ETF and index trading have become key components in diversified portfolios. Traders use these instruments to gain exposure to broad market sectors, track specific indices, or build long-term strategies without the need to manage individual stocks. The right trading platform can directly influence order execution, cost efficiency, and overall strategy performance. Choosing wisely helps maintain precision and reduce unnecessary friction during trades.

Understanding ETF and Index Trading

Exchange-Traded Funds (ETFs) are collections of assets—usually stocks or bonds—traded on an exchange like ordinary shares. They mirror the behavior of specific indices such as the S&P 500, NASDAQ 100, or FTSE 100. Index trading, on the other hand, refers to trading derivatives or contracts that follow an index’s value, offering a way to speculate or hedge against market movements.

Both approaches serve distinct objectives:

- ETFs are often used for portfolio diversification and passive investing.

- Index derivatives (like CFDs or futures) are suited for tactical exposure and short-term speculation.

- Many traders combine both to balance long-term holdings with short-term market opportunities.

The core advantage of ETFs and indices lies in their transparency and efficiency. They offer real-time pricing, lower maintenance costs, and consistent liquidity across market sessions.

Criteria for Selecting a Reliable Trading Platform

A good ETF and index trading platform must go beyond basic execution. It should integrate analytical tools, quick access to global exchanges, and strong compliance frameworks. Evaluating these platforms requires focusing on functionality, cost, and user protection.

Fees, Commissions, and Account Requirements

Trading costs can accumulate quickly. Even minor differences in commissions or spreads impact long-term returns. When assessing a trading service, check the following:

| Cost Element | Description | Average Industry Range |

| Trading Commission | Fixed or percentage per transaction | 0–0.1% per side |

| ETF Spread | Difference between bid and ask prices | 0.03–0.15% |

| Account Minimum | Required starting balance | $0–$1,000 |

Key points to consider:

- Zero-commission offers may still include hidden costs within spreads.

- Platforms with fractional ETF trading help small investors diversify easily.

- Check inactivity or withdrawal fees before opening an account.

Efficient cost management preserves capital and helps traders reallocate funds toward strategy optimization instead of overhead.

Access to Global Markets and Variety of Indices

The ability to trade across regions determines how diversified a portfolio can become. A reliable service should include ETFs and indices from major regions like North America, Europe, and Asia-Pacific. Access to emerging markets provides additional growth potential but may come with higher volatility.

Examples of accessible instruments:

- US-based ETFs: S&P 500, NASDAQ 100, Dow Jones Industrial Average

- European indices: DAX, FTSE 100, CAC 40

- Asia-Pacific indices: Nikkei 225, Hang Seng, ASX 200

Charting Tools, Order Types, and Execution Speed

Technical precision plays a decisive role in ETF and index trading. High-quality charting tools allow better identification of entry and exit points, while reliable execution reduces slippage.

Essential technical features include:

- Real-time multi-timeframe charts with overlays and indicators

- Order types such as stop, limit, trailing stop, and OCO (one-cancels-other)

- Millisecond-level order execution with low latency connections

Modern systems also integrate automation and alerts, helping users manage multiple assets efficiently. Consistent execution speed is critical when trading leveraged ETFs or volatile index contracts.

Regulatory Compliance and Investor Protection

Regulation ensures that client assets remain safe and operational transparency is maintained. Platforms regulated by tier-one authorities—such as the FCA (UK), ASIC (Australia), or CySEC (Cyprus)—offer greater reliability.

Investors should confirm:

- Segregation of client funds from company assets

- Negative balance protection (where applicable)

- Access to compensation schemes in case of insolvency

These factors minimize counterparty risk and reinforce trust in daily operations.

Top ETF and Index Trading Platforms in 2026

The ETF and index trading landscape in 2026 is more competitive than ever. Traders prioritize cost efficiency, robust analytical capabilities, and global coverage. Each service listed below excels in one area—fees, technology, long-term investing, mobility, or market diversity. Evaluating them according to specific needs helps identify the most effective choice for consistent results.

Best for Low-Cost Investing

Low-cost investing is the foundation of long-term performance. Minimizing transaction costs and spreads allows traders to accumulate returns without unnecessary drag.

Platforms recognized for cost efficiency typically include commission-free ETFs, tight bid–ask spreads, and low account minimums.

Main characteristics of low-cost brokers:

- Commission-free ETF and index trades on major markets

- Tight spreads on high-volume instruments such as SPY or QQQ

- Transparent overnight and conversion fees

Best for Advanced Charting and Analytics

Traders who rely on technical precision require advanced charting systems, multi-timeframe analysis, and real-time execution metrics. These tools assist in identifying momentum, breakouts, and reversals within index movements.

Essential analytical components:

- Over 100 built-in indicators with customizable parameters

- Volume profile and market depth visualization

- Backtesting modules for ETF strategies

- Integrated news feed for macroeconomic updates

Best for Long-Term Index Investors

Investors focusing on multi-year growth prefer stability and low maintenance. Their main objective is to replicate index performance efficiently, reinvest dividends, and reduce turnover costs.

Key aspects for long-term users:

- Fractional ETF investing to increase diversification

- Dividend reinvestment plans (DRIPs)

- Low management and custody fees

- Automatic rebalancing by market capitalization

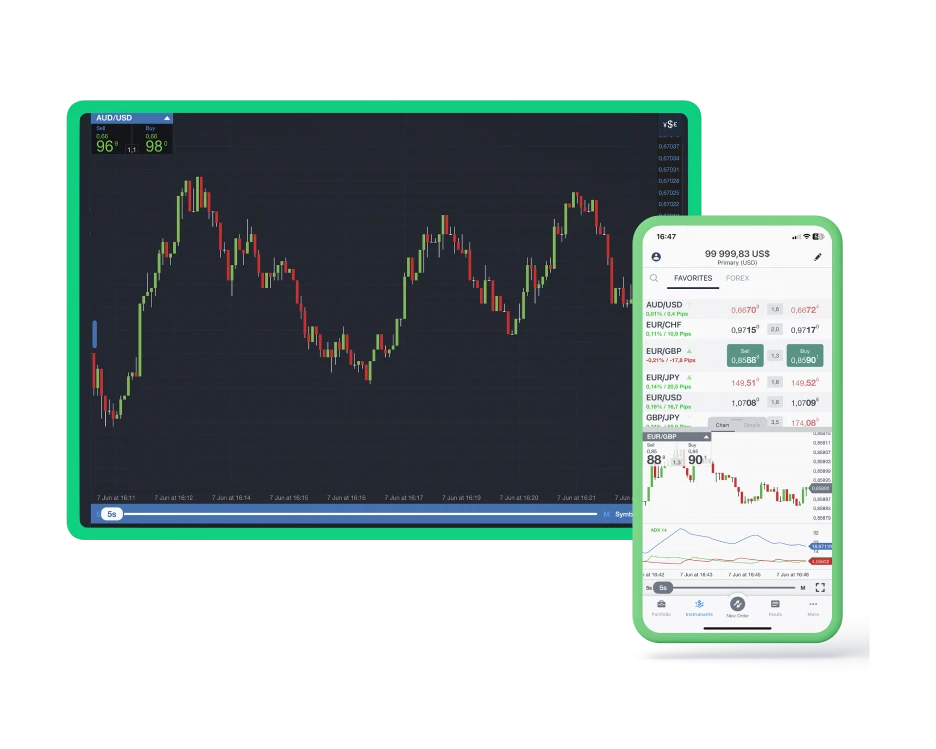

Best for Mobile ETF Trading

Mobile access has become essential. Modern investors monitor portfolios, place trades, and analyze charts from smartphones. A mobile-first trading system should retain nearly all desktop functions while maintaining reliability under network fluctuations.

Key requirements:

- Responsive interface with fast execution

- Integrated price alerts and watchlists

- Secure biometric login

- Lightweight design to reduce data usage

Best for Diversified International ETFs

International exposure is essential for those seeking balanced risk across economies and sectors. Platforms offering broad ETF access allow allocation between developed and emerging markets, commodities, and fixed income instruments.

Characteristics of globally oriented platforms:

- Access to ETFs listed in over 25 countries

- Multi-currency account options to avoid conversion losses

- Extended trading hours covering multiple time zones

Tips for Efficient ETF and Index Trading

Efficient ETF and index trading relies on managing execution quality, cost, and timing. Practical awareness of spreads, liquidity, and order control can significantly improve trade outcomes. Below are practical measures that experienced traders use to optimize their operations.

Managing Costs and Spreads

Trading costs extend beyond visible commissions. Spread and slippage can erode profitability, especially in volatile markets.

Practical steps:

- Trade during peak market hours when liquidity is highest.

- Avoid placing large market orders in illiquid ETFs.

- Use limit orders to control entry and exit prices.

- Review bid–ask data before initiating trades.

Monitoring cost impact per trade gives a clearer picture of actual portfolio performance.

Using Stop Orders and Rebalancing Tools

Stop orders are essential for risk management in ETF and index trading. They limit potential losses and lock in profits without requiring constant monitoring. Rebalancing tools help maintain portfolio alignment with the intended asset distribution, especially when market movements shift weights over time.

Core principles:

- Stop-loss orders automatically close trades once prices reach predetermined levels, preserving capital.

- Trailing stops adjust dynamically as prices move in favor, protecting profits during rallies.

- Portfolio rebalancing restores asset ratios by selling overperforming ETFs and buying underperformers.

Understanding Market Hours and Liquidity

Each ETF trades during the hours of its underlying exchange. Liquidity peaks when corresponding stock markets are open. Traders must synchronize their activity with those sessions to minimize spreads and slippage.

Liquidity insights:

- ETFs tracking US indices are most active between 14:30–21:00 GMT.

- European ETFs show tighter spreads from 08:00–16:30 GMT.

- Asia-Pacific ETFs offer better execution between 00:00–08:00 GMT.

- Off-hour trading often increases spreads and reduces order depth.

Common Mistakes to Avoid in ETF and Index Trading

Even experienced traders occasionally make errors that affect portfolio efficiency. Avoiding common traps improves discipline and performance consistency.

Frequent mistakes include:

- Ignoring expense ratios. High annual costs reduce compounding over time.

- Overtrading. Constant buying and selling increases frictional losses.

- Neglecting diversification. Concentrated exposure raises volatility risk.

- Trading illiquid ETFs. Low-volume assets can widen spreads and cause slippage.

- Skipping rebalancing. Portfolios drift from intended risk levels without regular adjustment.

- Reacting emotionally. Decisions based on news or short-term movements often backfire.

Maintaining a rules-based strategy with defined entry and exit criteria minimizes these errors.

Frequently Asked Questions

What is the main difference between ETFs and index funds?

ETFs trade on exchanges throughout the day, while index funds settle at the end of the session. ETFs also tend to have lower fees and more flexible access.