How to Choose a Reliable CFD Broker

Choosing the right CFD broker requires more than just comparing spreads or bonuses. It demands a structured approach, where regulation, transparency, and platform stability are evaluated carefully.

Below are the main steps to follow when selecting a trustworthy broker:

- Check Regulation – The broker should be licensed by a recognized authority such as the FCA (UK), CySEC (Cyprus), or ASIC (Australia). This helps ensure proper handling of funds and adherence to trading laws.

- Assess Platform Stability – Test demo accounts on MT4, MT5, or proprietary platforms to evaluate execution speed and reliability during volatile market hours.

- Review Trading Costs – Spreads, overnight swaps, and commission fees can vary significantly. Low trading costs help maintain consistency in profit margins.

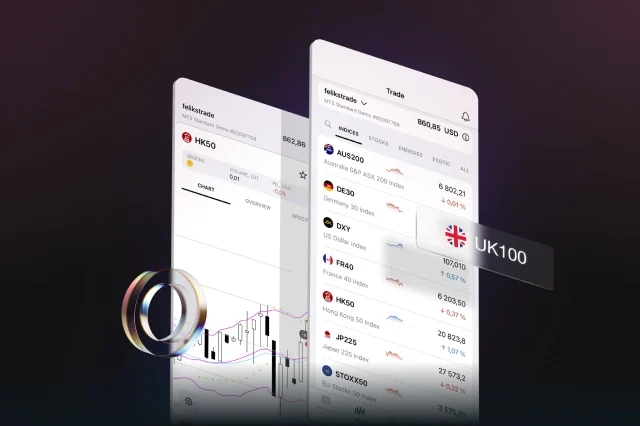

- Examine Instrument Diversity – A well-rounded broker should offer CFDs on forex, indices, commodities, and shares to allow portfolio flexibility.

- Evaluate Withdrawals and Deposits – Fast and transparent financial operations signal professional management.

- Read Real User Feedback – Traders’ reviews often reveal operational patterns, including withdrawal times or platform errors.

Top CFD Brokers for 2026

The CFD market continues to expand globally, with brokers introducing better trading conditions, advanced platforms, and regulated access to a variety of instruments. Below are the top CFD brokers for 2026, selected based on platform reliability, pricing transparency, and customer security standards.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| No commission, spreads from 0.6 pips | Forex Stocks Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 | ||

| Spread-only, from 0.6 pips | Indices Forex Commodities | $250 | 1:200 | MT4 proprietary | ||

| No commission, spreads from 0.0 pips | Forex Commodities Indices Crypto | $200 | Up to 1:500 | MT4 MT5 cTrader | ||

| From $5 per lot | Forex Commodities Indices Crypto | $100 | Up to 1:400 | AvaTradeGo MT4 MT5 | ||

| No commission, spreads from 0.1 pips | Forex Commodities Indices Crypto | $10 | Up to 1:2000 | MT4 MT5 |

XM

XM

XM remains one of the most consistent brokers for CFD traders. Regulated by CySEC, ASIC, and IFSC, the company offers a wide range of CFDs on forex, commodities, indices, and shares. The platform is known for stable execution and flexible leverage.

- Minimum Deposit: $5

- Platforms: MT4, MT5

- Leverage: Up to 1:1000

- Key Strength: Tight spreads and fast execution

Why traders choose XM:

- Transparent trading conditions

- Multiple account types

- Educational materials suitable for all levels

IG

IG

IG Markets, regulated by the FCA, ASIC, and BaFin, stands out as one of the oldest and most reputable brokers globally. The company offers CFDs on over 17,000 assets, including stocks, cryptocurrencies, and commodities.

IG Markets Overview

| Feature | Details |

| Platforms | MT4, ProRealTime, Web Trader |

| Minimum Deposit | $250 |

| Leverage | Up to 1:200 |

| Strength | Deep liquidity and low latency execution |

Notable advantage: IG Markets provides advanced analytical tools and detailed market research, making it ideal for experienced traders who rely on data-driven decision-making.

Pepperstone

Pepperstone

Pepperstone, licensed by ASIC, FCA, and DFSA, has built a strong reputation for execution speed and low spreads. It offers access to over 1200 CFDs, including forex, indices, and commodities.

- Platforms: MT4, MT5, cTrader

- Minimum Deposit: $200

- Leverage: Up to 1:500

- Spreads: From 0.0 pips on Razor accounts

Highlights:

- Institutional-grade execution technology

- Integration with advanced trading tools like Autochartist and TradingView

- Suitable for algorithmic and manual trading styles

AvaTrade

AvaTrade

AvaTrade provides a balanced combination of regulation, reliability, and platform diversity. Regulated by several bodies, including ASIC, FSCA, and FSA Japan, it offers CFDs on forex, indices, stocks, options, and cryptocurrencies.

- Platforms: MT4, MT5, AvaTradeGO, WebTrader

- Minimum Deposit: $100

- Leverage: Up to 1:400

Key reasons for selection:

- Variety of instruments for diversification

- Copy trading through AvaSocial

- Strong risk management features

FXTM

FXTM

FXTM (ForexTime) is a well-established broker regulated by FCA, CySEC, and FSCA. It offers competitive trading conditions and advanced educational support for CFD traders.

- Minimum Deposit: $10

- Platforms: MT4, MT5

- Leverage: Up to 1:2000

- Notable Point: Tight spreads and high leverage options

FXTM strengths include:

- Ultra-fast trade execution

- Multiple account types for different experience levels

- Detailed market insights for strategy planning

Key Factors Affecting CFD Trading Success

CFD trading success depends on more than just market knowledge. Several elements influence consistency, profitability, and decision-making accuracy. Each factor contributes to a trader’s ability to manage risk and maintain discipline under changing conditions.

- Market Volatility: Price fluctuations directly impact CFD performance. High volatility increases opportunity but also raises risk exposure. Understanding economic calendars, major news events, and central bank decisions helps anticipate sudden movements and manage exposure effectively.

- Leverage Management: Leverage magnifies both gains and losses. Choosing a suitable leverage ratio and maintaining proper margin levels protect accounts from rapid drawdowns. Many experienced traders prefer using moderate leverage, between 1:10 and 1:100, depending on strategy and risk tolerance.

- Execution Speed: Milliseconds matter in CFD trading. Delayed order execution may cause slippage, especially during volatile sessions. Choosing a broker with low latency infrastructure and reliable data feeds is essential for maintaining consistent results.

- Trading Psychology: Emotions often lead to errors such as overtrading or early position closure. Maintaining discipline, using stop-loss orders, and following a structured plan reduce impulsive decisions. Successful traders treat the process analytically rather than emotionally.

- Strategy Adaptability: No strategy works forever. Constant review of market patterns and periodic backtesting are necessary. Flexibility ensures adjustment to new conditions, whether in trending or ranging markets.

Tips for New CFD Traders

New traders often underestimate how fast market conditions can change. Developing discipline early can prevent many common mistakes. Below are practical guidelines to help beginners maintain control and improve results.

- Start with a Demo Account – Before investing real funds, test strategies in a simulated environment. It builds familiarity with platforms and market behavior.

- Trade with Small Positions – Avoid high exposure during early stages. Gradual scaling provides space to learn from mistakes without heavy losses.

- Set Realistic Goals – Focus on consistency rather than instant profit. Building experience and refining strategies take time.

- Keep a Trading Journal – Recording every trade helps identify recurring mistakes and track progress objectively.

- Use Stop-Loss Orders – Automatic exit points protect against emotional decisions and severe drawdowns.

- Avoid Overtrading – Frequent entries based on emotion lead to unnecessary costs and confusion.

- Continue Learning – Market dynamics evolve constantly. Regular study of global trends, indicators, and macroeconomic data strengthens decision-making.

For beginners, understanding these basics creates a solid foundation before engaging in high-risk CFD strategies.

Risks of CFD Trading

CFD trading carries substantial risk and is not suitable for everyone. Understanding potential downsides helps traders manage exposure and set proper expectations.

- High Leverage Exposure: While leverage increases profit potential, it can also lead to amplified losses. A small price change against an open position may quickly wipe out available margin. Maintaining strict risk management is essential.

- Overnight Financing Charges: Holding positions overnight incurs swap or interest fees, depending on the broker. These costs accumulate over time, affecting long-term profitability.

- Market Gaps: Price gaps can occur during major news events or over weekends. Stop-loss orders might not execute at expected levels, resulting in higher losses than planned.

- Broker Risk: Even regulated brokers face operational or liquidity issues. Traders should verify a broker’s regulatory standing and financial transparency before depositing funds.

- Emotional Pressure: Fast market movements often trigger impulsive behavior. Maintaining discipline, predefined stop levels, and realistic expectations prevents emotional trading.

Frequently Asked Questions

What is CFD trading?

CFD trading, or Contract for Difference trading, allows speculation on price movements of assets without owning them. The trader predicts whether the value of an asset—such as forex, gold, or a stock index—will rise or fall. The difference between the opening and closing price represents profit or loss. CFDs mirror real market conditions but use leverage, allowing control of larger positions with smaller capital.