Choosing the right CFD or Forex trading platform determines how efficiently a trader can execute, analyze, and manage positions. With hundreds of brokers and systems available, focusing on the key factors—security, cost structure, trading tools, and performance—becomes essential. A good platform should offer fast execution, transparent pricing, diverse instruments, and reliable risk-management tools. Comparing multiple options helps identify which interface aligns with a trader’s strategy, capital, and technical needs. The goal is not to find the most popular system but the one that delivers consistent accuracy, stability, and control across all market conditions.

Understanding the Basics of CFD and Forex Trading

CFD and Forex trading both involve speculating on market price movements without owning the underlying asset. Yet, they differ in structure and market behavior. A CFD, or Contract for Difference, allows traders to speculate on price changes across various assets—stocks, commodities, indices, and currencies. Profit or loss comes from the difference between entry and exit prices.

Forex, or foreign exchange trading, deals exclusively with currency pairs. Traders exchange one currency for another based on their value expectations. The Forex market is decentralized and operates 24 hours a day, five days a week. Its liquidity and tight spreads attract both short-term and long-term traders.

In short, CFDs cover multiple markets, while Forex focuses on currency trading. Both require careful analysis, risk control, and platform reliability.

| Feature | CFD Trading | Forex Trading |

| Underlying Asset | Multiple (stocks, commodities, indices, etc.) | Currency pairs only |

| Leverage | Often high, varies by asset | High, depends on regulation |

| Market Hours | Depends on asset | 24/5 |

| Ownership | No asset ownership | No currency ownership |

| Typical Strategy | Short- to medium-term speculation | Short- to long-term currency trading |

Factors to Consider When Comparing Trading Platforms

Selecting a trading platform goes beyond aesthetics or brand familiarity. A suitable platform ensures fast execution, robust tools, and compliance with regulatory standards. It should match the trader’s style, whether scalping, swing trading, or position trading.

Below are the primary elements to evaluate before committing to a broker or trading interface.

Regulation and Security Standards

Regulation is the first checkpoint when comparing trading systems. A regulated broker must comply with financial laws and maintain client fund segregation. This reduces the risk of fraud or mismanagement. Traders should check licenses from recognized authorities such as:

- The Financial Conduct Authority (FCA – UK)

- The Cyprus Securities and Exchange Commission (CySEC)

- The Australian Securities and Investments Commission (ASIC)

- The Financial Sector Conduct Authority (FSCA – South Africa)

Each authority enforces specific capital requirements, dispute mechanisms, and audit standards. Unregulated brokers often operate offshore and pose higher risks.

Security extends beyond regulation. The platform should use SSL encryption, two-factor authentication, and reliable data protection. A transparent privacy policy and segregated client accounts are strong signs of operational integrity.

Trading Instruments and Market Access

Breadth of instruments determines flexibility. A well-structured CFD and Forex platform should include:

- Major, minor, and exotic currency pairs

- Commodities such as gold, silver, and oil

- Stock CFDs for global companies

- Index CFDs for market-wide exposure

- Cryptocurrencies (where permitted)

Access to multiple asset classes helps diversify strategies. Liquidity is another key point. Deep liquidity means better order fills and less slippage, especially during volatile sessions.

| Market Access Type | Typical Assets Offered | Trading Advantage |

| Forex | Currency pairs | High liquidity and tight spreads |

| Commodities | Metals, energy, agriculture | Hedge against inflation |

| Indices | S&P 500, DAX, FTSE | Broader market exposure |

| Stocks | Company shares via CFDs | Speculate on earnings |

| Crypto | BTC, ETH, LTC (if regulated) | Volatility opportunities |

Spreads, Commissions, and Other Fees

Costs directly affect profitability. Spreads are the most common charge— the difference between bid and ask prices. Fixed spreads remain constant, while variable spreads widen or tighten based on volatility.

Some platforms charge a small commission per trade, often paired with tighter spreads. Overnight financing (swap) fees apply if a position stays open beyond one trading day. Inactive account or withdrawal charges may also appear in the fee schedule.

When evaluating costs, compare:

- Spread types (fixed vs. floating)

- Commission structure (per lot or per trade)

- Swap rates for holding positions overnight

- Deposit and withdrawal processing fees

Low fees are valuable, but execution speed and liquidity often matter more for active traders. A slightly higher spread may be acceptable if the platform offers faster execution and minimal slippage.

Evaluating Platform Usability and Tools

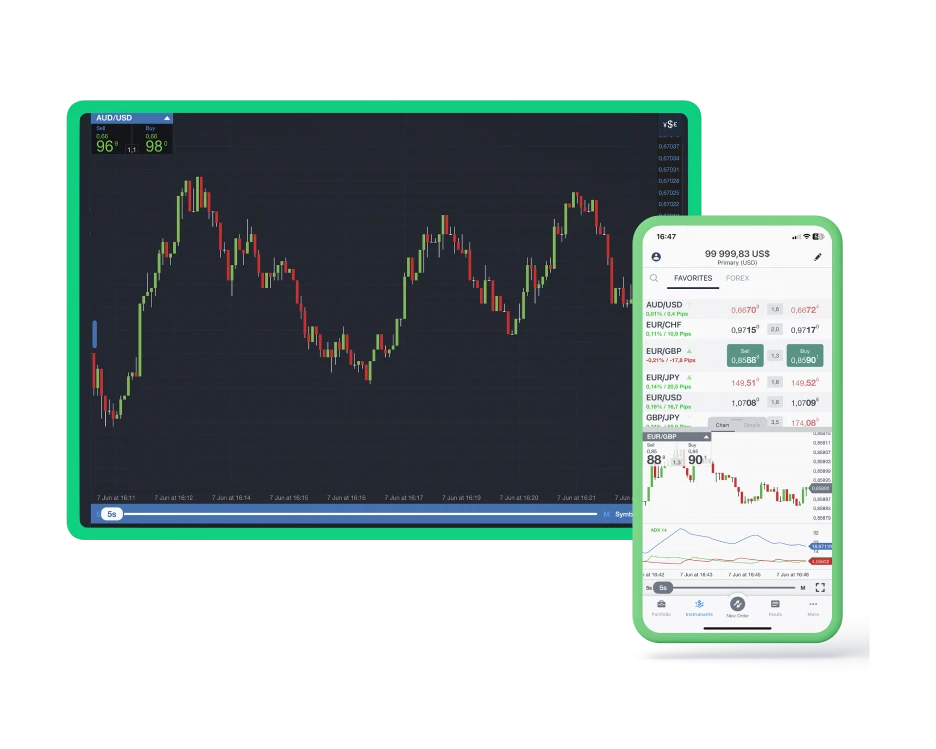

Ease of use defines efficiency. A trading platform should combine speed, clarity, and stability. Complicated layouts or lagging interfaces cause missed trades and frustration.

Below are key usability aspects to examine before settling on a trading environment.

Interface Simplicity and Navigation

A clean and intuitive interface reduces cognitive load, especially during volatile markets. Key metrics—price quotes, spreads, and margin levels—should be visible at a glance. Customizable layouts allow traders to focus on instruments relevant to their strategy.

Useful features include:

- Drag-and-drop order placement

- Multi-chart views

- Quick search for instruments

- One-click trading

A platform should perform smoothly across devices, with minimal delays or crashes during peak hours.

Charting Tools and Technical Indicators

Charting is a trader’s primary analysis weapon. The best systems offer dozens of indicators, including:

- Moving Averages (MA)

- Relative Strength Index (RSI)

- Bollinger Bands

- MACD (Moving Average Convergence Divergence)

- Fibonacci retracements

Drawing tools—trendlines, channels, and support/resistance zones—aid in visual planning. Timeframes should range from tick charts to monthly data. Some platforms integrate automated analysis tools that detect chart patterns or support expert advisors (EAs) for algorithmic trading.

Order Types and Risk Management Features

Effective trading requires control over order execution. Reliable platforms should support multiple order types, allowing precise entry and exit management. Common types include:

- Market orders – execute instantly at the best available price.

- Limit orders – execute only at a specified or better price.

- Stop orders – activate once the market reaches a trigger level.

- Trailing stops – move automatically with price fluctuations to protect gains.

These functions help maintain discipline and reduce emotional decisions. Risk management tools such as margin calculators, guaranteed stop-losses, and negative balance protection are equally valuable. They safeguard traders during sudden volatility or technical issues. Platforms offering customizable alerts and position sizing tools further improve control over exposure.

Mobile and Web Accessibility

Mobility defines modern trading. A platform should deliver identical core functions across desktop, mobile, and web. Traders expect to:

- Access live quotes and charts on mobile devices

- Open, modify, or close trades instantly

- Synchronize account data between web and app versions

- Receive push notifications for margin calls or price alerts

Mobile responsiveness must extend beyond interface design. Order execution speed, stability, and resource optimization determine actual usability. For example, a web terminal should perform equally well in Chrome, Safari, or Firefox without plug-ins.

| Device Type | Core Features | Performance Requirements |

| Desktop | Full trading suite, advanced charts | Fast execution, no lag |

| Mobile | Alerts, order placement, analysis | Lightweight, low latency |

| Web | Universal access via browser | Secure login, smooth syncing |

Research, Education, and Support Features

A strong trading platform should inform and educate its users. Access to analytics, learning content, and assistance often determines consistency in performance.

Built-in Market Analysis and News Feeds

Market insights directly within the interface help traders act faster. Integrated feeds from providers such as Dow Jones, Reuters, or Trading Central are common. Economic calendars with event filters (GDP, NFP, CPI) let users prepare for volatility.

Some systems include sentiment indicators, showing long/short positioning ratios. Real-time analytics and heatmaps allow cross-asset correlation tracking. These features help interpret market conditions without relying on external data sources.

Educational Materials for Traders

Continuous learning drives improvement. Many platforms now offer educational sections categorized by skill level:

- Beginner tutorials on order placement and margin use

- Intermediate guides on technical and fundamental analysis

- Advanced webinars on trading psychology and risk management

Interactive lessons and demo challenges allow users to test theories safely. Materials should be regularly updated and accessible in multiple languages.

Customer Support Availability and Quality

Support quality influences trader retention. Quick and competent assistance prevents losses caused by technical or account-related issues. Key factors include:

- Availability – 24/5 or 24/7 coverage through live chat, phone, and email.

- Response Time – under 1–2 minutes for chat, under 24 hours for email.

- Language Options – multilingual help for global traders.

- Technical Expertise – staff trained in trading operations, not just ticket management.

Some brokers also provide local office contacts or callback services, which add reliability for regulated regions.

Testing and Comparing Platforms in Practice

After evaluating features on paper, the next step is practical testing. Demo accounts and trial periods reveal how a platform performs under actual conditions.

Using Demo Accounts Before Committing

A demo environment allows trading with virtual funds while replicating live-market conditions. It’s ideal for testing:

- Execution speed

- Interface stability

- Order accuracy

- Charting flexibility

The demo should use real-time data, not delayed feeds, to reflect actual liquidity and volatility. It’s also a good opportunity to experiment with different account types—standard, raw spread, or commission-based.

Comparing Real-Time Execution and Slippage

Execution speed can make or break a strategy. A delay of even 100 milliseconds affects scalpers and high-frequency traders. When comparing platforms, observe:

- Order execution time during volatile events

- Frequency of requotes

- Average slippage in pips

- Order rejection rates

A small degree of slippage is normal in fast markets, but persistent delays suggest weak liquidity or poor infrastructure.

Evaluating Platform Stability During Volatility

Sudden price spikes test server reliability. A well-engineered system should maintain uptime above 99.9% even during events such as interest rate decisions or geopolitical announcements. Frequent disconnects or frozen charts indicate potential risk.

Some platforms include performance dashboards showing latency, execution quality, and order history accuracy. These metrics allow objective comparisons between brokers.

Frequently Asked Questions

What’s the main difference between CFD and Forex trading?

CFD trading includes multiple markets, while Forex trading focuses only on currency pairs. Both involve margin and leverage.