Binary and options trading attract traders seeking short-term or structured exposure to assets such as currencies, commodities, or indices. These instruments allow speculation on price direction or volatility within set time frames. Success depends not only on analysis but also on selecting a reliable trading platform with transparent pricing, strong regulation, and fast execution.

What Binary and Options Trading Mean

Binary trading involves predicting whether an asset’s price will rise or fall within a fixed period. The trader selects an asset, sets an expiry time, and chooses “up” or “down.” A correct prediction earns a fixed payout, while an incorrect one results in the loss of the stake. This format focuses on direction and timing rather than the size of price movement.

Options trading, in contrast, is more flexible. A trader buys a contract giving the right, but not the obligation, to buy (call) or sell (put) an asset at a specified price before or at expiration. Profit depends on how far the market moves beyond that strike price. While binary options are usually all-or-nothing outcomes, traditional options can be closed or adjusted before expiry.

| Type | Definition | Profit Mechanism | Expiry |

| Binary option | Predicts price direction | Fixed payout if correct | Short-term (30s to 1h typical) |

| Traditional option | Buy/sell right at strike price | Based on movement beyond strike | Flexible, days to months |

Both formats require discipline, timing, and strong market knowledge. Binary options suit short-term speculation, while traditional options fit structured hedging or volatility strategies.

How to Choose a Reliable Trading Platform

Selecting the right trading environment determines accuracy, payout consistency, and overall reliability. Traders should verify regulation, execution speed, and available assets before funding an account. A careful review of fees and withdrawal policies is equally important.

Regulation and licensing standards

Licensed brokers are monitored by recognized authorities such as the CySEC (Cyprus), IFMRRC (Russia), or ASIC (Australia). Regulation ensures segregated client funds, fair pricing, and transparent dispute handling. Unregulated platforms often promise unrealistic returns or lack proper auditing.

Checklist for regulation review:

- Verify registration number on the regulator’s website.

- Check client fund segregation policy.

- Review compensation or protection schemes.

- Avoid platforms with unclear company details.

Trade execution speed and accuracy

Execution speed directly impacts profitability, especially in short-term contracts like 30-second or 1-minute binaries. Slippage or delay can turn a winning trade into a loss. High-quality brokers maintain low latency servers and publish average execution times.

Key elements influencing execution quality:

- Server location relative to liquidity providers.

- Order routing technology (instant vs. market execution).

- Real-time quote updates without freezing.

- Transparency in trade confirmations.

An ideal trading platform executes orders in less than 100 milliseconds and provides visual confirmation of each filled position. Historical execution data, often published in audit reports, offers valuable insight into operational integrity.

Best Platforms for Binary Options Trading

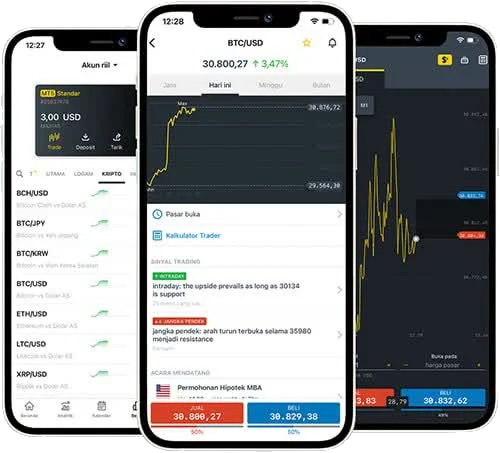

The binary options sector has grown rapidly, introducing specialized brokers that focus on fast execution, clear payout structures, and easy access through mobile or web interfaces. Below are four leading names offering different levels of flexibility and market access.

Quotex

Quotex is widely known for its minimalistic interface and instant execution. It supports digital contracts on currencies, commodities, stocks, and indices with expiry times starting from 30 seconds. The minimum trade size is $1, making it suitable for small-scale testing.

Key features include:

- Browser-based terminal without additional installations.

- Payouts up to 95% depending on market conditions.

- Integrated indicators and chart customization tools.

- Demo account with virtual balance for practice.

Pocket Option

Pocket Option offers a wide asset range and social trading tools, allowing users to follow strategies of other traders in real time. The broker supports over 100 trading assets and features turbo options with expiries from 5 seconds.

Advantages:

- Broad asset selection for cross-market speculation.

- Copy-trading module for mirroring trades.

- Bonus system for deposits and tournaments.

- Built-in charting and signals section.

IQCent

IQCent focuses on multi-asset binary trading and offers payouts up to 98% on selected contracts. The platform accepts both fiat and crypto deposits and supports video tutorials for strategy development.

Notable characteristics:

- Trade sizes starting from $0.01.

- One-click copy-trading integration.

- Round-the-clock customer communication channel.

- Tiered account structure with scaled benefits.

Olymp Trade

Olymp Trade remains a leading binary and fixed-time contract broker, licensed under the International Financial Commission. It combines technical analysis tools, risk management settings, and consistent market data delivery.

Core attributes:

- Built-in educational modules and webinars.

- Minimum trade amount of $1.

- Account types for beginners and advanced traders.

- Payout potential up to 90%.

Best Platforms for Traditional Options Trading

Traditional options trading requires deeper market access, broader analytical tools, and strong integration with exchanges. These brokers focus on professional-grade execution, derivative support, and margin management.

Interactive Brokers

Interactive Brokers (IBKR) is one of the largest multi-asset brokers globally, offering options trading across U.S. and international markets. It provides advanced order types, margin calculators, and deep liquidity through direct market access.

Key metrics:

- Access to over 30 global exchanges.

- Commission structure starting from $0.65 per contract.

- Options analytics through IBKR TWS (Trader Workstation).

- API connectivity for algorithmic systems.

eToro

eToro integrates social features with traditional derivatives trading. Although widely recognized for CFDs, it also provides access to certain options through partner liquidity providers.

Highlights:

- Simplified order entry with transparent pricing.

- Social feed showing popular strategies.

- Copy trading system for observing professional portfolios.

- Regulated under FCA, CySEC, and ASIC.

TD Ameritrade

TD Ameritrade is known for its Thinkorswim terminal, offering robust options analytics and advanced charting. U.S. clients benefit from low commissions, customizable spreads, and risk visualization tools.

Essential features:

- Strategy builder for multi-leg options.

- PaperMoney account for simulated trading.

- Real-time implied volatility analysis.

- U.S. regulatory protection under FINRA and SIPC.

IQ Option

IQ Option bridges binary and traditional options under a single interface. It offers multiple asset categories, intuitive layout, and dynamic chart tools with several technical indicators.

Distinct features:

- Trade expiry flexibility from 1 minute to several hours.

- Mobile and desktop versions with full synchronization.

- Demo environment with virtual balance.

- Multi-asset exposure including forex and stocks.

Tips for Safer Binary and Options Trading

Short-term contracts and option spreads both punish sloppy risk control. A clear plan keeps outcomes measurable and repeatable.

Start with a small balance and test strategies

A modest account limits drawdown while the method is still unproven. Forward-test with a demo first, then risk small cash stakes. Track every entry, exit, and rationale in a trade log. After 30–50 recorded samples, review win rate, average R, and time-of-day performance. If the equity curve drifts or variance explodes, pause, refine rules, and restart with fresh samples. Tools matter, but a verified edge and disciplined sizing matter more.

Keep risk per trade under 2% of total capital

Position size should follow the stop distance and instrument volatility. For binary contracts, think in “risk units” per ticket; for listed options, use Greeks to estimate P/L swing under typical moves. A 1–2% cap per decision helps the account survive losing streaks. Example: on a $2,000 balance, risk $20–$40 per decision. During high-volatility sessions, cut size, widen buffers, or step aside. Compounding comes from consistency, not oversized bets.

Avoid trading under pressure or emotional bias

Fatigue, FOMO, or revenge tactics corrupt judgment. Pre-define daily loss limits and a maximum number of tickets. If either limit trips, stop for the day. Use alerts instead of staring at the screen. Turn off social feeds during active sessions. A short checklist before each entry—trend context, key levels, event calendar, spread/fee impact—reduces impulsive clicks.

Frequently Asked Questions

Is binary trading legal?

Legality depends on jurisdiction. Some regions permit fixed-time contracts under specific rules; others restrict or ban them. Check local regulations and verify the broker’s license on the regulator’s website.