Cryptocurrency futures trading has evolved into a major segment of the digital asset market, attracting both individual and institutional participants. The best platforms combine advanced order execution, strong security, and deep liquidity to support professional trading strategies. In 2025, exchanges such as Binance, OKX, Bybit, Deribit, and Bitget dominate the space due to their wide contract selection, transparent fee models, and compliance with international standards. Each offers distinct advantages—from ultra-fast order books and precise margin control to comprehensive analytics tools and flexible leverage settings. Choosing the right futures platform depends on a trader’s priorities—whether they value competitive fees, regulatory protection, or access to niche assets with stable funding rates.

What Is Cryptocurrency Futures Trading

Cryptocurrency futures trading involves contracts that allow participants to speculate on the future price of digital assets without owning them directly. Instead of purchasing coins like Bitcoin or Ethereum, traders buy or sell a futures contract representing an agreement to trade the asset at a specific price on a future date. This form of trading provides exposure to crypto market movements while allowing for hedging strategies and leveraged positions.

Futures markets attract both short-term speculators and institutional participants. They serve as a risk management tool for those aiming to protect existing spot holdings and as a profit mechanism for traders expecting price fluctuations. Exchanges offering these contracts use different settlement types—cash-settled or coin-settled—depending on whether the payout is in fiat currency or cryptocurrency.

Example of a Basic Futures Contract

| Type of Contract | Description | Example |

| Perpetual Futures | No expiry date; price anchored to spot via funding rate | BTC/USDT perpetual |

| Quarterly Futures | Fixed expiry every quarter | ETH/USD Q1 futures |

| Inverse Contracts | Denominated in crypto instead of USD | BTC/USD inverse futures |

The main appeal of these instruments lies in leverage. Traders can open positions larger than their account balance, magnifying both potential profits and losses. Leverage levels vary widely across exchanges—from 5x to 125x or more—depending on the asset and user risk profile.

While futures allow profit from both rising and falling markets, they require strict discipline. Understanding margin calls, liquidation thresholds, and funding rates is essential before committing real capital.

Key Factors to Consider Before Choosing a Futures Trading Platform

Selecting a reliable futures exchange is one of the most critical steps for a trader. The quality of execution, fee structure, and overall safety can dramatically affect long-term results. Below are the primary aspects to assess before opening an account.

Security and Fund Protection

Security should be the top priority. A strong exchange uses multi-signature cold storage, withdrawal whitelists, and two-factor authentication. Regular third-party audits and proof-of-reserves reports further confirm solvency.

Traders should also examine insurance or compensation mechanisms for unexpected breaches. Some exchanges maintain dedicated protection funds that cover losses caused by liquidation failures or system vulnerabilities.

| Security Measure | Purpose | Example |

| Cold Wallet Storage | Isolates funds from online threats | 95%+ of user assets stored offline |

| 2FA Authentication | Prevents unauthorized logins | Google Authenticator or SMS |

| Insurance Fund | Covers liquidation shortfalls | Binance SAFU Fund |

Trading Fees and Margin Requirements

Fee structures directly influence profitability. Most futures exchanges apply maker and taker models, rewarding liquidity providers with lower costs. Hidden charges can occur through funding rates in perpetual markets, so traders must account for them in their strategy.

Margin rules differ by platform. Initial margin defines the minimum capital to open a position, while maintenance margin determines when liquidation occurs. Lower margin requirements offer higher leverage but increase liquidation risk.

Supported Cryptocurrencies and Contract Types

The range of tradable assets indicates how versatile a platform is. Leading exchanges offer not only Bitcoin and Ethereum futures but also contracts on altcoins like Solana, Avalanche, or XRP.

Contract diversity also matters—perpetual swaps, calendar futures, and inverse contracts suit different strategies. More options mean better portfolio hedging possibilities and improved flexibility during volatile market conditions.

Liquidity and Order Execution Speed

High liquidity ensures that large trades can be executed with minimal slippage. Platforms with deep order books and robust market-making activity allow smoother entries and exits. Latency is equally crucial; order delays can distort strategy performance, especially for scalping or high-frequency systems.

Exchanges with direct market access or co-located servers typically achieve faster execution. For manual traders, responsive order interfaces and stable APIs are key technical advantages.

Regulation and User Verification Policies

Regulation varies across jurisdictions, affecting how an exchange operates and what protections users receive. Licensed entities under financial authorities such as the FCA, CySEC, or MAS tend to maintain higher transparency and compliance standards.

User verification policies (KYC) also play a role. Platforms that require identity verification usually offer larger withdrawal limits and additional legal safeguards. However, some offshore exchanges still allow limited access without full KYC, which may suit users in restricted regions but poses higher regulatory risks.

Top Cryptocurrency Futures Trading Platforms in 2025

The crypto derivatives sector continues to expand rapidly, offering traders more instruments, leverage options, and improved infrastructure. The leading futures exchanges in 2025 differentiate themselves by liquidity depth, trading tools, and transparency. Below is an overview of the most reputable and technically advanced providers currently dominating this segment.

Binance Futures

Binance remains a dominant name in global derivatives trading. It offers perpetual and quarterly contracts across more than 200 assets, with leverage up to 125x on major pairs such as BTC/USDT. The exchange features an advanced matching engine capable of processing over 100,000 orders per second, reducing slippage during volatile conditions.

Its interface supports multiple layouts, including TradingView charts, allowing in-depth technical analysis. Risk control tools such as position modes, auto-deleveraging, and customizable margin types give traders flexibility. Binance Futures also maintains an insurance fund that mitigates loss during unexpected liquidations.

OKX Futures

OKX is known for its extensive product lineup and robust infrastructure. It supports perpetual swaps, standard futures, and options. The platform’s dual-account system (simple and professional) suits both short-term traders and algorithmic strategies.

Users benefit from flexible margin modes—cross and isolated—and transparent fee schedules. OKX employs a strong security framework with proof-of-reserves reporting and on-chain verification. Its liquidity and execution speed make it particularly suitable for institutional trading.

Bybit

Bybit has become a preferred destination for futures trading due to its intuitive interface and reliable order execution. It focuses on perpetual contracts for major cryptocurrencies but continues to expand its product catalog. The platform’s funding rate transparency and responsive charting tools are useful for high-frequency participants.

Bybit’s risk management system includes an auto-margin replenishment feature that prevents unnecessary liquidations. It also maintains a user protection fund and offers detailed analytics dashboards for position monitoring.

Deribit

Deribit is primarily associated with options trading but remains one of the most advanced futures exchanges in the market. It specializes in BTC and ETH derivatives with high liquidity and professional-grade order matching.

The exchange provides real-time Greeks, volatility metrics, and portfolio margining—features designed for advanced participants. Deribit’s API access supports institutional connectivity, and its reputation for fair pricing attracts hedge funds and prop trading firms.

Bitget

Bitget’s strength lies in its global accessibility and well-developed copy trading system, which extends into futures markets. It supports perpetual contracts on more than 100 coins, with leverage levels reaching 125x.

The exchange integrates advanced order types and allows both USDT-margined and coin-margined contracts. Its focus on user protection, including an $300 million protection fund, adds credibility among international users.

Comparing the Best Crypto Futures Platforms

Evaluating exchanges requires examining several dimensions: fees, leverage structure, toolset, regulatory status, and geographical reach. The table below summarizes some of the core metrics of top-tier futures providers in 2025.

| Exchange | Max Leverage | Contract Types | Notable Features | Proof of Reserves |

| Binance Futures | 125x | Perpetual, Quarterly | Deep liquidity, advanced order book | Yes |

| OKX | 125x | Perpetual, Standard Futures, Options | Cross/Isolated margin, on-chain verification | Yes |

| Bybit | 100x | Perpetual | User protection fund, strong UI | Yes |

| Deribit | 100x | Futures, Options | Professional tools, volatility metrics | Yes |

| Bitget | 125x | Perpetual, Coin-margined | Copy trading, security fund | Yes |

Fee Structure and Margin Levels

Trading costs vary by venue but typically include maker and taker fees. Makers add liquidity to the order book, while takers remove it. Discounts apply to high-volume users or those holding native exchange tokens.

| Exchange | Maker Fee | Taker Fee | Funding Rate (Perpetual Avg.) |

| Binance Futures | 0.02% | 0.04% | ±0.01% every 8 hours |

| OKX | 0.02% | 0.05% | ±0.01% every 8 hours |

| Bybit | 0.01% | 0.06% | ±0.01% every 8 hours |

| Deribit | 0.01% | 0.05% | N/A |

| Bitget | 0.02% | 0.06% | ±0.01% every 8 hours |

Margin tiers determine how much collateral is required to open a position. As exposure grows, maintenance margin rates increase to protect the exchange from defaults. Many platforms use automatic deleveraging systems to manage extreme volatility.

Interface, Tools, and User Support

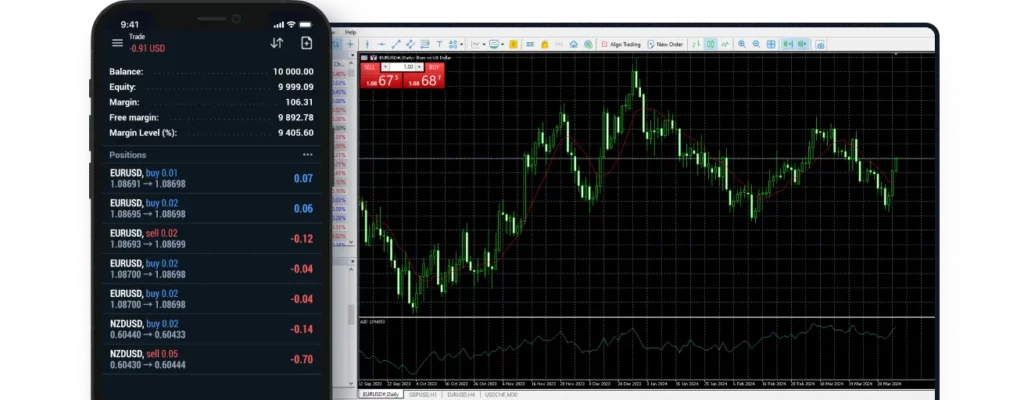

A practical trading interface can significantly impact execution efficiency. Binance and Bybit stand out for their clean dashboards and integrated charting modules. OKX and Deribit target advanced users by providing real-time metrics, volatility surfaces, and institutional API access.

Key features often include:

- Advanced Charting: Integration with TradingView or custom chart engines.

- Risk Controls: Adjustable leverage and position modes.

- Analytics: Profit and loss breakdowns, liquidation alerts.

- Support: 24/7 multilingual live chat or ticket systems.

Exchanges also publish detailed documentation for API developers, essential for automated strategies and bot deployment.

Availability in Different Jurisdictions

Regulatory access differs widely across regions. Some exchanges operate under licenses from recognized financial bodies, while others remain offshore. Traders must check if the service is available in their country, as compliance rules often restrict U.S., Canadian, or European residents from using certain derivatives products.

| Exchange | Licensed Region | Restricted Jurisdictions |

| Binance Futures | Seychelles / Global Entities | U.S., Canada, U.K. |

| OKX | Seychelles / Global | U.S., Singapore |

| Bybit | Dubai (VARA license) | U.S., China |

| Deribit | Panama | U.S., Canada |

| Bitget | Seychelles | U.S., Singapore |

Regional compliance is expected to tighten throughout 2025 as more regulators focus on derivatives oversight. Exchanges adopting transparent frameworks and on-chain audits are better positioned to maintain trust.

How to Start Trading Cryptocurrency Futures

Before trading any derivative instrument, preparation and correct setup are essential. The process usually includes creating an account, completing verification, depositing collateral, and understanding how to place and manage orders. Each of these steps influences both the security of funds and the ability to control risk effectively.

Account Setup and KYC Requirements

Opening an account on a futures exchange typically requires basic registration followed by Know Your Customer (KYC) verification. This step complies with anti-money-laundering laws and allows access to higher withdrawal limits and advanced features.

The verification process usually includes:

- Identity Proof: Uploading a government-issued ID (passport or driver’s license).

- Address Confirmation: Submitting a recent utility bill or bank statement.

- Facial Verification: A short video or selfie to confirm authenticity.

Completion time ranges from a few minutes to several hours depending on the exchange’s workload. Once approved, traders gain access to all futures products, leverage settings, and API keys for automated systems.

Accounts can be secured using two-factor authentication (2FA), withdrawal whitelists, and anti-phishing codes. These measures prevent unauthorized access, especially on accounts holding large balances or connected bots.

Deposits, Collateral, and Margin Management

After verification, the next step is funding the account. Most futures exchanges accept cryptocurrency deposits, though some also support fiat via card or bank transfer. Deposits are usually credited after a few blockchain confirmations.

Traders must then allocate funds as collateral to open positions. The collateral can be:

- USDT-margined: Contracts settled in Tether or another stablecoin.

- Coin-margined: Positions backed and settled in the base cryptocurrency (e.g., BTC or ETH).

Margin allocation is crucial for risk control. Two main margin modes are common:

- Cross Margin: Uses the entire account balance to maintain all positions. Suitable for advanced users managing multiple trades.

- Isolated Margin: Limits the margin to a single position, reducing the risk of full account liquidation.

Maintaining proper margin levels prevents forced liquidation. Exchanges automatically close positions once the maintenance margin falls below a critical threshold. Traders should always monitor this value, particularly when using high leverage.

Order Types and Risk Control Tools

Efficient order execution depends on understanding available order types. Futures exchanges offer several options for different trading objectives:

| Order Type | Description | Purpose |

| Market Order | Executes immediately at the best available price | Fast entry or exit |

| Limit Order | Executes at a set price or better | Controls entry price |

| Stop Order | Triggers when a price threshold is reached | Limits losses |

| Take-Profit Order | Automatically closes when a target price is hit | Locks in profit |

Many exchanges also feature trailing stops, one-cancels-the-other (OCO) orders, and conditional triggers, helping automate exits without constant monitoring.

Modern platforms provide integrated risk dashboards showing liquidation price, position size, unrealized profit/loss, and available margin. Understanding these indicators helps traders adjust leverage and avoid overexposure.

Tips for Managing Risk in Crypto Futures

Futures trading can amplify both returns and losses. Maintaining discipline and applying consistent strategies are critical for survival in a leveraged market. The following practices help reduce exposure to unnecessary risk:

- Limit Leverage: Beginners should start with low leverage (2x–5x). High leverage amplifies small price moves into large losses.

- Set Stop-Loss Orders: Automated exits protect against sudden market swings. Every position should include a predefined exit level.

- Diversify Exposure: Avoid committing all margin to one contract. Splitting capital across multiple assets lowers volatility impact.

- Track Funding Rates: In perpetual contracts, funding costs can erode returns. Checking them regularly ensures sustainable positions.

- Use a Trading Journal: Recording entries, exits, and reasoning builds consistency and highlights mistakes for improvement.

- Avoid Emotional Trading: Reacting impulsively to price moves leads to poor decisions. Predefined plans help maintain discipline.

Frequently Asked Questions

What is the minimum amount required to start trading crypto futures?

It depends on the exchange and contract type. Some allow positions as small as $5–$10 using micro contracts or low-margin requirements.