What Is a Crypto Trading App?

A crypto trading app is a mobile or desktop platform that allows users to buy, sell, and monitor cryptocurrencies directly from their devices. These apps connect traders to global markets, enabling transactions in assets such as Bitcoin, Ethereum, and stablecoins.

Unlike traditional exchanges, modern crypto apps integrate analytical tools, price alerts, and charting software similar to forex platforms. Most offer access to derivatives like CFDs (Contracts for Difference), margin trading, and copy strategies.

Below is a quick overview comparing the main features traders usually look for when selecting a crypto app.

| Feature | Description | Importance |

| Regulation | Licensed platforms reduce risks of fraud and misuse. | High |

| Transaction Fees | Includes spreads, commissions, and withdrawal costs. | High |

| Trading Instruments | Range of available coins, tokens, and CFDs. | Medium |

| Analytical Tools | Advanced charts, signals, and order types for strategy development. | Medium–High |

| Mobile Optimization | Stability and speed on smartphones and tablets. | High |

These parameters form the foundation for evaluating the best crypto trading apps of 2026.

Top Crypto Trading Apps for 2026

The competition among crypto platforms remains intense. Below is a shortlist of the most efficient and trusted trading apps used by retail and professional traders alike. Each of them combines transparency, flexibility, and user-oriented technology.

- NinjaTrader

- FXCM

- IG Markets

- Plus500

- Interactive Brokers

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| From $0.09 per Micro Contract | Futures Forex | $400 | 1:50 | NinjaTrader | ||

| Variable, low spreads | Forex Indices Commodities | $50 | 1:400 | MT4 NinjaTrader Trading Station | ||

| Spread-only, from 0.6 pips | Indices Forex Commodities | $250 | 1:200 | MT4 proprietary | ||

| Commission-free on opening/closing trades, competitive spreads | Forex Shares Indices Crypto | $100 | 1:30 | Web Mobile | ||

| From $2 / lot | Indices Forex Commodities | $0 | 1:100 | TWS |

NinjaTrader

NinjaTrader

NinjaTrader is known for its advanced charting and strategy development tools, originally built for futures and forex trading but now offering access to cryptocurrencies. The app suits traders who prefer detailed market analysis and automated strategies.

Users can customize workspaces, backtest algorithms, and connect multiple liquidity providers. Its charting interface supports custom indicators and plugins, making it highly flexible.

Pros:

- Comprehensive chart customization.

- Integration with external data feeds.

- Suitable for both manual and automated trading.

Cons:

- More complex setup for beginners.

- Requires paid add-ons for full functionality.

FXCM

FXCM

FXCM is a global multi-asset platform offering CFDs on forex, commodities, indices, and cryptocurrencies. Its mobile app stands out for clear execution, transparent pricing, and built-in educational tools. FXCM is suitable for traders seeking both speed and simplicity.

The platform provides access to major cryptocurrencies such as Bitcoin, Ethereum, and Ripple, all tradable as CFDs. Market data updates quickly, and spreads remain competitive even during high volatility periods.

Pros:

- Regulated by the FCA (UK) and ASIC (Australia).

- Intuitive mobile interface with quick order execution.

- Integration with TradingView and MetaTrader 4.

Cons:

- Limited crypto selection compared to dedicated exchanges.

- Some features unavailable in certain regions.

IG Markets

IG Markets

IG Markets is one of the longest-established trading brands, operating under strict regulation in multiple jurisdictions. Its crypto offering is integrated into the same system used for forex, indices, and commodities. The IG Trading app stands out for stability, precision, and wide charting functionality.

Traders can access cryptocurrencies as CFDs, enabling both long and short positions without directly owning the assets. IG provides advanced risk-management tools such as guaranteed stop orders and real-time margin monitoring, ensuring consistent control over open trades.

Pros:

- Regulated by FCA, ASIC, and DFSA.

- Broad choice of analytical tools and technical indicators.

- Smooth integration with MetaTrader 4 and ProRealTime.

Cons:

- Crypto trading restricted in some countries.

- Minimum deposit slightly higher than competitors.

Plus500

Plus500

Plus500 is a widely recognized CFD provider known for its simple interface and strict regulatory compliance. It allows users to trade multiple crypto pairs alongside indices, shares, and forex. The Plus500 app focuses on clarity and speed, offering all essential trading features within a minimalistic design.

Real-time charts, stop-loss options, and negative balance protection help users control exposure even in volatile conditions. The app is designed for traders who prefer simplicity combined with reliability.

Pros:

- Licensed in multiple regions, including the EU and Australia.

- Fast account setup with verification through mobile.

- No hidden withdrawal or deposit charges.

Cons:

- Limited range of advanced indicators.

- Inactivity fee applies after 90 days.

Interactive Brokers

Interactive Brokers

Interactive Brokers remains a preferred choice among experienced traders who manage diverse portfolios. Its app supports both spot crypto trading and derivatives, combining low fees with high execution speed. The platform integrates institutional-grade order routing, ensuring optimal liquidity across multiple exchanges.

What separates Interactive Brokers from others is the ability to manage crypto, stocks, and ETFs within one account. It appeals to traders who value diversification and transparent cost structure.

Pros:

- Direct crypto trading through Paxos Trust partnership.

- Tight spreads and real-time execution.

- Regulated in the US, UK, and Asia.

Cons:

- More advanced interface may confuse beginners.

- Higher minimum deposit in certain countries.

How to Choose the Right Crypto Trading App

Selecting the right crypto trading app depends on personal goals, trading style, and regional regulation. Some users prefer minimalist apps with quick execution, while others need advanced analytics and deep market access.

Key considerations include the level of security, transaction costs, and usability on mobile devices.

Security and Regulation

Security forms the foundation of any trading platform. Regulated apps maintain strict compliance with financial authorities such as the FCA, ASIC, or CySEC. These institutions ensure that platforms follow segregation of client funds, anti-money-laundering procedures, and fair pricing practices.

When assessing security, traders should check:

- Whether the app is licensed and by which authority.

- If two-factor authentication and biometric login are available.

- How client funds are stored — segregated accounts are preferable.

- Whether the app includes encryption for data transmission.

A secure trading environment reduces operational risks and enhances trust, especially for those handling large transactions.

Fees and Commissions

Transaction costs directly influence profitability. Each crypto trading app applies its own pricing model, usually combining spreads and commissions. Some platforms also charge overnight financing or inactivity fees.

Below is a simplified comparison of common charges:

| Platform | Average Spread (BTC/USD) | Commission per Trade | Inactivity Fee |

| NinjaTrader | Variable, from 0.6% | $2–$4 | None |

| FXCM | From 0.5% | None | After 12 months |

| IG Markets | From 0.4% | Variable per region | None |

| Plus500 | Built into spread | None | After 90 days |

| Interactive Brokers | Tight, from 0.2% | From $1.75 | None |

Traders should calculate the full cost of transactions, including withdrawal charges and conversion rates, before selecting a platform.

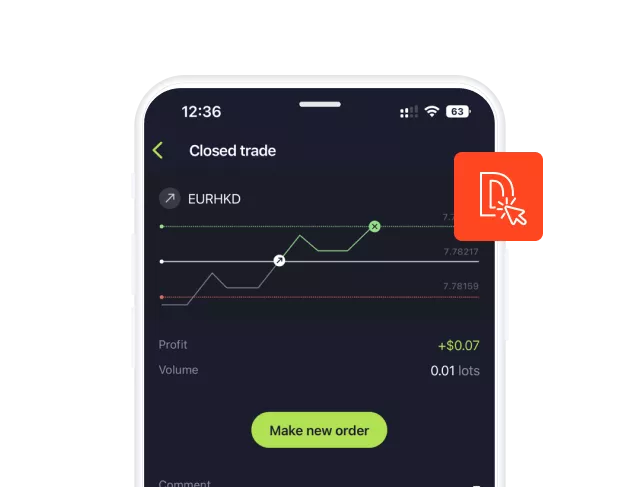

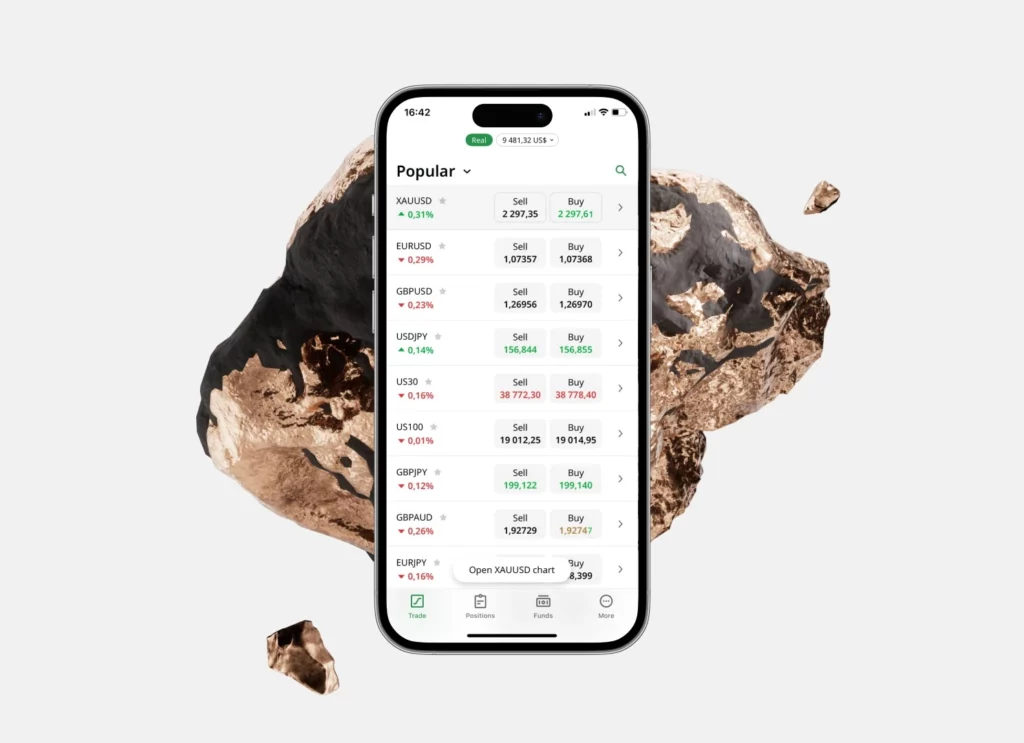

Interface and Functionality

The usability of a crypto app determines trading efficiency. A good interface allows fast execution, easy chart navigation, and immediate order modification. Smooth operation during market volatility is especially crucial for short-term traders.

Look for apps that include:

- Real-time charting with multiple timeframes.

- Customizable indicators and order types.

- Stable mobile performance during peak hours.

- Quick switching between assets or watchlists.

A clean design reduces errors and helps focus on key market movements rather than complex navigation.

Pros and Cons of Using Crypto Trading Apps

Trading through mobile applications offers convenience and speed that traditional desktop platforms cannot always match. However, the choice between comfort and control should be made carefully.

Main Advantages:

- Instant Access: Traders can open or close positions anytime, reacting to market movements in seconds.

- Real-Time Updates: Price notifications and alerts help users monitor volatility even when away from a computer.

- Integrated Tools: Most apps include advanced charts, order types, and economic calendars for quick analysis.

- User-Friendly Setup: Registration and verification usually take only a few minutes through biometric identification.

Main Disadvantages:

- Limited Screen Space: Complex charting or multi-window analysis is less practical on smartphones.

- Battery and Connectivity Issues: Weak connections can affect execution speed and order accuracy.

- Security Risks: Unprotected devices or public Wi-Fi connections may expose accounts to cyber threats.

- Feature Restrictions: Some brokers limit certain trading functions in mobile versions compared to desktop platforms.

For traders who value constant mobility and flexible control, crypto trading apps offer an effective solution. However, those relying on in-depth analysis may still prefer desktop tools for detailed strategy planning.

Future of Mobile Crypto Trading

The next phase of mobile crypto trading is likely to focus on smarter automation, decentralized access, and AI-powered insights. Developers are building systems capable of identifying trading patterns and executing strategies without manual intervention.

Blockchain integration is expected to expand beyond simple asset transfers. Many brokers are exploring on-chain transaction verification and decentralized storage of client records to enhance transparency.

Another emerging direction is cross-market compatibility — allowing traders to manage crypto, forex, and stocks from a single app. This unified structure reduces complexity and streamlines portfolio management.

Traders should also expect:

- More biometric and blockchain-based authentication for higher account protection.

- Enhanced data analytics powered by machine learning for predictive analysis.

- Tokenized assets accessible via CFD structures within regulated frameworks.

- Regional licensing expansion to comply with new digital asset regulations.

In short, mobile crypto trading is moving toward higher intelligence, regulation, and user autonomy. Traders who adapt early will likely experience more stability and access to advanced tools.

Frequently Asked Questions

Are crypto trading apps safe?

Safety depends on licensing, encryption standards, and the trader’s own precautions. Regulated apps that implement multi-factor authentication and data protection measures are generally considered secure.