders filled instantly. Exness guarantees low latency and quick execution speeds, minimizing slippage.

- Customizable Leverage: Exness offers various leverage options, allowing scalpers to adjust their exposure and manage risk effectively.

- Low Transaction Costs: With low commissions and fees, Exness allows traders to execute numerous trades without incurring high transaction costs.

- Advanced Trading Platforms: Exness provides access to MT4 and its proprietary platforms, both of which are equipped with advanced charting tools and quick execution capabilities.

Scalping Strategies to Use on Exness

Each scalping strategy requires a good understanding of market behavior and timing. Below are some of the most popular scalping techniques that traders use when executing trades on Exness.

The One-Minute Scalping Strategy

The one-minute scalping strategy focuses on very short-term price movements, with traders opening and closing positions within a minute or two. This strategy relies heavily on indicators that can quickly show price momentum and potential reversals.

How to Execute:

- Indicators Used: Moving Average Convergence Divergence (MACD), Relative Strength Index (RSI).

- Entry Signal: Look for MACD to cross above the signal line while RSI stays below 70, indicating the potential start of an upward move.

- Exit Signal: Set a profit target based on price movement or wait for signs of reversal when indicators suggest weakening momentum.

- Time Frame: 1-minute chart for ultra-short trades.

- Leverage: High leverage (up to 1:2000 on Exness) to maximize short-term opportunities.

Stochastic Oscillator Scalping

The Stochastic Oscillator is an effective tool for identifying overbought or oversold conditions in the market. For scalpers, this tool helps pinpoint entry and exit points when the market is likely to reverse.

How to Execute:

- Indicators Used: Stochastic Oscillator, Bollinger Bands.

- Entry Signal: Enter a trade when the Stochastic Oscillator is under 20 (indicating oversold conditions) and the price touches the lower Bollinger Band. Conversely, enter a sell trade when the oscillator is above 80 (overbought) and price nears the upper Bollinger Band.

- Exit Signal: Close the position when the oscillator crosses back above or below the thresholds.

- Time Frame: 5-minute charts, as they capture rapid changes in market conditions.

- Leverage: Moderate leverage (between 1:200 and 1:500) to avoid risk during fast movements.

Breakout Scalping

This strategy involves trading when price breaks through a key support or resistance level. Scalpers look for strong momentum after a breakout, betting on the continuation of the price movement.

How to Execute:

- Indicators Used: Bollinger Bands, Moving Averages.

- Entry Signal: When price breaks above the upper Bollinger Band or below the lower band, enter the trade in the direction of the breakout. Moving averages can be used to confirm the breakout direction.

- Exit Signal: Exit the trade once the price hits a predetermined resistance or support level.

- Time Frame: 1-minute to 5-minute charts, as price moves quickly after breakouts.

- Leverage: Medium to high leverage, depending on the size of the breakout.

Range Scalping

Range scalping works best in a sideways or ranging market, where price oscillates between support and resistance levels. Traders aim to buy near support and sell near resistance, profiting from the price bounce.

How to Execute:

- Indicators Used: RSI, Moving Averages.

- Entry Signal: Buy when price hits support and RSI is below 30 (indicating oversold conditions) or sell when price reaches resistance and RSI is above 70 (indicating overbought conditions).

- Exit Signal: Close the position when the price reaches the opposite boundary of the range.

- Time Frame: 5-minute charts, ideal for range-bound market conditions.

- Leverage: Low leverage to reduce risk during lateral price movements.

Risk Management for Scalping

Given the rapid nature of scalping, it’s easy to be swept up in the excitement and overlook risk management. However, managing risk is essential to ensure that small losses don’t wipe out the gains from successful trades. Below are some practical risk management techniques for scalpers:

- Use Stop-Loss Orders: Always set stop-loss levels to limit potential losses. Exness allows tight stop-loss levels, which is vital when scalping.

- Position Sizing: Risk a small percentage of the account balance per trade. Most scalpers risk no more than 1% of their capital on each trade.

- Scalp During the Right Market Hours: Scalping works best during high volatility periods, such as when major markets overlap or when economic news is released.

- Leverage Control: Exness provides high leverage, but excessive leverage can lead to significant losses. It’s essential to use leverage cautiously.

- Monitor Transaction Costs: Scalpers make many trades, so keeping an eye on commission costs is essential to avoid eroding profits. Exness’ competitive pricing helps mitigate this concern.

Why Exness is Tailored for Scalping

Exness stands out among other brokers because of its reliable features tailored for scalpers. Fast execution, low spreads, and transparent pricing are just the beginning. Whether a trader uses MT4 or Exness’ proprietary platform, these tools provide all the flexibility a scalper needs for success.

- Exness’ Execution Technology: Minimizes slippage and ensures that orders are filled in milliseconds.

- No Swap Fees: Exness doesn’t charge swap fees on many instruments, which is perfect for scalpers who don’t hold positions overnight.

- Advanced Trading Platforms: Both MT4 and Exness’ platform are optimized for scalpers, offering advanced charting, custom indicators, and fast order execution.

Conclusion

Scalping is a high-risk but potentially high-reward strategy that requires speed, precision, and a solid understanding of market conditions. Exness’ low spreads, fast execution, and powerful tools make it an excellent choice for those wanting to execute scalping strategies effectively. However, successful scalping requires more than just the right platform; it also demands discipline, quick decision-making, and careful risk management.

When implemented correctly, scalping can be a consistent and profitable trading method. By using the right strategies and leveraging Exness’ robust platform features, traders can take advantage of small price movements and maximize their trading potential.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs

What is scalping in forex trading?

Scalping is a strategy where traders make multiple small trades over short periods to capture small price movements. The goal is to make profits from quick, short-term trades rather than holding positions for extended periods.