Starting in forex can be overwhelming, but the right trading platform makes the process much easier. A suitable interface, clear fee system, and risk-free demo access help beginners learn trading mechanics without financial pressure. The goal is to find a platform that combines usability with technical reliability — tools should be simple, not confusing, and data should be presented in a clear format.

What Makes a Forex Platform Suitable for Beginners

Not every trading environment fits a new trader’s needs. Beginners require stability, low-cost entry, and easy access to practice tools. A suitable platform should simplify the learning process while offering the same data accuracy and execution speed as professional-level systems.

User-Friendly Interface and Simple Navigation

A good beginner platform focuses on clarity. Navigation should feel intuitive — from opening charts to placing orders. Too many tabs or hidden functions can lead to errors. Layouts with drag-and-drop chart tools and customizable dashboards help users adapt faster.

Many platforms now include built-in tutorials, step-by-step tooltips, and visual trade confirmations. These elements minimize confusion and prevent accidental trades. Simplicity is not about fewer features but about accessibility — critical tools like indicators, position summaries, and risk calculators should be visible without digging through multiple menus.

Checklist for interface evaluation:

- Clear order window with instant and pending options

- Visible balance, equity, and margin indicators

- Customizable chart templates

- Mobile version synchronized with desktop trades

Low Minimum Deposit and Flexible Account Options

New traders often start with smaller budgets, so entry requirements matter. Platforms that allow low initial deposits and micro accounts help build confidence gradually.

| Account Type | Typical Minimum Deposit | Leverage Range | Suitable For |

| Cent Account | $1–$10 | Up to 1:1000 | First-time traders |

| Standard Account | $50–$100 | Up to 1:500 | Intermediate level |

| Pro Account | $200+ | Up to 1:200 | Consistent traders |

Flexible account structures also let users test strategies without committing large sums. Some brokers even allow trading fractions of standard lots, making position sizing more precise.

Demo Accounts for Practice

A demo account mirrors real market conditions but uses virtual money. It helps beginners understand how spreads, margin, and volatility affect orders. Practice accounts are critical before moving to live trading.

Advantages of demo trading:

- Risk-free learning environment

- Real-time quotes identical to live markets

- Ability to test strategies before risking capital

- Familiarity with interface and execution speed

However, beginners should treat demo trading seriously — trading impulsively in a demo can lead to unrealistic habits. Keeping a simple trading journal even in demo mode helps track emotional reactions and mistakes.

Key Features to Look for in a Beginner Forex Platform

A platform’s usability is not enough; transparency and technical stability matter equally. Beginners should compare fee models, execution times, and the range of available instruments.

Transparent Fee Structure and Spreads

Hidden fees can discourage beginners quickly. A beginner-friendly broker should publish all costs clearly — including spreads, overnight swaps, and withdrawal charges.

| Fee Type | Description | Ideal Condition for Beginners |

| Spread | Difference between buy and sell prices | Fixed or low-variable |

| Commission | Cost per trade (if applicable) | Minimal or included in spread |

| Swap | Interest for holding overnight positions | Clearly shown before order placement |

Platforms offering real-time spread display and swap calculators allow users to estimate costs before opening trades. This transparency builds trust and helps new traders control their balance more effectively.

Best Forex Platforms for Beginners in 2026

The forex market in 2026 offers a variety of platforms designed for both beginners and intermediate traders. Each combines stability with practical trading tools, though their strengths differ. The following section reviews the most reliable and beginner-friendly options widely used across the market.

MetaTrader 4 (MT4) – Classic and Beginner-Friendly

MetaTrader 4 remains one of the most popular forex trading systems, even after more than a decade. Its strength lies in simplicity. The interface is compact, functional, and free from unnecessary distractions. MT4 supports basic and custom indicators, making it suitable for both manual and automated strategies.

Why beginners prefer MT4:

- Straightforward order execution window

- Compatible with most brokers

- Access to thousands of free indicators and scripts

- Works smoothly on both desktop and mobile

The platform offers four main order types and allows traders to modify stop-loss and take-profit levels directly on the chart. The community around MT4 also provides an abundance of free educational material and templates, which simplifies the learning process.

MetaTrader 5 (MT5) – Advanced Yet Accessible

MT5 builds upon MT4 with added functionality, but it retains a similar interface, making it easy for beginners to transition. It supports more instruments, including stocks and commodities, along with multiple pending order types.

| Feature | MT4 | MT5 |

| Order Types | 4 | 6 |

| Timeframes | 9 | 21 |

| Built-in Indicators | 30 | 38 |

| Economic Calendar | No | Yes |

| Netting/Hedging | Hedging only | Both |

MT5’s integrated economic calendar and market depth view give traders better insight into market movements. Beginners benefit from its one-click trading and advanced testing tools, allowing them to backtest strategies efficiently before live use.

cTrader – Clean Interface and Strong Analytics

cTrader focuses on user comfort and visual clarity. Its interface is minimalistic but rich in analytical tools. The order book is transparent, and the execution speed is impressive, even under volatile market conditions.

Main features:

- Level II pricing display

- Algorithmic trading through cAlgo

- Detachable chart windows for multi-screen setups

- Built-in copy trading function

Beginners who value visual chart analysis often find cTrader easier to understand than other terminals. It also highlights each trade’s entry and exit on charts, helping users analyze past decisions without confusion.

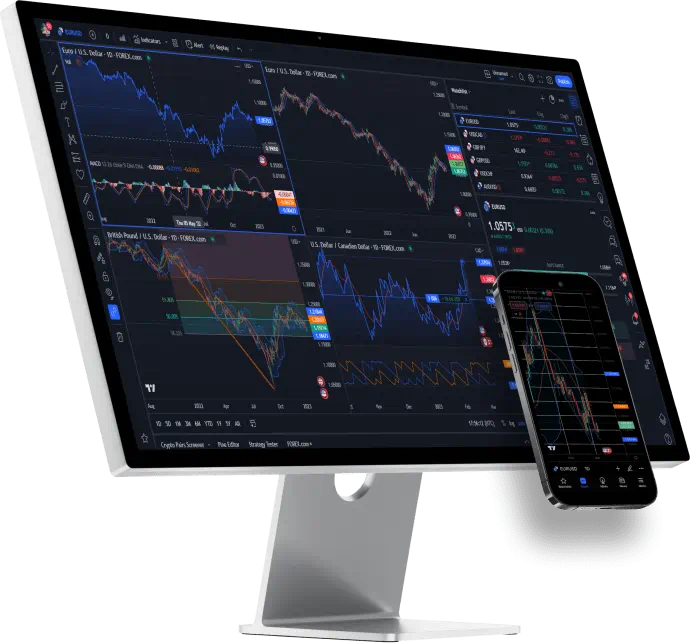

TradingView – Great for Analysis and Learning

TradingView has gained massive popularity due to its browser-based functionality and community-driven environment. While it’s more of a charting and analysis tool than a broker-specific platform, many brokers now integrate it directly for live trading.

Advantages for beginners:

- No software installation needed

- Access to professional charting tools

- Large library of public indicators

- Educational ideas shared by other traders

Its social aspect allows users to follow and learn from public trading strategies. Beginners can analyze how professionals interpret charts, compare notes, and refine their technical understanding without leaving the interface.

How to Choose the Right Forex Platform as a Beginner

Selecting the most suitable system depends on personal goals and trading style. Beginners should focus on finding balance — ease of use should come first, followed by flexibility for gradual skill growth.

Here are practical steps to narrow down options:

- Start with a demo version. Spend at least two weeks testing order functions and charting tools.

- Compare trading costs. Even small spread differences can affect long-term results.

- Check for educational materials. Tutorials, tooltips, and guides shorten the learning curve.

- Assess mobile compatibility. Modern traders often monitor positions on the go.

- Evaluate platform stability. Connection drops or slow execution can lead to unnecessary losses.

It’s useful to test at least two systems side by side — for example, MT4 for execution practice and TradingView for analysis. This comparison helps identify which interface feels more intuitive and efficient.

Common Mistakes Beginners Make in Forex Trading

Every new trader faces a learning curve. Many early losses are caused not by market volatility but by poor habits and lack of preparation. Understanding the most common errors helps beginners build discipline and realistic expectations.

Ignoring Education and Relying on Luck

The first mistake is treating forex like gambling. Some beginners open trades based on guesses or social media signals without understanding market logic. Successful trading requires structure — analysis, timing, and emotional control.

Without proper education, traders fail to interpret price charts, misread economic events, or overreact to market noise. Reliable platforms often include learning resources, but consistent self-study is still essential.

Practical steps to avoid this mistake:

- Study basic candlestick patterns and chart trends

- Follow one strategy at a time instead of jumping between systems

- Review trades weekly to identify repeating errors

- Use demo accounts to test ideas before applying them live

Trading education is not about memorizing terms; it’s about understanding how decisions affect results over time.

Overleveraging Without Risk Planning

Leverage amplifies both profits and losses. Beginners often use high leverage ratios without understanding margin requirements, leading to account wipeouts after minor market swings.

For example, trading a $100 account with 1:1000 leverage means controlling a $100,000 position — a small movement can erase the balance instantly. Responsible use of leverage means keeping position sizes modest and setting stop-loss levels before entering any trade.

| Account Size | Safe Leverage Ratio | Max Recommended Risk per Trade |

| $100 | 1:50 | 1–2% |

| $500 | 1:100 | 2% |

| $1,000 | 1:200 | 2–3% |

A basic rule: if losing two or three trades in a row feels devastating, position sizing is too high. Using a trading journal and pre-calculating margin exposure prevents emotional decisions during volatile periods.

Frequently Asked Questions

Which forex platform is easiest for beginners?

MetaTrader 4 remains the simplest option. Its interface is clear, and it supports most educational content online. The structure helps new traders understand order placement, chart analysis, and strategy testing.