Commodity CFDs (Contracts for Difference) have become a practical tool for traders seeking exposure to energy, metals, or agricultural assets without owning them directly. This approach allows speculation on price movements — whether rising or falling — with smaller capital compared to traditional futures. Yet, the performance and reliability of the trading platform play a decisive role in outcomes.

What Are Commodity CFDs and How They Work

Commodity CFDs are derivative instruments that mirror the price of an underlying physical asset — such as gold, crude oil, silver, or coffee. Instead of purchasing a barrel of oil or a ton of copper, the trader opens a contract with a broker. The profit or loss depends on how the market moves between the opening and closing price.

These instruments typically include two positions:

- Long (buy) — used when expecting prices to rise.

- Short (sell) — used when anticipating price drops.

Main characteristics of commodity CFDs:

- Leverage access — allows control of a larger position with a smaller deposit.

- No physical delivery — only the price difference is settled.

- Diverse asset coverage — includes energy, metals, and soft commodities.

- Availability on various timeframes — from scalping to position trading.

Common Commodity CFD Categories

| Category | Examples | Average Daily Volatility | Typical Margin (1:Leverage) |

| Energy | Crude Oil, Natural Gas | High | 1:100 |

| Precious Metals | Gold, Silver | Medium | 1:200 |

| Agriculture | Wheat, Coffee, Sugar | Moderate | 1:50 |

Commodity CFDs appeal to traders due to accessibility and cost control. However, their volatility requires risk discipline and a well-built trading setup.

What to Look for in a CFD Trading Platform for Commodities

When evaluating a trading system, several criteria define its performance in real market conditions. The right platform should combine stability, clear pricing, and tools that suit both fast execution and long-term analysis.

Key aspects to evaluate:

- Execution quality — slippage, re-quotes, and order reliability under volatility.

- Spreads and commissions — impact short-term profitability.

- Asset variety — covering metals, energy, and agricultural commodities.

- Charting and analytics — customizable indicators, drawing tools, and timeframes.

- Risk control features — negative balance protection and adjustable margin alerts.

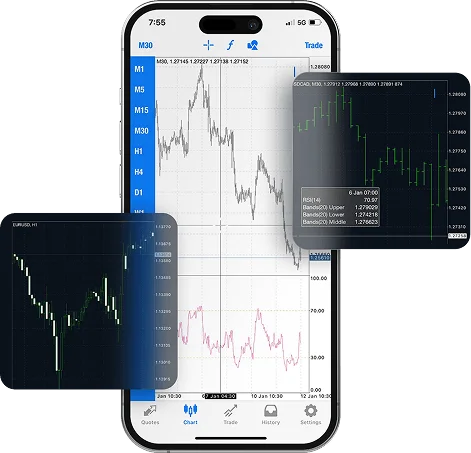

- Mobile compatibility — access for monitoring trades on the go.

A solid commodity CFD setup provides consistency across multiple market sessions and remains stable even when liquidity fluctuates.

Trading Conditions — Spreads, Leverage, and Execution Speed

Each trading environment depends on these three variables:

| Factor | Why It Matters | Typical Range for Commodities |

| Spread | Defines cost per trade; lower spread = tighter entry | 0.1–0.5 USD (Gold), 0.03–0.06 (Oil) |

| Leverage | Increases exposure with smaller capital | Up to 1:200 (varies by region) |

| Execution Speed | Affects order fill quality, especially in volatility | <50 ms on fast servers |

Spreads determine the immediate cost per transaction, and tight ones help scalpers keep margins intact. Leverage magnifies both gains and losses, so understanding position size is crucial. Execution speed ensures minimal slippage during rapid price swings common in commodities such as crude oil or gold.

A trader focusing on metals, for example, would prioritize consistent pricing and fast execution, while one in agricultural CFDs might value stability over speed due to slower market moves.

Comparing CFD Platforms — Which One Fits Different Trading Styles

Commodity CFD traders differ in strategy, time commitment, and tolerance for volatility. The most suitable platform depends on how orders are executed, how spreads behave under pressure, and what tools are offered for analysis. Some brokers focus on low latency for intraday trading, while others optimize for stability and portfolio tracking.

The table below summarizes how features differ among typical trading approaches:

| Trading Style | Key Platform Features | Ideal Conditions |

| Scalping / Day Trading | Tight spreads, instant execution, low latency | Fast servers, low commission |

| Swing Trading | Comprehensive charts, order history tracking | Reliable overnight swaps, flexible leverage |

| Copy / Social Trading | Integrated sharing tools, verified strategies | Transparent performance statistics |

Let’s review how different trader types align with platform features in more depth.

For Short-Term Traders

Short-term traders, including scalpers, rely on speed and precision. They execute multiple trades daily, focusing on minor price movements.

What matters most:

- Execution speed — delays above 100 milliseconds can distort entry and exit points.

- Low spreads and commission structure — frequent trades make costs add up quickly.

- Advanced order types — such as one-click trading, trailing stops, and partial closes.

- VPS hosting options — reduce latency during volatile sessions.

Short-term commodity CFD traders often prioritize brokers that support real-time data and minimal slippage. Energy assets, especially crude oil and natural gas, demand instant price feeds due to unpredictable market reactions to geopolitical events or supply reports.

For Swing and Position Traders

Swing and position traders hold trades for several days or weeks, relying on macroeconomic trends, supply-demand cycles, and technical levels. They prefer reliability over speed and require detailed charting and overnight rate clarity.

Key platform features:

- Integrated economic calendar for tracking commodity reports.

- Extended charting history with custom indicators.

- Swap-free options or transparent overnight charges.

- Stable server uptime for long-term trade monitoring.

A commodity CFD platform suited for swing traders should allow smooth margin adjustments and long-term analytical tools like Fibonacci retracement or moving averages over extended periods.

For Copy and Social Trading Users

Some traders prefer observing and replicating others’ strategies rather than managing positions manually. For them, the ideal platform integrates ranking systems, verified profiles, and clear performance data.

Key elements of a good copy trading setup:

- Transparent track records showing historical performance and drawdowns.

- Adjustable risk allocation to control position size relative to copied accounts.

- Diverse leader options specializing in commodities like gold, oil, or silver.

- Instant execution mirroring — ensures copied trades reflect real market entries.

This type of trading suits users still learning market behavior or those diversifying across multiple strategies.

Costs and Fees in Commodity CFD Trading

Every position in commodity CFDs involves transaction-related expenses. These costs differ by broker, asset class, and order volume. Understanding how they accumulate helps prevent hidden charges from eroding profits.

Common cost categories:

- Spread and commission

- Overnight financing (swap)

- Inactivity or withdrawal fees

- Currency conversion for non-USD pairs

Below is a general breakdown of how costs appear in actual trading setups.

Spread and Commission Breakdown

Each trade starts with a spread — the difference between bid and ask price — and sometimes an additional commission. Tight spreads are ideal for frequent traders, while slightly wider spreads might be acceptable when execution quality is high.

| Commodity | Average Spread | Typical Commission (per lot) | Notes |

| Gold (XAU/USD) | 0.15–0.25 USD | $3.5–$7 | High liquidity, frequent volatility spikes |

| Crude Oil (WTI) | 0.04–0.06 USD | $2–$5 | Sensitive to energy news and reports |

| Silver (XAG/USD) | 0.02–0.04 USD | $3–$5 | Moderate spread, reacts to USD strength |

| Wheat CFD | 0.10–0.20 USD | $1–$3 | Seasonal activity affects pricing |

Lower spreads improve profit margins for traders who rely on precise entries. However, some brokers offset tight spreads with commissions. Therefore, evaluating total cost per transaction is more accurate than focusing on a single parameter.

Overnight Financing and Swap Rates Explained

Holding a CFD position past the daily market close incurs swap charges (also called overnight financing). These depend on interest rate differentials and the direction of the trade (long or short).

Formula: Swap = (Trade Size × Swap Rate × Days Held) / 10

Practical example:

A trader holding a long gold CFD worth $10,000 with a swap rate of –0.02% would pay roughly $2 per day.

Key points about swaps:

- Rates vary by asset and direction.

- Negative swaps reduce profit for long-term positions.

- Some brokers offer swap-free accounts for specific regions or trading styles.

Monitoring swap values is essential for swing or position traders, as they accumulate over time and can influence net returns.

Risk Management When Trading Commodity CFDs

Commodity CFDs can produce sharp moves triggered by economic reports, supply disruptions, or geopolitical events. Managing these risks is the foundation of consistent trading. While leverage allows better capital use, it can magnify exposure if used carelessly.

The following principles apply across all commodities — whether trading gold, oil, or agricultural assets — and are key for both short-term and long-term strategies.

Using Stop Loss and Take Profit Orders Effectively

Stop Loss (SL) and Take Profit (TP) orders define the exit boundaries of a trade. Setting them correctly ensures losses remain controlled and profits are secured without emotional interference.

Basic rules for effective SL and TP setup:

- Align stops with market structure — avoid placing them exactly on round numbers where many orders cluster.

- Use the Average True Range (ATR) to measure normal volatility and place stops beyond that level.

- Maintain a fixed risk-to-reward ratio, usually 1:2 or higher.

- Update trailing stops when a trade moves in favor, locking in profit.

Example: If gold trades at 2400 USD and a trader sets an SL at 2388 and TP at 2424, the risk is $12 per unit for a $24 potential gain — a 1:2 ratio. Such consistency is more valuable than random target placement.

Position Sizing and Margin Control

Position sizing defines how much of the account balance is exposed per trade. Proper margin use prevents liquidation during normal price swings.

Recommended process:

- Decide the maximum percentage risk per trade (often 1–2%).

- Calculate lot size using account equity, stop distance, and asset value.

- Keep free margin above 70% to avoid forced closure.

Managing Volatility in Commodity Markets

Commodities often react more violently than currency pairs due to limited supply and external shocks. Crude oil and natural gas, for example, may swing several percent in minutes following production data.

To manage this effectively:

- Avoid trading during high-impact news releases unless using automated strategies.

- Diversify positions — combine metals and agricultural contracts to balance exposure.

- Adjust position sizes during volatile sessions to reduce drawdown risk.

- Use guaranteed stop orders when the broker provides them to limit gap exposure.

Volatility Comparison Table

| Commodity | Average Daily Range | Typical Reaction to News | Recommended Approach |

| Gold | 1.0–1.5% | Moderate | Use fixed SL and partial exits |

| Oil (WTI) | 2–4% | Strong | Trade smaller lots with wider stops |

| Wheat | 0.8–1.2% | Seasonal | Focus on fundamental reports |

| Natural Gas | 3–6% | Extreme | Tight monitoring, avoid over-exposure |

Monitoring volatility allows flexible adaptation of trading frequency, leverage, and stop levels. Platforms with real-time risk meters and margin alerts help maintain control during turbulent market phases.

Frequently Asked Questions

What is the minimum capital needed to trade commodity CFDs?

Most brokers allow trading from $100–$200, but risk control is easier with at least $1,000, especially when margin usage and volatility are high.