How Algo Trading Software Works

At its core, algorithmic trading software follows a set of coded instructions that determine when to buy or sell financial instruments. These rules are based on market indicators such as price movements, volume, or time-based signals. The program continuously monitors live data and executes orders without human intervention once specific criteria are met.

The operational flow generally involves several key stages:

- Strategy Definition – A trader defines entry and exit rules using historical data or quantitative models.

- Backtesting – The system tests these rules on past data to assess profitability and accuracy.

- Optimization – Parameters are adjusted to improve risk-to-reward ratios and reduce drawdowns.

- Execution – Once activated, the algorithm sends orders directly to the broker or exchange.

- Monitoring – The system records all trades, allowing performance review and fine-tuning.

Automation relies heavily on Application Programming Interfaces (APIs) that connect trading terminals to brokerage servers. These interfaces allow continuous data exchange — price quotes, order confirmation, and trade updates — in real time.

| Process | Function | Tools Involved |

| Data Input | Collecting market prices, indicators, and news feeds | APIs, data aggregators |

| Signal Generation | Detecting trade opportunities | Mathematical models, trend algorithms |

| Order Execution | Placing buy/sell orders | Broker integrations, order routers |

| Reporting | Analyzing trade outcomes | Dashboards, analytics tools |

Efficiency depends on execution speed, data accuracy, and network latency. Many traders host their systems on VPS servers to reduce delay between order generation and broker execution. Others employ machine learning modules that adjust trading logic dynamically, adapting to evolving market conditions.

Benefits of Using Algo Trading Software

Algorithmic trading software simplifies complex decision-making and improves consistency in execution. By relying on coded instructions rather than human reaction, traders can maintain discipline across all market situations. The efficiency of automation provides measurable advantages that influence both profitability and trading precision.

Main Advantages

- Speed and Accuracy – Orders are executed instantly after signal confirmation, reducing slippage and taking advantage of short-lived market opportunities.

- Emotion-Free Trading – Algorithms remove psychological factors like fear or greed that often affect manual trading decisions.

- Backtesting Capabilities – Historical data can be used to test and refine strategies before applying them in real markets.

- 24/7 Operation – The software can monitor and execute trades around the clock, especially useful for cryptocurrency or global forex markets.

- Diversification – Multiple strategies can run simultaneously across various assets, reducing exposure to a single market condition.

- Consistency – The system repeats predefined actions without fatigue, improving overall trade management.

Algo trading also enhances risk management. Stop-loss and take-profit levels are automatically calculated and applied. Complex position sizing formulas ensure that exposure stays within a defined threshold. In volatile markets, automatic rebalancing helps maintain the intended risk profile.

| Feature | Description | Trader Impact |

| Automated Execution | Executes trades at predefined conditions | Faster market entry and exit |

| Historical Testing | Evaluates strategy performance using past data | Reduces trial-and-error costs |

| Multi-Asset Trading | Operates on several markets simultaneously | Broader diversification |

| Real-Time Monitoring | Tracks positions and performance automatically | Better control and analysis |

Automation allows traders to focus on improving strategies instead of constant manual observation. For institutions, algo systems reduce operational errors and enhance transparency, while for individuals, they offer scalability and continuous performance tracking.

Top Algo Trading Software Platforms

A growing number of platforms now cater to algorithmic traders with different levels of technical expertise. Below is a selection of well-known software solutions recognized for stability, customization, and compatibility with global markets.

| Commision | Instruments | Min Dep | Leverage | Platforms | ||

|---|---|---|---|---|---|---|

| Variable, low spreads | Forex Indices Commodities | $50 | 1:400 | MT4 NinjaTrader Trading Station | ||

| Spread-only, from 0.6 pips | Indices Forex Commodities | $250 | 1:200 | MT4 proprietary | ||

| From $2 / lot | Indices Forex Commodities | $0 | 1:100 | TWS | ||

| No commission, spreads from 0.4 pips | Forex Commodities Indices | $5 | Up to 1:1000 | MT4 MT5 | ||

| No commission, spreads from 0.7 pips | Forex Commodities Indices | $1 | Up to 1:3000 | Mobile & Web Apps |

FXCM

FXCM

FXCM offers flexible algorithmic trading through its REST and FIX APIs. Traders can develop and connect strategies using Python or Java, analyze tick-level data, and execute orders directly through the brokerage. The platform provides competitive pricing and advanced analytics for currency pairs and CFDs.

It’s favored by users who require deep historical data and custom strategy integration.

IG Markets

IG Markets

IG Markets delivers automation via its proprietary API and MetaTrader connection. It enables users to trade indices, forex, and commodities using automated systems. The interface combines web-based simplicity with access to advanced trading tools.

Its educational resources and practice accounts make it attractive to traders learning algorithmic systems.

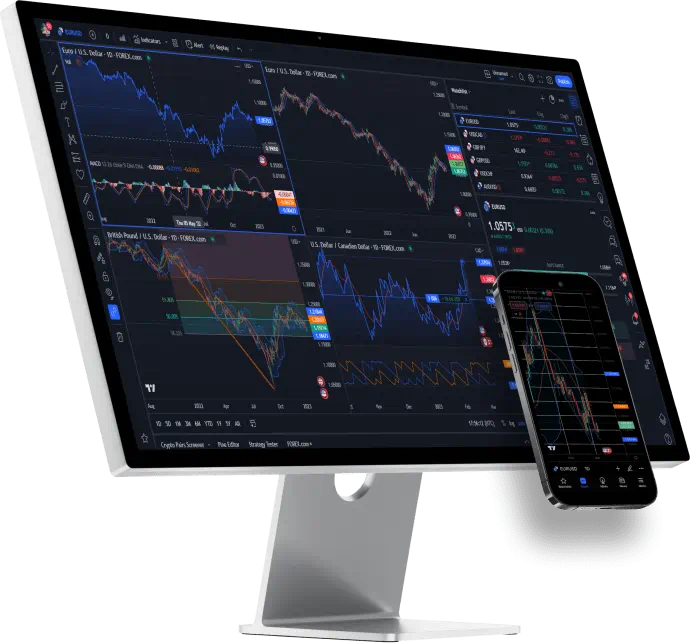

Interactive Brokers

Interactive Brokers

Interactive Brokers provides one of the most comprehensive infrastructures for professional automation. Through its Trader Workstation (TWS) and API, it supports high-frequency trading and integration with quantitative research platforms. The software handles a large variety of instruments, including stocks, options, futures, and currencies.

It is widely used by institutional traders and algorithmic developers due to its global market access and execution reliability.

Alpari

Alpari

Alpari integrates automated trading through MetaTrader 4 and MetaTrader 5, allowing traders to develop Expert Advisors (EAs) or connect third-party algorithms. The platform supports VPS hosting for low-latency execution and offers a wide selection of trading instruments, including forex, metals, and cryptocurrencies.

Its user-friendly environment and multiple account types make it suitable for both beginners and professional algo traders.

FBS

FBS

FBS provides comprehensive algorithmic trading capabilities through MetaTrader platforms, offering compatibility with automated strategies, signal copying, and VPS optimization. Traders benefit from low spreads, fast order execution, and flexible leverage options.

The platform’s technical stability and educational resources make it popular among users developing and testing automated trading systems.

Key Features to Consider Before Choosing Software

Selecting the right algorithmic trading software depends on functionality, compatibility, and personal trading goals. Each trader requires a different combination of speed, analytical tools, and control. Before making a decision, it’s essential to assess how the platform performs under real market conditions.

- Execution Speed and Reliability: Fast execution is vital in algorithmic trading. Even a delay of a few milliseconds can affect profitability. Look for software that offers low-latency order routing, stable connectivity, and minimal downtime. VPS hosting and direct market access (DMA) can further improve performance.

- Customization and Scripting Language: Good platforms allow full control over trading rules. The presence of an integrated scripting language (such as Python, C#, or MQL) enables traders to write and modify algorithms easily. Customization makes it possible to adapt to changing market dynamics or personal strategies.

- Data Quality and Analysis Tools: Accurate data feeds are the foundation of reliable automation. Choose software that provides tick-by-tick data, real-time updates, and access to historical information for backtesting. Built-in analysis modules for volatility, volume, and correlation improve decision quality.

- Risk Management Functions: Effective risk control is non-negotiable. The software should support automated stop-loss, take-profit, trailing stops, and position-sizing models. These tools reduce exposure and help maintain consistent results even in unstable markets.

- Compatibility and Integration: Software compatibility with brokers, trading terminals, and APIs is critical. Ensure that it supports integration with platforms like MetaTrader, cTrader, or custom institutional systems. Smooth API connectivity ensures efficient data exchange and reliable trade execution.

Common Algorithmic Trading Strategies

Algo trading relies on mathematical and statistical models designed to capture specific price behaviors. Each strategy follows logic derived from technical indicators or market inefficiencies. Below are several common approaches widely used by professionals.

- Trend Following: This approach identifies and trades in the direction of established price movements. Algorithms use moving averages, breakout levels, or momentum indicators to detect entry points. Trend following works best in markets with sustained directional movement, such as major forex pairs or commodities.

- Mean Reversion: Mean reversion strategies assume that prices eventually return to their historical average. When the asset price deviates significantly from this mean, the system opens a position expecting reversion. This technique often uses Bollinger Bands or standard deviation measures.

- Arbitrage: Arbitrage seeks profit from temporary price differences between related assets or markets. The algorithm monitors multiple exchanges simultaneously, buying where the price is lower and selling where it’s higher. Execution speed is crucial, as opportunities disappear within milliseconds.

- Scalping: Scalping algorithms open and close multiple small trades throughout the day, targeting minimal price changes. These systems rely on high-frequency execution and ultra-low latency connections. They’re best suited for traders with access to stable, fast brokers.

- Statistical Models: Advanced algorithms may employ machine learning or regression-based systems. These models analyze patterns, correlations, or sentiment data to predict future price movements. While more complex, they offer flexibility in adapting to new market behavior.

Risks and Limitations of Algo Trading

While algorithmic trading provides efficiency and precision, it also introduces new types of risk. Every system depends on code accuracy, data quality, and market conditions. Mismanagement or technical failure can lead to rapid financial losses.

- Technical Failures: Algorithmic systems depend on continuous server uptime, internet connection, and broker availability. Power outages, hardware malfunctions, or server disconnections can disrupt trade execution. Even minor latency can change the outcome of a strategy during volatile market periods.

- Over-Optimization: Backtesting is valuable, but excessive optimization can cause curve-fitting — when a strategy performs well on historical data but fails in live markets. Traders must balance historical performance with forward testing to avoid unrealistic expectations.

- Market Volatility: Unexpected events such as geopolitical news or economic releases can cause abnormal volatility. Algorithms designed for stable conditions might react unpredictably, executing trades outside acceptable parameters or failing to adapt quickly enough.

- Data Feed Errors: Inaccurate or delayed market data can trigger false signals. Since most systems rely on continuous real-time information, a single corrupted data point may affect the entire sequence of trades.

- Regulatory and Broker Constraints: Some brokers restrict high-frequency trading or have specific requirements for automated strategies. Traders must ensure compliance with local regulations and broker terms to prevent account restrictions.

Frequently Asked Questions

What is algorithmic trading software?

It’s a computer-based system that executes trades automatically according to predefined rules, using live market data and quantitative models.