Exness offers educational content for traders at different experience levels. You’ll find trading tutorials, market analysis, webinars, and strategy breakdowns that cover everything from basic forex concepts to advanced techniques. The platform includes social trading features where you can follow experienced traders and see their approaches. These resources help whether you’re starting out or looking to refine existing strategies.

Exness Educational Resources Matter

Exness educational materials equip traders with the knowledge to trade confidently. They cover essential areas like market analysis, risk management, and trading strategies, ensuring you can handle real-world trading scenarios. These resources are free and accessible to all Exness users, making them a valuable tool for building skills.

Key benefits of exness resources:

- Free access for all traders

- Covers beginner to advanced topics

- Practical, actionable advice

- Available in multiple formats (articles, videos, webinars)

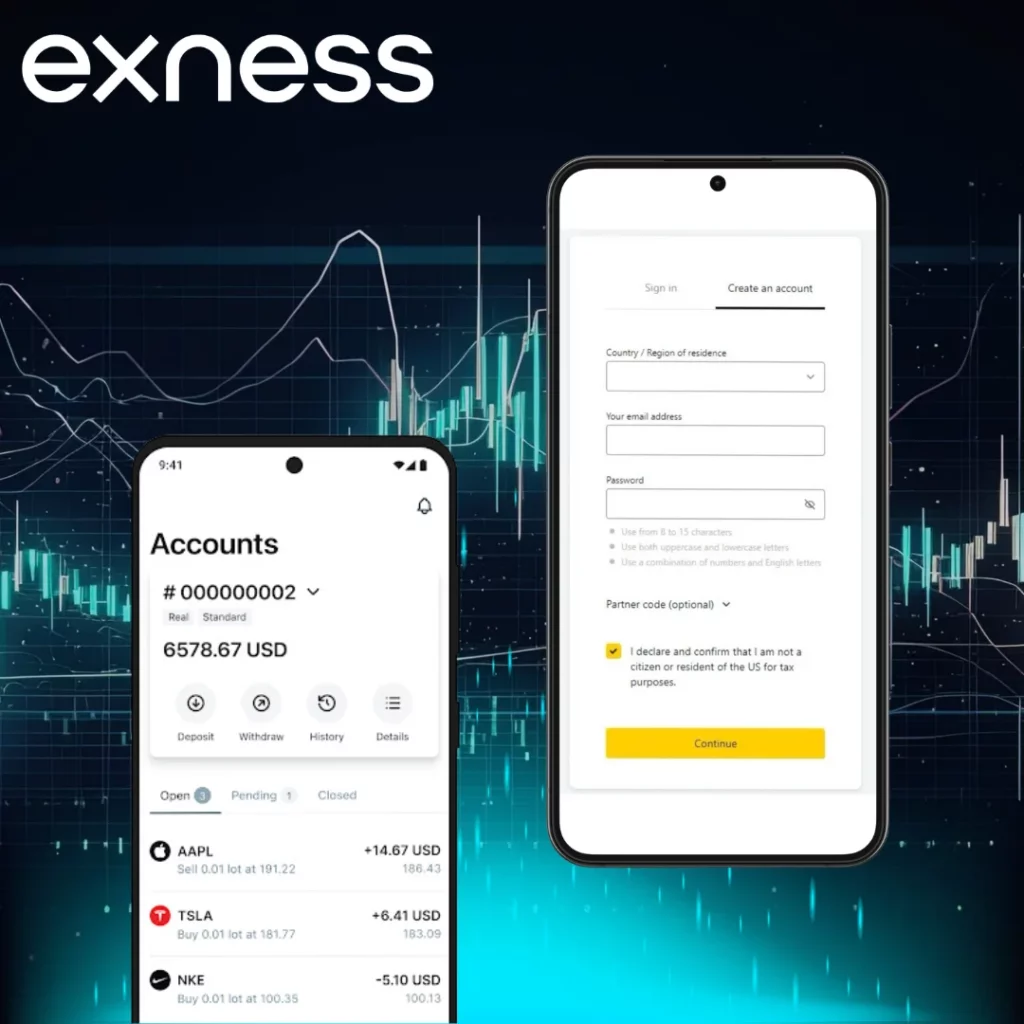

Steps to Get Started

Visit the Exness website and navigate to the “Education” section. Browse topics like “Forex Basics” or “Technical Analysis” and select one to study for 20–30 minutes daily. Open a demo account on Exness, choose a currency pair like EUR/USD, and apply what you’ve learned. For example, if you read about candlestick patterns, use the MT4 platform to identify a “doji” pattern on a 1-hour chart and practice predicting price movements.

Exness Forex Basics for Beginners

Exness offers simple guides to help new traders understand forex trading. These materials explain key concepts like currency pairs, pips, leverage, and spreads in clear language, making it easy for beginners to grasp the market’s fundamentals and start trading.

How to Use Exness as a Beginner

To get started with Exness, visit the Exness Education hub and explore beginner guides. Take notes on key terms such as “pip” and “leverage,” then practice using a demo account.

- Visit the Exness Education Hub

- Open a Demo Account and Place Small Trades

- Monitor Spreads and Pip Movements

By placing small trades with different pairs, you can gain confidence in using the platform and better understand how trading concepts work in real-time.

Essential Forex Concepts Exness

Understanding key forex concepts is crucial for successful trading. Below are some essential terms every trader should know:

| Concept | Description | Example |

| Currency Pair | Two currencies traded against each other | EUR/USD (Euro vs. US Dollar) |

| Pip | Smallest price movement in forex | 0.0001 change in EUR/USD |

| Leverage | Borrowed funds to increase trade size | 1:100 leverage |

| Spread | Difference between buy and sell price | 1.2 pips on GBP/USD |

These terms form the foundation of forex trading, and understanding them will help you make informed decisions when trading in the market.

Exness Technical Analysis Tools and Tutorials

Exness provides tutorials on technical analysis, teaching traders how to use charts and indicators to predict price trends. Topics include moving averages, RSI, and candlestick patterns, explained in a way that’s easy to understand and apply.

- Moving Average: Smooths price data to show trends

- RSI (Relative Strength Index): Measures overbought/oversold conditions

- Bollinger Bands: Tracks price volatility

- Fibonacci Retracement: Identifies potential support/resistance levels

Find a technical analysis tutorial in the Exness Education section, such as “Using Moving Averages.” Watch or read it, then open the Exness MT5 platform. Add a 50-day moving average to a GBP/USD daily chart. Practice identifying buy signals when the price crosses above the moving average. Place a demo trade based on this signal and track its performance over a week to refine your skills.

Exness Fundamental Analysis Resources

Exness offers guides on fundamental analysis, focusing on how economic events affect market prices. These resources explain indicators like interest rates, inflation, and employment data, helping traders anticipate market shifts.

| Indicator | Impact on Markets | Example Event |

| Interest Rates | Affects currency strength | Federal Reserve Rate Hike |

| GDP | Shows economic growth | US GDP Report |

| Employment Data | Influences currency demand | Non-Farm Payrolls (NFP) |

| Inflation (CPI) | Impacts purchasing power | Consumer Price Index |

Applying Fundamental Analysis

Check the Exness economic calendar in the Education section for events like the US Non-Farm Payroll report. Study a fundamental analysis guide to understand its impact. Before the event, analyze EUR/USD in a demo account and predict price movement based on the news. Place a trade (e.g., buy USD/JPY if data strengthens USD) and monitor the outcome to practice using economic data.

Exness Webinars and Live Training Sessions

Exness runs live webinars through their Essential Learning section, covering everything from basic market concepts to advanced technical analysis. These sessions feature experienced traders who answer questions in real-time and provide practical examples from current market conditions.

The webinars are completely free and accessible after creating an account on the platform. Topics include risk management, trading psychology, fundamental analysis, and platform tutorials for both MetaTrader and Exness Terminal. Sessions often focus on current market events and how to apply different strategies during various market conditions. You can practice what you learn using their demo accounts with virtual funds, allowing you to test strategies without risking real money. The platform also provides recorded sessions for review, plus supplementary materials like articles and video tutorials. Most webinars run for about an hour and include dedicated time for participant questions, making them interactive rather than just presentations.

Trading Strategies Exness

Exness offers strategy education covering scalping, swing trading, position trading, and day trading approaches. Each method targets different timeframes and risk profiles, from quick scalping profits to long-term position trades based on fundamental analysis. Their educational materials explain entry and exit techniques, recommended timeframes, and risk management for each strategy.

You can test these approaches using demo accounts before risking real money. For example, swing trading guides typically recommend 4-hour charts with indicators like Bollinger Bands, where you might enter trades when price touches the lower band and exit near the upper band. Day trading strategies focus on opening and closing positions within a single session, while position trading looks at longer-term fundamental factors that drive currency movements over weeks or months.

Risk Management Exness Education

Exness provides comprehensive risk management education covering stop-loss and take-profit orders, position sizing calculations, and leverage management techniques. Their materials teach you how to calculate appropriate lot sizes based on account balance and risk percentage, typically recommending risking no more than 1-2% per trade. You can practice these concepts using demo accounts, where you might trade pairs like USD/CAD with predetermined stop-loss levels to see how position sizing affects potential losses. The education hub includes guides on calculating risk-to-reward ratios and adjusting trade sizes based on your risk tolerance, helping you develop disciplined trading habits before using real money.

Trade with a trusted broker Exness today

See for yourself why Exness is the broker of choice for over 800,000 traders and 64,000 partners.

FAQs About Exness Educational Resources

What types of educational resources does Exness offer?

Exness provides free articles, videos, webinars, and guides on forex basics, technical and fundamental analysis, strategies, and risk management, accessible via their website.